Amid the recent temporary suspension of electricity and gas rate hikes by the government and ruling party, opinions from various sectors sharply clashed regarding the adjustment of rates. On one side, there were views that energy public enterprises can no longer sustain losses if electricity and gas rates remain frozen, while on the other, there were calls for a cautious approach as rate increases could trigger a chain reaction of inflation.

According to the Ministry of Economy and Finance and the Ministry of Trade, Industry and Energy on the 4th, the Korea Development Institute (KDI) and the Korea Energy Economics Institute jointly hosted a meeting with stakeholders related to electricity and gas rates at the Korea Fiscal Information Service in Jung-gu, Seoul. The meeting was organized to exchange opinions among stakeholders on the increase of electricity and gas rates, covering topics such as the national economy, users, suppliers, financial market outlook, and energy market outlook.

On the 19th, when the announcement on the electricity rate hike was imminent, an electric meter installed in a residential area in Seoul was seen. As prices of essential goods and energy soar across the board, and public utility fees such as electricity, water, and gas increase, these have become major causes of rapid inflation, deepening concerns for inflation authorities. If the government accepts Korea Electric Power Corporation's request for an electricity rate hike, there are concerns that the consumer price inflation rate, which has already recorded mid-5%, could exceed 6%. Photo by Kim Hyun-min kimhyun81@

On the 19th, when the announcement on the electricity rate hike was imminent, an electric meter installed in a residential area in Seoul was seen. As prices of essential goods and energy soar across the board, and public utility fees such as electricity, water, and gas increase, these have become major causes of rapid inflation, deepening concerns for inflation authorities. If the government accepts Korea Electric Power Corporation's request for an electricity rate hike, there are concerns that the consumer price inflation rate, which has already recorded mid-5%, could exceed 6%. Photo by Kim Hyun-min kimhyun81@

Rate Freeze, Caution Against Consumer Wasteful Usage

Research institutions supporting the suppliers’ standpoint argued that energy rates should be gradually adjusted to realistic levels and that policy measures to reduce demand should be strengthened. Professor Kim Yoon-kyung of Ewha Womans University’s Department of Economics stated, “It is necessary to restore soundness to ensure a stable supply system for energy companies and the sustainability of public services,” adding, “Low rates send a wrong signal to consumers that they can use more energy, which can lead to expanded losses.” This implies that if the low-rate system continues, energy public enterprises such as Korea Electric Power Corporation (KEPCO), the supplier, will find it difficult to escape a deficit structure.

Kim Chang-sik, Director of Demand Policy at the Korea Energy Agency, said, “Our country’s energy import dependency is 93%, and the recent surge in energy prices has increased energy import costs, placing a heavy burden on the national economy,” adding, “To reduce energy demand, appropriate pricing policies and incentives to encourage investment should be provided, and measures for vulnerable groups affected by pricing policies should be considered.” KDI’s Head of Industrial and Market Policy Research Division, Koo Ja-hyun, also emphasized the need to “gradually reflect (smoothing) the sharp fluctuations in international energy prices in domestic energy prices.”

Additional Rate Hikes, Direct Blow to Small Business Owners

On the other hand, Kim Ki-hong, auditor of the Small Business Federation, said, “Electricity and gas rates have already risen to levels that small business owners find difficult to bear, and any further increase will make it hard to continue operations.” Auditor Kim argued, “Monthly rent cannot be increased by more than 5% per year, but electricity bills have increased so much that they are higher than rent,” and insisted, “The current rate system places an excessive burden on small business owners, so a rate system reform and support for small business owners are necessary.”

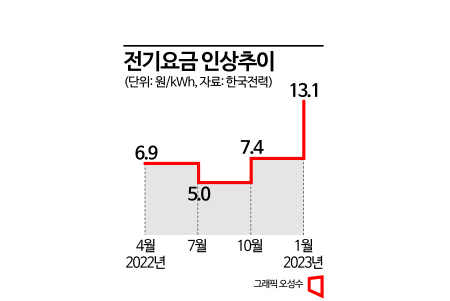

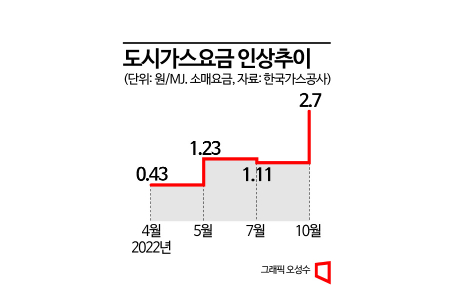

Yu Mi-hwa, co-representative of the Green Consumer Network, also said, “Household burdens have increased due to four price adjustments in the past year,” adding, “In a period of high inflation, raising electricity and gas rates could trigger a chain reaction of price increases, so a cautious approach is needed.” She further stated, “When raising rates, it is necessary to persuade consumers by providing specific information about the extent and timing of the increase,” and “In addition to rate hikes, incentive policies for reducing usage should be expanded to decrease energy demand.”

Lee Yoo-soo, Head of the Energy Carbon Neutrality Research Division at the Korea Energy Economics Institute, also supported the need for rate increases. Lee said, “If rates are frozen due to concerns about inflation and the public burden, the stability of energy supply will be undermined, and inefficiencies in resource allocation will increase,” adding, “There is also a risk of significant cost burdens arising from financing issues across the economy.”

KEPCO Bond Issuance Burden Not Large VS Increased Bond Market Pressure

Opinions also diverged regarding KEPCO’s issuance of bonds to continue deficit management. Lee Hyo-seop, Director of the Financial Industry Office at the Korea Capital Market Institute, said, “This year’s conditions for KEPCO bond issuance have greatly improved compared to last year,” adding, “Even if the issuance scale slightly expands, it can be issued without difficulty at the current interest rate level.” Lee cited the current stability of domestic and international financial markets and the fact that KEPCO’s net bond issuance in the first quarter of this year was about 6.8 trillion won, indicating that supply-demand pressure is not significant.

Lee added, “However, if the issuance scale expands significantly beyond expectations and external uncertainties increase again, it could cause volatility in the bond market,” and said, “Appropriate electricity rate increases and proper KEPCO bond issuance will reduce bond market burdens and help corporate financing.”

On the other hand, Kim Ki-myung, senior advisor at Korea Investment & Securities, said, “There are concerns within the market about a reduction in the corporate bond issuance limit as electricity rate hikes fall short of expectations and KEPCO’s deficit recovery remains difficult,” adding, “Some institutions have internal management standards that limit the inclusion of companies with consecutive deficits.” He also noted, “Considering the use of hybrid capital securities, self-help efforts, and the effect of LNG price declines, the possibility of KEPCO facing repayment difficulties is low,” but forecasted, “If large-scale KEPCO bond issuance continues, weak issuance will persist.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)