SK Hynix and SK On Large-Scale Investment

Severe Losses Due to Industry Downturn

"SK Group's total borrowings reached 105 trillion won, an increase of 44 trillion won compared to 61 trillion won at the end of 2019 before the spread of COVID-19. The group's debt burden has expanded significantly due to large-scale investments in the battery, semiconductor, and materials sectors" (March 24, NICE Credit Rating).

Warning signs have been raised regarding the financial soundness of SK Group, which rose to second place in the business world last year through large-scale investments and bold mergers and acquisitions (M&A). The so-called 'BBC (Bio, Battery, Semiconductor)' new growth businesses are repeatedly underperforming, increasing the debt burden. The bold investments and large-scale M&A, which were the driving forces of growth, are now seen as holding the group back.

SK REITs (SK Entrusted Management Real Estate Investment Company) will enter the KOSPI market next month. Photo of SK Group headquarters, SK Seorin Building in Jongno-gu, on the 18th. Photo by Moon Honam munonam@

SK REITs (SK Entrusted Management Real Estate Investment Company) will enter the KOSPI market next month. Photo of SK Group headquarters, SK Seorin Building in Jongno-gu, on the 18th. Photo by Moon Honam munonam@

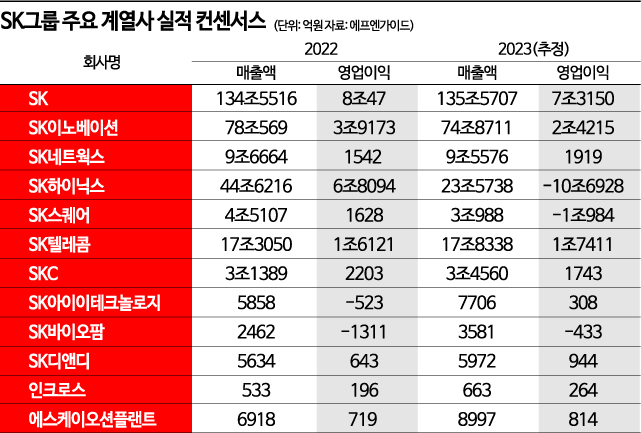

According to an estimate of the annual performance of 12 listed companies of SK Group commissioned to financial information firm FnGuide, five companies are expected to see operating profits decline this year compared to last year. This includes key affiliates such as the top holding company SK Inc., SK Innovation, SK Square, SK Hynix, and SKC.

SK Hynix, which has served as the group's treasury, is expected to post a loss exceeding 10 trillion won. SK Square is also forecasted to record a loss of about 1 trillion won. The combined debt of the 12 listed companies is estimated at 252 trillion won (simple sum), with significant interest burdens. Last year, SK's interest expenses rose 48.4% year-on-year to 2.1411 trillion won. Interest payments due this year are likely to surge further.

SK has repeatedly borrowed money to fund new investments. It is pointed out that the debt burden has surged due to large-scale investments exceeding its financing capacity. Hyong Shinyong, a senior researcher at NICE Credit Rating, warned, "If the semiconductor sector's poor performance prolongs or the battery sector's business stabilization is delayed, leading to a deterioration in the group's debt repayment ability, a downgrade of SK Group's overall credit rating will be inevitable." When credit ratings fall, interest rates rise. Interest rates have already been soaring since the second half of last year. This is a case of adding insult to injury.

Semiconductor Slump... SK Hynix Posts 11 Trillion Won Loss

At the core of SK Group's slump is SK Hynix. SK Hynix has played a key role in the group's investments and served as a growth engine for the entire group. However, it is facing difficulties due to excessive investments and large-scale acquisitions during its growth. A representative case is Solidigm, which is currently posting losses.

Solidigm is the former Intel NAND flash business unit, acquired by SK Hynix in 2021 with an investment of 9 billion USD. It is an SSD (solid-state drive) subsidiary. At the time of acquisition, SK Hynix stated it aimed to strengthen its competitiveness in the NAND business, as SSDs are made using NAND memory, the company's main product. However, there has been no significant performance yet. After the acquisition, the NAND market share has actually decreased. Market research firm Omdia reported that Hynix's market share was 20.4% in Q2 last year but dropped to 16.8% in Q4.

To make matters worse, SK Hynix began to incur losses in the trillion-won range amid the worst semiconductor downturn in history. SK Hynix recorded an operating loss of 1.898 trillion won in Q4 last year, turning to a deficit. Non-operating losses also amounted to 2.523 trillion won. The worsening NAND market conditions led to a decline in the value of intangible assets such as Solidigm's technology.

When acquiring Solidigm, SK Hynix paid 7 billion USD (about 8.192 trillion won at the time) in the first phase, which was 65% of that year's operating profit (12.4103 trillion won). The approximately 4 trillion won invested in the past by participating in the Korea-Japan-US consortium led by Bain Capital to acquire Toshiba Memory (now Kioxia) also resulted in a loss of 620 billion won based on valuation.

