IMF 'World Economic Outlook April 2023'

General Government Debt Soars 52.5% in 7 Years

Debt Ratio Rises from 51.3% in 2021 to 58.2%

Including Public Sector, National Debt Exceeds 2000 Trillion

Dire Situation... 'Fiscal Rules' Passage Delayed Indefinitely

An analysis has emerged predicting that the South Korean government's debt will surpass 1,600 trillion won in five years. The overall "national debt," including the public sector, is likely to exceed 2,000 trillion won. The scale of the debt is rapidly increasing, but fiscal rules aimed at resolving the issue are currently stalled in the National Assembly.

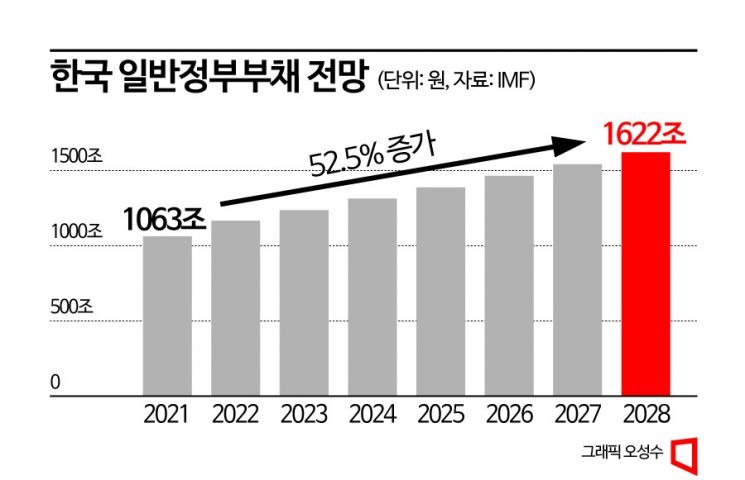

According to the International Monetary Fund (IMF)'s "World Economic Outlook April 2023" released on the 12th, South Korea's general government debt is projected to reach 1,622.6799 trillion won by 2028. This represents a 52.5% increase compared to the baseline year 2021, when the debt was 1,063.9948 trillion won. The growth rate is faster than major advanced countries such as the United States (49.4%), Japan (22.5%), the United Kingdom (45.4%), Germany (18.1%), and France (34.5%). Countries with a steeper debt increase than South Korea are mostly underdeveloped nations or those facing extreme internal and external conditions like Russia or T?rkiye.

The ratio of general government debt to Gross Domestic Product (GDP) is expected to approach 60%. This ratio first surpassed 50% in 2021 at 51.3% (51.5% according to the Ministry of Economy and Finance) and has been rising annually, reaching 58.2% by 2028. During the same period, countries like Germany (68.6% → 59.6%) and Mexico (58.6% → 57.9%) have lowered their debt ratios, bringing South Korea close to their levels.

The actual national debt, including the public sector, is even larger. IMF statistics estimate South Korea's fiscal balance based on government finances, the 2023 budget, medium-term fiscal plans, and IMF's own adjustments, but exclude debts of non-financial public enterprises. Considering that public sector debt was about 400 trillion won higher than government debt last year, the total debt the country must repay is expected to exceed 2,000 trillion won. Although this is not debt that must be repaid immediately, when factoring in pension liabilities that will become future burdens, the debt load increases significantly.

Debt Ratio Soars... Fiscal Rules Passage Stalled

While the IMF statistics cover a medium-term (five-year) period, South Korea's debt indicators are expected to worsen over time due to rapid aging, low birth rates, deteriorating fiscal conditions, and rising welfare expenditure costs. The Organisation for Economic Co-operation and Development (OECD) projects the government debt ratio to reach 150.1% by 2060, while the Korea Development Institute (KDI) and the National Assembly Budget Office forecast national debt ratios of 144.8% and 161.0%, respectively, for the same period.

The IMF has already expressed concerns about the speed of South Korea's debt increase. In February, Victor Gaspar, Director of the IMF Fiscal Affairs Department, met with Choi Sang-dae, Second Vice Minister of the Ministry of Economy and Finance, and stated, "South Korea is one of the countries with the fastest debt growth in the future," emphasizing that "proactive fiscal soundness management is necessary, especially to respond to demographic changes."

The government has declared its intention to establish a sound fiscal policy, but the situation remains challenging. Attempts to legislate fiscal rules have been stalled in the National Assembly for months. The fiscal rules aim to maintain the management fiscal balance deficit ratio within 3% of GDP during normal times and to reduce the deficit ratio to within 2% if the national debt ratio exceeds 60% of GDP. Although there is consensus between ruling and opposition parties on the necessity, the opposition's focus on passing the Social Economy Act has delayed the legislation.

Meanwhile, the Ministry of Economy and Finance plans to establish a "Fiscal Vision 2050" within the first half of this year to address the deteriorating national fiscal soundness.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)