Hana Financial Research Institute

'2023 Korea Wealth Report'

More Assets Linked to Outgoing and Sensory ESTJs

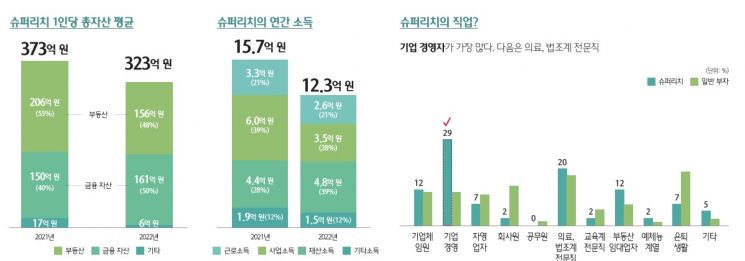

The average total assets of domestic super-rich individuals amount to 32.3 billion KRW, and as of the end of last year, they held 60% of their financial assets in cash and deposits, according to data released on the 9th.

Hana Financial Management Research Institute published the '2023 Korea Wealth Report,' analyzing the financial behaviors of wealthy Koreans, defining those with financial assets over 10 billion KRW and total assets over 30 billion KRW as 'super-rich.' Individuals with financial assets over 1 billion KRW transacted with financial companies are defined as 'wealthy,' and those holding financial assets between 100 million KRW and less than 1 billion KRW are classified as the mass affluent.

Most 'Super-Rich' Are Business Executives

The super-rich had an equal split between real estate and financial assets, and as of the end of last year, held 60% of their financial assets in cash and deposits. The most common occupation was business executives at 29%, followed by medical and legal professionals at 20%.

The average annual income of the super-rich was approximately 1.2 billion KRW. Among this, property income accounted for the largest share at 39% (about 500 million KRW). For general wealthy individuals, earned income (37%) was higher than property income (22%). The super-rich saved more than half of their monthly income (57%), using the remainder for consumption (37%) and loan repayments (6%). This saving capacity was higher than that of general wealthy individuals, who consumed 59% and saved 38%.

Super-Rich Increased Cash and Deposit Holdings Last Year

The most notable feature of the super-rich's financial asset portfolio last year was the increased proportion of cash and deposits. The research institute explained that the preference for deposits rose due to interest rate hikes, and there was also an aspect of increasing cash holdings to prepare for uncertainties. The proportion of cash and deposits among the super-rich more than doubled compared to the previous year, while the share of stocks was reduced to about half.

Last year, 38% of the mass affluent, 64% of general wealthy individuals, and 73% of the super-rich held foreign currency assets. The proportion of people holding foreign currency assets increased as the scale of financial assets grew. Looking at foreign currency assets by type, the super-rich increased foreign currency cash holdings from 63% in 2021 to 73%. Investments in overseas stocks rose from 30% to 43%, and bonds from 10% to 17%.

Seventy percent of the super-rich achieved positive returns through financial asset investments last year, and 15% of them attained high returns exceeding 10%. About 60% of the super-rich plan to invest this year with an expected return of 5-10%, and more than 15% aim for over 20%. Stocks (29%) were the top choice for investment preference, followed by real estate (27%) and deposits (15%).

Interest in art investment was also high. According to the survey, about 41% of the super-rich owned artworks, a higher level compared to general wealthy individuals (23%) and the mass affluent (14%). Similar to foreign currency assets, the proportion of art owners increased in proportion to asset size. The total price of artworks held by the super-rich was concentrated at the 100 million KRW or more range at 41%, and one in two super-rich individuals expressed willingness to purchase additional artworks in the future.

Wealthy Prefer Real Estate Assets... Increase in Safe Assets Like Deposits

As of the end of last year, the average total assets of wealthy individuals were 7.2 billion KRW. Among these, real estate assets amounted to about 3.97 billion KRW, accounting for 55% of total assets. Compared to the previous year, the scale of financial assets was similar, but real estate assets decreased by more than 500 million KRW.

Nevertheless, wealthy individuals showed a high preference for real estate as an asset for future investment. The reasons for preferring real estate assets were 'to maintain and preserve assets stably (36%)' and 'superior investment returns compared to other assets from a long-term perspective (32%).'

80% of wealthy individuals predicted that the real economy would worsen this year and that real estate prices would decline further. They agreed that the real estate market would only recover after 2025.

Amid growing uncertainties, the financial asset portfolio of wealthy individuals showed changes. Expecting an economic recession, they shifted funds to safer assets. Compared to the previous year, the stock proportion in their holdings decreased from 27% to 16%, while bonds (3%→6%) and deposits (28%→35%) increased.

What Are the MBTI Personality Types of the Wealthy?

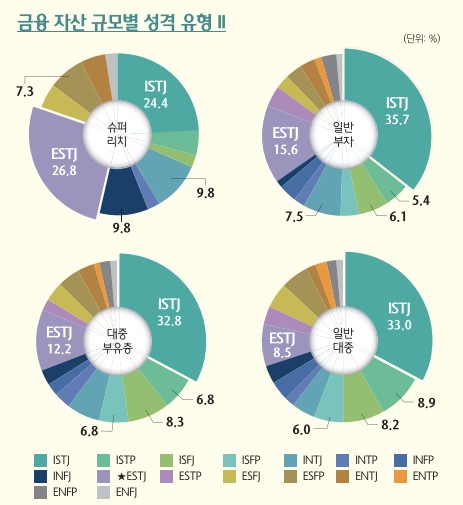

According to the institute, the higher the assets, the lower the proportion of I (Introverted) and S (Sensing) types, and the higher the proportion of T (Thinking) and J (Judging) types. Especially among the super-rich group, the 'ESTJ' type showed the highest proportion. While the general public had an 8.5% rate of 'ESTJ,' more than three times as many super-rich individuals (26.8%) were 'ESTJ.' The 'ESTJ' type is commonly called the leader or executive type, valued for emphasizing social order, being practical, and having strong drive. Many private bankers (PBs) at banks also cited execution ability as a characteristic of the wealthy.

Looking at MBTI by occupation among the wealthy, medical and legal professionals had a particularly high rate of 'ISTJ' (42%), real estate rental business owners had a high rate of 'INTJ' (23%), and housewives showed a much higher proportion of 'ISFJ,' described as the 'protector' or 'helper,' compared to other occupations.

Seonkyung Hwang, senior researcher at Hana Financial Management Research Institute, said, "In all crises, from the past foreign exchange crisis, global financial crisis, to the COVID-19 pandemic, there were opportunities for wealth, and those who recognized these opportunities became new rich and super-rich."

Meanwhile, the institute conducted interviews with a total of 21 individuals, including Hana Bank PBs and clients, and conducted an online survey with 2,013 respondents (745 wealthy individuals, 818 mass affluent, and 450 general public).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.