There is speculation that Samsung Electronics' recent decision to cut memory semiconductor production was influenced by the burden of its continuously rising market share.

On the 11th, the semiconductor industry pointed out that if Samsung Electronics' global market share of DRAM and NAND in the first quarter of this year rises further compared to the fourth quarter of last year, it could cause problems not only in profitability but also in establishing a fair market order. In fact, as memory semiconductor competitors other than Samsung Electronics began production cuts last year, Samsung's market dominance likely increased as it joined the production cuts later than others.

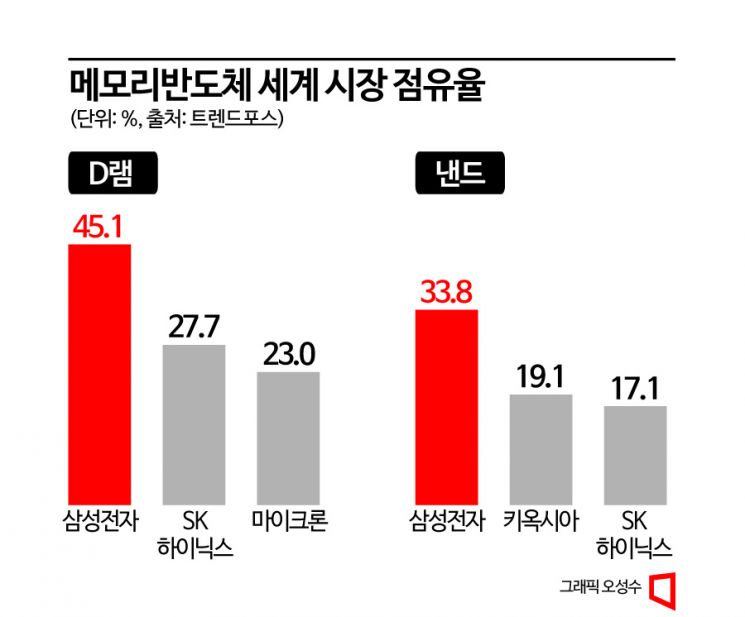

According to market research firm TrendForce, Samsung Electronics' DRAM market share in the fourth quarter of last year was 45.1%, up 4.4 percentage points from 40.7% in the third quarter. During the same period, SK Hynix's share fell from 28.8% to 27.7%, and Micron's from 26.4% to 23%, while only Samsung Electronics' market share increased. In NAND, Samsung's share rose by 2.4 percentage points to 33.8%, whereas the second and third ranked companies, Kioxia and SK Hynix, dropped by 1.5 and 1.4 percentage points to 19.1% and 17.1%, respectively. Unlike other companies that started production cuts last year, Samsung Electronics, with its superior cost competitiveness, did not reduce production despite falling semiconductor prices, likely causing its market share to rise further.

Especially in the DRAM market, which is returning to an oligopoly structure dominated by Samsung Electronics, SK Hynix, and Micron, Samsung's share is approaching 50%, the threshold for market monopoly judgment. It is effectively a market-dominant player. In the NAND market, the top three companies currently share 70% of the market, but if the current downturn worsens, lower-tier players like Western Digital could be hit hard, potentially turning the market into an oligopoly at any time.

An industry insider said, "An increase in Samsung Electronics' memory semiconductor market share itself is not problematic, but the market tends to closely monitor companies with monopoly or oligopoly status for potential violations of antitrust laws by abusing their position." Professor Shin Chang-hwan of Korea University's Department of Electrical and Electronic Engineering also recently stated at a forum, "Especially if a single company holds more than half of the DRAM market share, it becomes subject to antitrust regulation," explaining that it is now important to maintain the current market share while making efficient investments to ensure smooth technological transitions.

Amid growing US-China high-tech hegemony conflicts, an additional rise in Samsung Electronics' memory semiconductor market share could potentially provoke countermeasures from neighboring countries strengthening their semiconductor industries, such as the US, China, and Japan. The market has already experienced a "chicken game" during the semiconductor downturn from 2007 to 2009, which led to the bankruptcy of competing companies.

From the perspective of countries competing in advanced technology hegemony and aiming to grow their domestic semiconductor industries, Samsung Electronics' rapid advance in memory semiconductors is unwelcome. If Samsung's memory semiconductor market share increases further, antitrust agencies such as the US Federal Trade Commission (FTC) and China's State Administration for Market Regulation (SAMR) may apply stricter standards and strengthen regulations targeting Samsung Electronics, a possibility that must be taken into account.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.