Samsung Electronics NAND Production Cut Brightens Price Outlook

"Attention Needed on Signal Effect to Market"

Competition in 200-Layer Stacking Moves to 300-Layer Level

Samsung Electronics is reportedly reducing NAND flash production like other competitors, which could lead to higher product prices. Related companies are fiercely competing in stacking (layer count stacking), a measure of NAND technology, to increase their market share in the growing market.

On the 11th, the semiconductor industry viewed that the decline in NAND prices could stop due to Samsung Electronics' production cut. Earlier, on the 7th, Samsung Electronics released explanatory materials on the day of its preliminary earnings announcement, stating that it is "adjusting memory production downward." It is known to be reducing production of memory products such as DRAM and NAND.

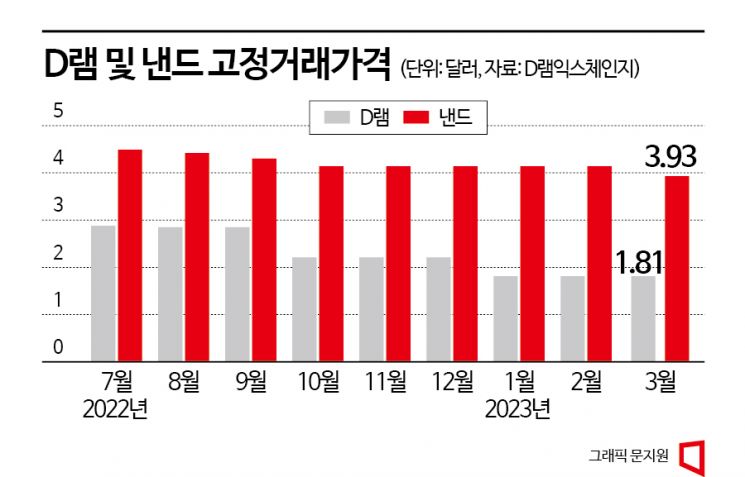

NAND prices have been falling continuously since June last year. Due to the global economic downturn, demand decreased, and oversupply led to excessive inventory buildup. According to statistics from market research firm DRAMeXchange, the fixed transaction price (contract price between companies) for NAND (128Gb 16Gx8) used in memory cards and USBs last month was $3.93, down 5.12% from the previous month.

In the NAND market, major companies such as SK Hynix, Kioxia, and Micron are already cutting production. If Samsung Electronics, the top player, also reduces production, the effect of production cuts could be significant. In fact, market research firm TrendForce forecasted in a report last month that if additional production cuts occur in the NAND industry, prices could rebound in the fourth quarter.

Of course, for NAND prices to rise, supply must decrease while demand increases. The industry is paying attention to the market signal effect of Samsung Electronics' production cut. Simply put, customer reactions may occur just from the announcement of production cuts. An industry insider said, "Even Samsung Electronics, which had been holding out, is cutting production, making it unlikely that supply will increase significantly until next year," adding, "Customers' inventory strategy calculations are becoming more complex, and some will order products as needed."

Similar forecasts have emerged in the securities industry. Choi Do-yeon, head of the SK Securities Research Center, said, "If the scale of production cuts is maintained until the second half of this year, downstream customers may proactively accumulate inventory beyond actual demand starting in the second half," and "We expect a rebound in DRAM prices at the end of this year or in the first quarter of next year." He also predicted, "NAND, which has reached cash cost, could see a faster price rebound."

If the NAND price recovery revitalizes the market, the long-term outlook is bright. Market research firm Omdia expects the NAND market to grow larger than the DRAM market in the future. With an average annual growth rate of 6.6%, the market size is predicted to reach $81.619 billion by 2027.

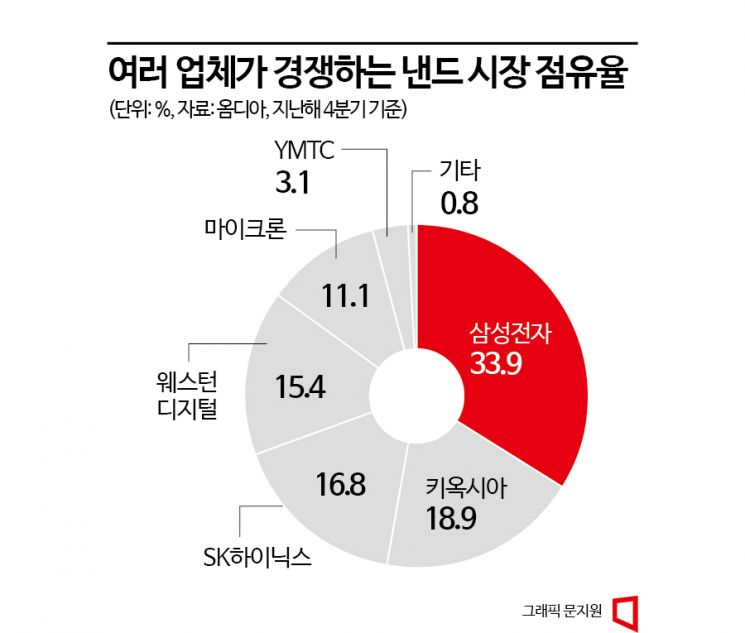

Competition among companies is expected to be fierce. Unlike the DRAM market, where three companies compete, five companies are competing in the NAND market. According to Omdia statistics, last year's fourth-quarter market share was ▲Samsung Electronics (33.9%) ▲Kioxia (18.9%) ▲SK Hynix (16.8%) ▲Western Digital (15.4%) ▲Micron (11.1%).

These companies are competing in stacking technology in the NAND market. NAND stores data in cells, and capacity is increased by stacking cell layers. Increasing the number of layers has become a key indicator of technological competitiveness.

NAND companies have been introducing 200-layer products since last year. Micron began mass production of 232-layer NAND last year and released consumer solid-state drives (SSDs) using this NAND. Samsung Electronics started mass production of 236-layer 1-terabit (Tb) 8th generation V-NAND in November last year. Kioxia and Western Digital announced 218-layer 3D NAND technology last week and plan to mass-produce products this year. SK Hynix will also begin mass production of 238-layer 4D NAND this year.

Top-tier NAND with over 300 layers is expected to be available soon. Samsung Electronics has announced plans to develop 1000-layer V-NAND by 2030. SK Hynix revealed 300-layer 1Tb NAND technology last month at the International Solid-State Circuits Conference (ISSCC). It is expected to mass-produce related products next year.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.