Cash and borrowings are also in poor condition. SK Hynix's cash, including cash equivalents and short-term financial products, stood at 6.41 trillion won in Q4 last year, down 26.07% from the same period the previous year. Borrowings, including long- and short-term debt, long-term liquidity liabilities, and bonds, increased by 30.53% to 23 trillion won over the same period. The debt ratio rose from 28% to 36%. In this situation, SK Hynix is striving to secure business funds by issuing about 1.39 trillion won in corporate bonds and 2.24 trillion won in overseas exchangeable bonds (EB) this year.

Capital expenditures (CAPEX) will be reduced this year. SK Hynix rapidly increased CAPEX since 2020 but plans to cut investment by more than 50% compared to last year (19 trillion won). This is an unavoidable choice due to depleted cash reserves, but since investment is directly linked to business competitiveness, this could pose a risk if the market rebounds. On the bright side, Samsung Electronics officially announced semiconductor production cuts earlier this month. Thanks to this, semiconductor prices rose on the 12th for the first time in about 400 days.

Money-Guzzling 'Battery'... Profit Turnaround Far Off

The battery sector is also facing severe losses. The securities industry estimates SK On's operating loss in Q1 to be between 350 billion and 430 billion won. The six consecutive quarters of losses since its launch have become a foregone conclusion. Last year, SK On recorded sales of 7.6177 trillion won and an operating loss of 1 trillion won.

To increase profitability quickly, SK On can only expect benefits from the Inflation Reduction Act (IRA) implemented in the United States. The industry expects SK On to receive about 420 billion won in subsidies this year through the Advanced Manufacturing Production Credit (AMPC) in the U.S. This is anticipated to somewhat ease the pressure on performance improvement.

However, the financial situation shows no signs of improvement. As of the end of last year, SK On's debt reached 15.3 trillion won, an increase of 8.7 trillion won compared to the previous year. The debt ratio rose from 166.9% to 258.1% in one year.

The problem is that ongoing capital needs mean debt will inevitably increase further. SK On currently operates two plants in Georgia, U.S., and is making large-scale investments through its joint venture with Ford, 'BlueOvalSK.' BlueOvalSK is investing 10.2 trillion won to build three battery production bases in Kentucky and Tennessee.

To secure funds, SK On is raising capital from financial investors (FI). In November last year, SK Innovation and SK On finalized a funding plan with a consortium of KDB PE and East Bridge for up to 1.32 trillion won.

Most of the funds flowing into SK On are going overseas. On the 6th, SK On poured 350 billion won and 170 billion won into capital increases for SK Battery America and its Hungarian subsidiary, respectively. SK On's financial burden is also affecting its parent company, SK Innovation. SK Innovation's short-term borrowings increased nearly ninefold from 864 billion won in 2021 to 7.6 trillion won last year.

An SK On official said, "In addition to pre-IPO (initial public offering), we are securing funds through various methods such as cash flow generation from business ramp-up, incentives and policy financing from investment countries, 2 billion USD financing through domestic and international public export credit agencies, and partner investment contributions upon joint venture establishment."

Warning Signals from Increasing External Borrowings

The capital market generally views SK Group's financial situation as solid enough to withstand the poor performance and increased borrowings of the semiconductor and battery affiliates. However, there are warnings that prolonged large-scale losses at SK Hynix and others could increase financial burdens and lead to credit rating downgrades.

As of the end of last year, SK Hynix's debt ratio and net borrowing dependency stood at 64.1% and 17.7%, respectively. Although borrowings have increased this year due to large-scale corporate bond and exchangeable bond (EB) issuances, it is assessed that there is still considerable capacity for financing.

SK Hynix's corporate bond and short-term credit ratings remain strong at AA and A1, respectively. Additional EB issuance is possible using remaining treasury shares. About half of the 40,351,325 treasury shares held were used for this EB issuance. Bond yields reflecting corporate credit risk are also stable.

An investment banking industry official said, "Although SK Hynix's borrowings doubled over the past two years, sales and EBITDA also increased by about 1.5 times during the same period," adding, "In absolute terms, the financial burden is not yet at a level that would cause serious concern." However, the official expressed concern, saying, "If SK Square, the major shareholder, cannot provide support and SK Hynix continues to increase external borrowings while performance deterioration prolongs, financial capacity will be rapidly depleted."

SK On finds it difficult to raise borrowings independently. Its corporate bonds were issued with guarantees from its parent company, SK Innovation. However, domestic and foreign institutional investors interested in investing in the battery business are waiting, so it is expected that SK On can attract sufficient external investment without SK Innovation's support if necessary.

NICE Credit Rating forecasted, "SK Group generates about 20 trillion won in annual EBITDA overall, so if investments are partially adjusted, it can sufficiently control financial deterioration. However, until visible results emerge in the semiconductor and battery sectors, external financing will inevitably increase."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.