Sharp Divergence in Trading Between Individuals and Foreigners This Month

Samsung Electronics Up 3.13%, POSCO Holdings Up 10.46%

Since the beginning of this month, the stocks traded by foreign investors and individual investors have sharply diverged, drawing attention. Foreign investors are focusing on semiconductor stocks, the traditional flagship stocks, while individual investors are concentrating on secondary battery stocks, which have driven this year's stock market rise. So far, individual investors have had the upper hand in terms of returns. However, with forecasts suggesting that the market's center of gravity will shift to semiconductors, there is growing interest in who will be the ultimate winner between foreign and individual investors.

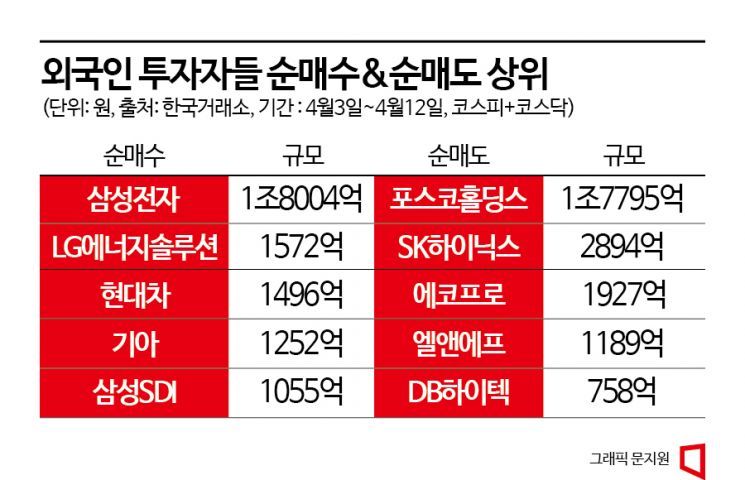

According to the Korea Exchange on the 13th, foreign investors' top net purchase this month through the 12th was Samsung Electronics. During this period, foreign investors bought Samsung Electronics shares worth 1.8004 trillion KRW. This was followed by LG Energy Solution (175.2 billion KRW), Hyundai Motor (149.6 billion KRW), Kia (125.2 billion KRW), and Samsung SDI (105.5 billion KRW) in net purchases. In contrast, foreign investors mainly net sold secondary battery stocks. During the same period, foreign investors most heavily net sold POSCO Holdings (1.7795 trillion KRW), followed by SK Hynix (289.4 billion KRW), EcoPro (192.7 billion KRW), L&F (118.9 billion KRW), and DB HiTek (75.8 billion KRW).

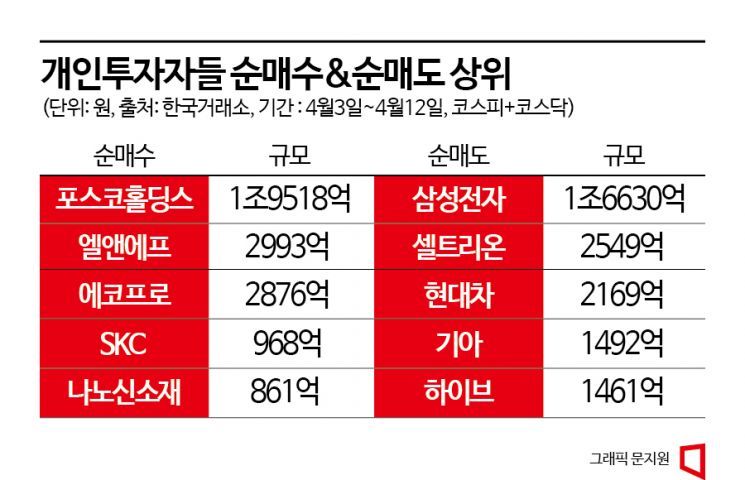

The portfolio of individual investors showed a contrasting pattern to that of foreign investors. The stock most bought by individuals was POSCO Holdings (1.9518 trillion KRW), which foreign investors sold the most. This was followed by L&F (299.3 billion KRW) and EcoPro (287.6 billion KRW) in net purchases, indicating a bet on secondary battery-related stocks. Individuals most heavily sold Samsung Electronics (1.663 trillion KRW), the top net purchase stock of foreign investors. This was followed by Celltrion (254.9 billion KRW) and Hyundai Motor (216.9 billion KRW) in net sales.

So far, individual investors have the upper hand. During this period (April 3 to April 12), Samsung Electronics' stock price rose by 3.13%. POSCO Holdings rose much more sharply by 10.46%. The divergent investment sentiment is interpreted as due to differing evaluations of new businesses. Lee Taehwan, a researcher at Daishin Securities, explained, “Individual investors regard POSCO Holdings not as a steel company but as a new materials company,” adding, “Since secondary battery-related stocks have surged recently, they highly value the new business, such as lithium, which is a raw material for secondary batteries.”

Although Samsung Electronics recorded an ‘earnings shock’ in the first quarter, foreign investors continue to send unwavering love calls. This is due to expectations of a bottoming out in semiconductor performance in Q1 and Samsung Electronics’ decision to cut production. Recently, after Samsung Electronics decided to reduce memory semiconductor production, foreign securities firms, following domestic ones, have raised Samsung Electronics’ target price. Goldman Sachs raised the target price from 74,000 KRW to 77,000 KRW, HSBC from 75,000 KRW to 88,000 KRW, and Mizuho from 77,000 KRW to 80,000 KRW. Kim Unho, a researcher at IBK Investment & Securities, analyzed, “The sluggish production cut decision reflects expectations that the oversupply phase could be resolved faster than previously forecasted,” adding, “Investment sentiment is expected to improve significantly.”

Investment sentiment between foreign and individual investors also diverges regarding secondary battery stocks such as EcoPro and L&F. EcoPro has risen 54.26% this month alone and a staggering 646.60% since the beginning of the year. Individual investors have bought EcoPro shares worth 1.1639 trillion KRW this year, while foreign investors have net sold 470.9 billion KRW. L&F rose 1.28% this month and 83% this year.

The securities industry views EcoPro’s stock price as overheated. While there is no disagreement about the growth potential of the secondary battery industry, there are calls for a thorough review of how much the current stock price should reflect expectations of future value. In particular, Kim Hyunsoo, a researcher at Hana Securities who issued a ‘sell’ rating on EcoPro for the first time on the 12th, analyzed, “EcoPro’s current market capitalization has exceeded the expected corporate value five years from now,” adding, “It is a great company, but it is difficult to see it as a good stock currently, and a detailed review of its fair value is necessary.”

Samsung Securities also issued a ‘hold’ investment opinion on EcoPro. Jang Junghoon, a researcher at Samsung Securities, pointed out, “Holding companies mainly earn income from dividends received from controlled subsidiaries, and their value has traditionally been discounted at a certain rate based on their holdings, but EcoPro is being valued about 20% higher,” adding, “Even reflecting the increase in net asset value due to the sharp rise in the stock prices of EcoPro’s subsidiaries, EcoPro BM and EcoPro HN, the current stock price is overheated compared to its fair value.”

So far, individual investors betting on secondary batteries have gained the upper hand, but there are also forecasts that the market’s center of gravity will shift to semiconductors. Kim Younghwan, a researcher at NH Investment & Securities, analyzed, “In response to the concentration of funds in the secondary battery sector in February and March, investors now have a strong desire to find alternatives other than secondary batteries,” adding, “Based on past experience, semiconductor stocks have often performed well during turnaround phases in the semiconductor industry.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)