The global market size of antibody-drug conjugates (ADCs) has grown to the 9 trillion won range, accelerating commercialization efforts by domestic pharmaceutical and bio companies. ADCs are a cancer treatment method that targets specific proteins. They combine antibodies that bind to cancer antigens with cytotoxic drugs (payloads) that can kill cancer cells via a linker, effectively delivering toxins only to cancer cells. Like guided missiles, they deliver drugs exclusively to cancer cells to induce cell death, making them a next-generation technology.

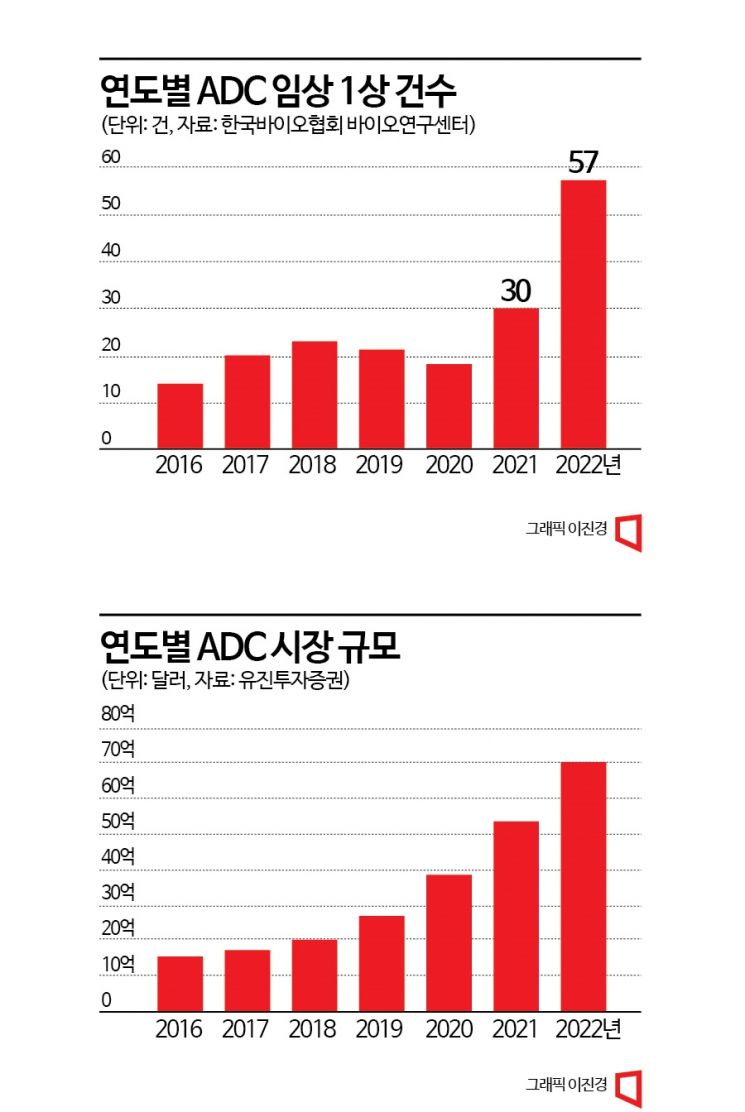

According to the Korea Bio Association Bio Research Center on the 12th, the number of ADCs entering Phase 1 clinical trials last year was a total of 57. Considering that 30 ADCs entered Phase 1 trials in 2021, the number of entries increased by 90% in one year. The total number of new clinical trials initiated last year to evaluate ADCs was 249, a 35% increase compared to the previous year. According to Eugene Investment & Securities, the combined sales of 11 ADC products approved by the U.S. Food and Drug Administration (FDA) last year exceeded $7 billion (about 9.2 trillion won). This represents a 32% growth compared to the previous year's sales. The ADC breast cancer drug 'Enhertu,' developed by AstraZeneca and Daiichi Sankyo, has driven market growth by achieving $1 billion (about 1.3 trillion won) in sales in less than three years since its launch in 2019.

Among domestic companies, LegoChem Bio is exporting ADC technology through open innovation. In December last year, it signed an ADC platform technology export contract worth a total of 1.6 trillion won with global pharmaceutical company Amgen. Last month, Fosun Pharma, a Chinese partner company that received technology transfer from LegoChem Bio, entered Phase 3 clinical trials and received a milestone payment of $3.5 million (about 4.6 billion won). Samjin Pharmaceutical also began developing new anticancer drugs by signing a joint research agreement for ADC development with Novelty Nobility in January.

Large pharmaceutical companies are also securing technology. Celltrion signed an option contract to introduce ADC technology with Pinobio in October last year. Celltrion plans to apply Pinobio’s ADC platform technology to its pipeline candidate substances under development to develop anticancer drugs. The contract scale between the two companies is expected to reach up to $1.2428 billion (about 1.5423 trillion won) depending on the technology exercise option. Chong Kun Dang also announced plans to actively develop anticancer drugs after signing an ADC technology introduction contract with Dutch biotechnology company Synaffix in February. The contract signed by Chong Kun Dang is worth about $132 million (about 165 billion won), including contract fees and development, approval, and sales milestones.

Samsung Biologics, which focuses on contract development and manufacturing organization (CDMO), announced plans to expand into next-generation therapeutics including ADCs at the JP Morgan Healthcare Conference (JPMHC) in January. The company is reportedly preparing ADC-related facilities and aims to start production in the first quarter of next year. Lotte Biologics also plans to equip ADC contract manufacturing organization (CMO) related facilities at the Syracuse plant acquired from Bristol-Myers Squibb (BMS) in the U.S.

The industry believes that the level of technologies constituting ADCs, such as antibodies, linkers, and payloads, has significantly improved through past research. The Bio Association stated, "The linker field has achieved considerable innovation, with many individual linkers disclosed, 33 of which have been used in clinical trials," adding, "There are also more than 60 new payloads used in ADC clinical stages, attracting significant investment interest." Kim Jeong-hyun, a researcher at Kyobo Securities, said, "To develop good ADC therapeutics, antibodies, drugs, linkers, and conjugation methods are all important," and added, "More focus is needed on efficacy and safety data at the clinical stage, and comparative efficacy with competing pipelines must precede value assessment."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.