KakaoT Posts Profit for 2 Consecutive Years... Wooty and Tada Face Growing Losses

Gap Widens Despite Aggressive Investment... Targeting Niches with Specialized Services

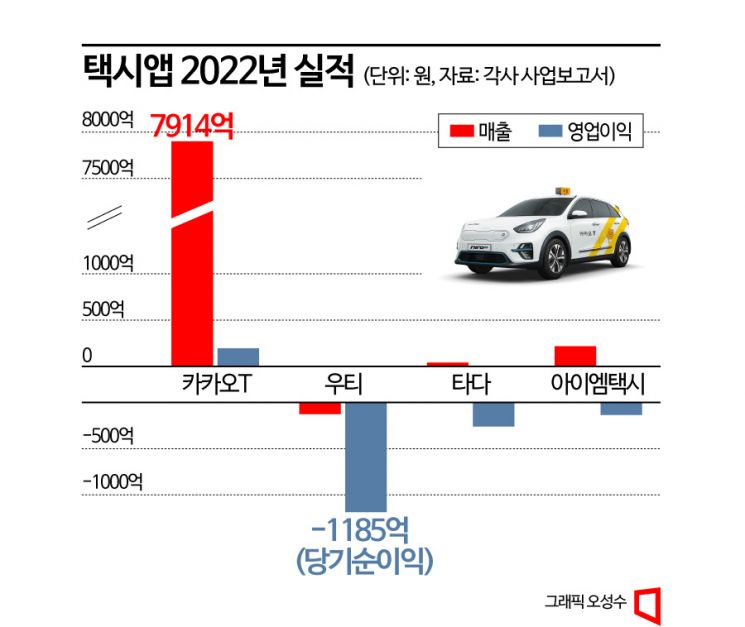

The performance gap between 'KakaoT,' the number one taxi app in the domestic market, and other operators has widened further. Last year, companies like 'Wooty' and 'Tada' increased their operating expenses through driver acquisition and user discounts, but they failed to shake Kakao's dominant position. Taxi apps have targeted niche demands such as foreign tourists and business travelers.

Operating Expenses Increased but Gap with KakaoT Widens

According to each company's business reports on the 12th, Kakao Mobility, which operates KakaoT, posted sales of 491.4 billion KRW last year, a 45% increase compared to the previous year. Operating profit rose 55% to 19.4 billion KRW, marking a profit for the second consecutive year.

Other operators increased sales but saw larger operating losses. VCNC, the operator of Tada, recorded sales of 4.1 billion KRW last year, up 7.9% from the previous year. However, operating expenses exceeded revenue, resulting in an operating loss of 26.2 billion KRW. Jin Mobility, which operates I’m Taxi, saw sales nearly quadruple to 21.7 billion KRW last year but continued to post an operating loss of 13.6 billion KRW. Wooty, a joint venture between Uber and T Map Mobility, recorded unprecedented negative sales. Last year, sales were -12.8 billion KRW, with a net loss of 118.5 billion KRW. This reflects marketing costs, including promotions, accounted for in sales according to accounting standards.

Despite increasing operating expenses while incurring losses, they failed to narrow the gap with KakaoT. According to Mobile Index, a mobile data analysis platform, KakaoT had 7.6 million users last month (based on Google Play). Even combined, Wooty (270,000), Tada (50,000), and I’m Taxi (40,000) account for only 4.7% of KakaoT’s user base. Although the gap narrowed briefly when KakaoT faltered due to the Kakao outage in October last year, it was only a temporary effect.

Customized Mobility Services for Medical Tourists and Business Travelers

Taxi apps have targeted niche markets. They focus on demand from tourists and business travelers. Although the market is small, the services are highly profitable. Drivers who can provide foreign language services are assigned, and since waiting time beyond travel is included, the fares are higher than regular services.

Tada signed a business agreement with Hana Tour ITC through its directly operated taxi company, Pyeonanhan Idong, to provide mobility services to domestic and foreign customers using Hana Tour travel packages. Additionally, targeting users who need to handle multiple long schedules such as business trips or meetings, they introduced a 'rent by the hour' service. Wooty partnered with Busan City to target foreign tourists. I’m Taxi launched 'Medicall Taxi,' a medical tourist pickup service. In collaboration with Gangnam-gu, it offers customized services for foreign patients receiving surgery or treatment at 34 hospitals located in Gangnam-gu.

A mobility industry insider said, "They aim to secure demand in advance to improve operational efficiency and maximize profits. Since it is difficult to easily overturn market asymmetry in the taxi-hailing market, this year they plan to focus on cost reduction and efficient operations."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.