PayPal CEO Compensation Cut by 34%

ExxonMobil Raises Pay by 52%

Last year, global oil giants, which recorded their highest profits since their founding due to the surge in oil prices, received 'super salaries' worth hundreds of billions of won. In contrast, tech companies, entering ultra-tight management amid recession concerns, are in a mood to deflate their valuation bubbles.

According to Bloomberg on the 13th (local time), U.S. payment service provider PayPal cut the total compensation of former CEO Dan Schulman by 32% last year. Schulman received $22 million (approximately 25.6 billion won) in compensation last year. His total compensation in 2021 was $32 million.

PayPal's board explained the cut as a measure taken because "(former CEO Schulman) failed to achieve the company's management goals such as target revenue and active user numbers."

Schulman became CEO in 2015 when PayPal separated from e-commerce company eBay and led the company for eight years. He announced his voluntary retirement in February, but it is reported that he decided to step down taking responsibility for the deteriorating management. PayPal's board is currently searching for a successor.

PayPal is experiencing growth slowdown difficulties as the consumer market shrinks due to inflation and high-intensity tightening. Amid worsening performance and finances, the company cut about 2,000 employees, equivalent to 7% of its total workforce, earlier this year.

The company explained that this reduction was proactively carried out amid simultaneous signs of recession such as funding shortages caused by high interest rates.

Apple CEO Tim Cook, the leader of the top U.S. big tech company, voluntarily decided to cut his salary by 40% this year. Cook is expected to receive $49 million this year, including a base salary of $3 million, a bonus of $6 million, and stock compensation of $40 million. This is 40% of his salary last year.

In the wake of the recession, big tech companies have been conducting high-intensity restructuring, cutting more than 170,000 employees last year, and Cook is praised for leading the way in breaking the bubble salary practice.

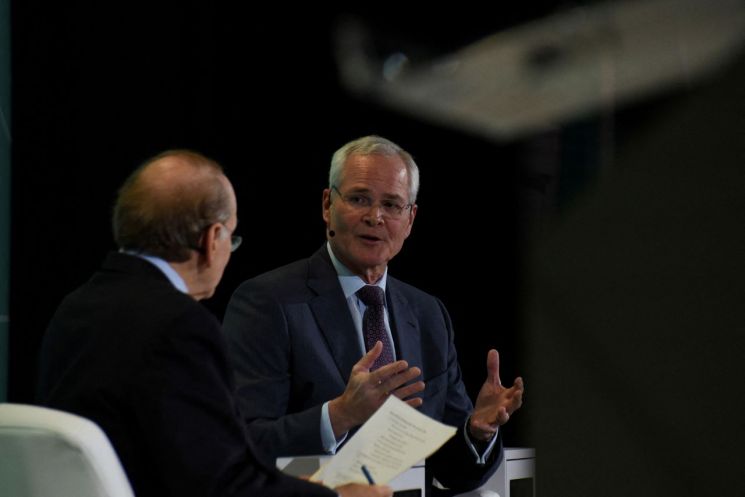

On the other hand, heads of major global oil companies received 'super salaries' worth hundreds of billions of won, thanks to record-high profits. Darren Woods, CEO of ExxonMobil, the largest U.S. oil company, earned a total compensation of $36 million (about 47 billion won) last year. This is a 52% increase compared to the previous year's $25 million and more than doubled compared to 2020.

As ExxonMobil posted record profits last year, Woods also received stock options worth $25 million and a cash bonus of $6.4 million (about 840 million won) as performance incentives.

Ben van Beurden, former CEO of Royal Dutch Shell, one of the world's two largest oil companies alongside ExxonMobil, received ?9.7 million (about 15.9 billion won) last year. This is a 53% increase compared to the previous year.

British Petroleum (BP), the largest oil company in the UK, also paid CEO Bernard Looney ?10 million (about 16.3 billion won) last year, doubling the previous year's amount.

Foreign media explained that Looney's actual total compensation was set higher than ?10 million, but some of his pay was cut due to management responsibility following legal lawsuits related to an explosion at a refinery in Ohio, USA.

Despite oil companies making huge profits last year thanks to the Russia-Ukraine war, they are criticized for ignoring demands for climate crisis response investments and windfall taxes, and indulging in money celebrations.

Pressure is also mounting for investigations into these companies' responses to climate change. BP announced plans to reduce oil and gas carbon emissions by 35-40% by 2030. However, it recently lowered its carbon emission targets to 20-30%, citing the need for more investment to meet oil and gas demand, drawing heavy criticism from environmental groups and others.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)