Rapid Growth in Demand for Electric and Autonomous Vehicles

Twice as Expensive as MLCCs for Home Appliances

Samsung Electro-Mechanics Market Share Expected to Rise from 4% to 13%

Japan Accelerates Facility Investment

As electric vehicles (EVs) and autonomous vehicles rapidly spread in the global automotive market, the demand for multilayer ceramic capacitors (MLCCs) for automotive electronics is surging. Although demand for MLCCs used in information technology (IT) remains sluggish, the automotive MLCC market is expected to remain robust this year due to improved consumer sentiment following China's reopening and Tesla's decision to cut prices. Samsung Electro-Mechanics, which has focused on MLCC as a core business, plans to diversify its premium automotive product lineup to capture market share from leading Japanese companies such as Murata.

The increasing number of electrical devices and convenience features installed in vehicles naturally drives up the demand for MLCCs used in electronic devices. Traditionally, cars have been equipped with 3,000 to 5,000 MLCCs, but current electric vehicles use more than 10,000 MLCCs. Electric vehicles equipped with advanced driver-assistance systems (ADAS) are estimated to have 2.7 times more MLCCs than previous vehicles, and autonomous electric vehicles are expected to have 3.3 times more.

However, MLCCs used in automobiles face higher entry barriers compared to those used in smartphones and home appliances due to stringent safety requirements. Since the performance of MLCCs is directly linked to driver safety, they must meet strict conditions regarding temperature, humidity, and shock resistance. On the other hand, automotive MLCCs are more expensive, which helps improve profitability for manufacturers. For the same capacitance, automotive MLCCs can be nearly twice as expensive as those used in consumer electronics. This is why MLCC manufacturers are fiercely competing to develop automotive MLCCs.

Samsung Electronics Chairman Lee Jae-yong is personally overseeing automotive MLCCs. On the 24th of last month (local time), he visited Samsung Electro-Mechanics’ plant in Tianjin, China, to inspect the production facilities for automotive MLCC electronic components. Previously, in 2020 and 2022, he visited Samsung Electro-Mechanics’ Busan plant to check MLCC production sites and urged proactive measures to secure future markets, including automotive MLCCs.

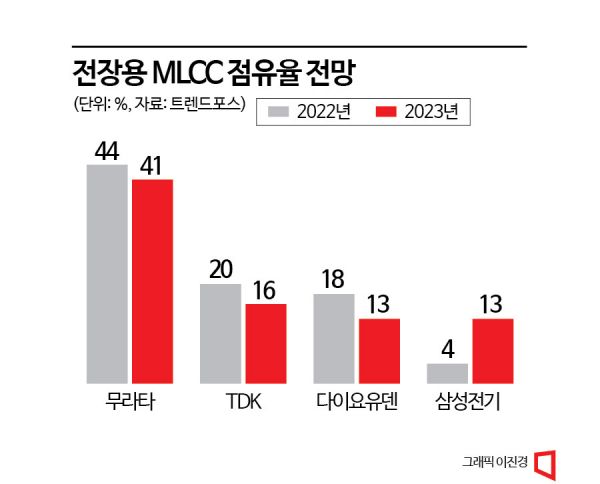

Currently, Japanese companies such as Murata, TDK, and Taiyo Yuden dominate the automotive MLCC market. Market research firm TrendForce reported that Murata held a 44% share of the global automotive MLCC market last year, followed by Japan’s TDK, Taiyo Yuden, and Yageo with 20%, 18%, and 9%, respectively. Japanese companies thus control about 90% of the market. Samsung Electro-Mechanics’ share of the automotive MLCC market stands at 4%.

However, Samsung Electro-Mechanics is expected to make significant gains this year. TrendForce forecasts Murata’s market share to decline from 44% last year to 41% this year, TDK’s from 20% to 16%, and Taiyo Yuden’s from 18% to 13%, while Samsung Electro-Mechanics’ share is projected to jump from 4% to 13%.

Samsung Electro-Mechanics is pioneering the premium market segments for infotainment, ADAS, and high-temperature/high-pressure powertrain products rather than general-purpose products. Targeting customers who produce high value-added electronic products is essential to increasing sales and surviving competition with Japan’s top MLCC companies.

However, Japanese companies are expanding production through large-scale investments, so Samsung Electro-Mechanics will need to accelerate its efforts to catch up. Murata plans to build a new MLCC production line worth 45 billion yen (approximately 430 billion KRW) on land it owns in Jiangsu Province, China, through its subsidiary Ushimurata Electronics. This investment represents about 20% of Murata’s annual capital expenditure and is the largest single facility investment in the company’s history. Murata aims to increase its monthly production capacity of automotive MLCCs by 10% annually. As of the second quarter this year, Murata’s automotive MLCC production capacity reportedly reaches 25 billion units per month. TDK also plans to expand its existing factory in Kitakami, Iwate, Japan, to add an additional 5 to 8 billion units of monthly production.

In contrast, Samsung Electro-Mechanics’ capital expenditure this year is expected to decrease compared to last year. During the fourth-quarter earnings conference call last year, Samsung Electro-Mechanics explained, "This year’s capital expenditure will decline from last year due to weakening demand for smartphones and PCs. While package substrates will remain similar to last year, MLCC and camera module investments will decrease."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.