Kang Seongbu KCGI·Lee Changhwan Align Partners CEO

Recognition of the Need to Enhance Shareholder Value, Gains in Minority Shareholders' Rights Awareness

The star of the domestic capital market in the first quarter of this year was undoubtedly activist funds. When they got involved, stock prices rose, and changes occurred in corporate governance. Although shareholder proposals by activist funds were mostly rejected at last month's general meetings, the winds of change are strong enough to dismiss their activities as a 'tempest in a teacup.' The biggest achievements are the recognition by listed companies of the need to enhance shareholder value, leading to agreements without vote battles, and the heightened awareness of rights among 14 million 'retail shareholders.' Asia Economy asked Kang Sung-bu, CEO of KCGI, a leading domestic activist fund, and Lee Chang-hwan, CEO of Align Partners Asset Management, about their achievements, regrets, and plans after this year's shareholder meetings.

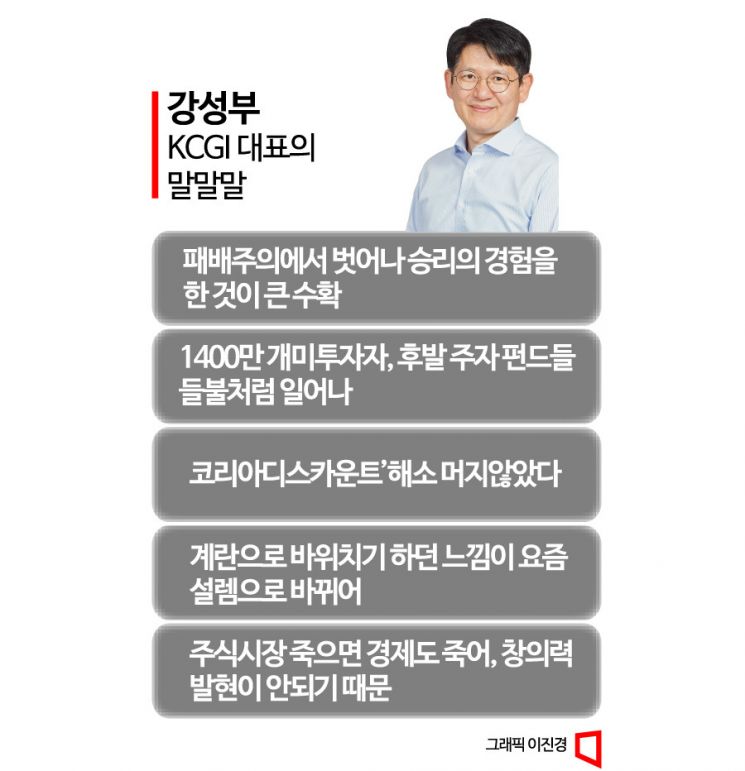

CEO Kang Sung-bu: "From Egg-Throwing at Rocks to Excitement... The Experience of Victory Is the Greatest Gain"

Kang Sung-bu, CEO of KCGI, said, "It is a natural right of shareholders, but until now, we were trapped in defeatism and could not even attempt much. The biggest gain is that at least a focal point has emerged, allowing us to taste victory even once." He glimpsed the possibility of change in the capital market through the active activities of minority shareholders and activist funds, with shareholder proposals sent to more than 40 companies this year.

CEO Kang reported that KCGI recorded an internal rate of return (IRR) of 143% through the exit (investment recovery) from Osstem Implant in the first quarter. He said, "In the first quarter, KCGI responded to a tender offer and did not do anything special at the Osstem Implant shareholders' meeting," but added, "However, with Chairman Choi Kyu-ok, who was at the core of all governance issues such as internal control problems, family corporation issues, and VIP insurance raised by KCGI's shareholder proposals, stepping down and two funds becoming major shareholders, we can now focus solely on increasing corporate value."

He also mentioned, "These days, 14 million retail investors are awakening through YouTube, SNS, and communities." Kang said, "Seeing various emerging funds like Align and Truston rising like wildfire, I felt that the 'Korea Discount' (the undervaluation of the Korean stock market) is not far from being resolved." He added, "I have been writing governance books almost every year for 20 years, and the frustration and thirst I always felt are now being relieved. The lonely and seemingly futile feeling of throwing eggs at rocks when I first created the Yojin Construction fund eight years ago and the Hanjin Kal fund five years ago has turned into excitement."

Nevertheless, he said, "There is still a long way to go." He criticized that domestic investor protection systems are still insufficient and that corporate dividend payout ratios are among the lowest in the world. He claimed, "It is still a country where legal capital transactions (corporate splits, mergers, delisting, paid-in capital increases, etc.) and profit transactions (such as preferential treatment of related parties) can legally deprive ordinary shareholders of their interests."

CEO Kang emphasized, "Looking at the history of industrial capitalism, when the stock market dies, the economy dies too," explaining, "Because if fundraising does not work well, creativity cannot be expressed." He continued, "In the future, I want to be called not 'activist funds' but 'governance improvement funds' or 'shareholder rights restoration funds.' KCGI will continue to find undervalued companies due to governance issues and develop various improvement strategies to reward investors with high returns." Meanwhile, KCGI has moved to acquire shares of DB HiTek, announcing on the 30th of last month that it acquired 7.05% of DB HiTek's shares. After the announcement, DB HiTek's stock price rose for three consecutive trading days.

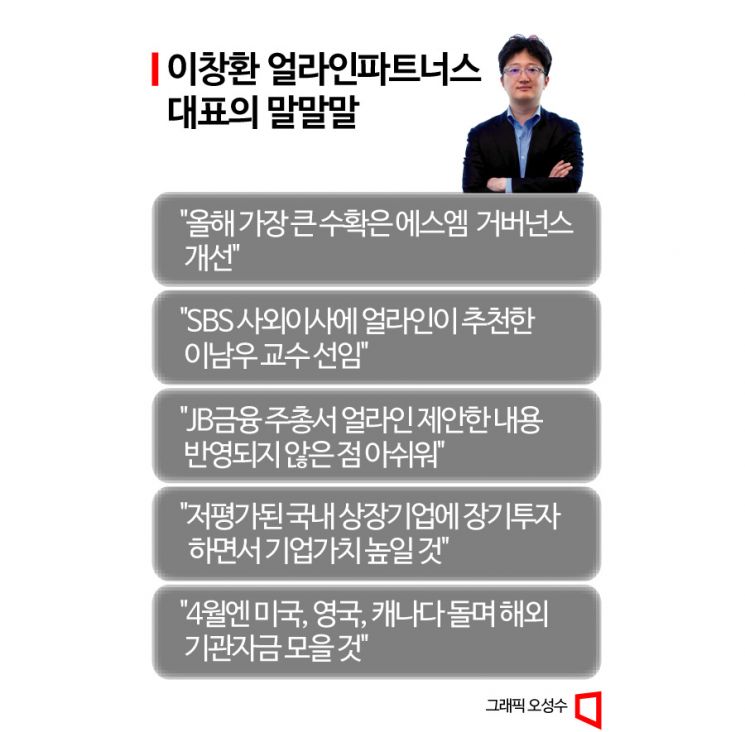

CEO Lee Chang-hwan: "The Greatest Gain Is Governance Improvement at SM... Fundraising Overseas in April"

CEO Lee Chang-hwan said, "The greatest achievement at this year's shareholder meetings was the governance improvements such as the reorganization of SM's board and amendments to the articles of incorporation." After securing a 1% stake in SM, Lee actively participated in management through shareholder proposals demanding governance improvements. He directly challenged excessively low dividends and the unfair service contract of then-chairman Lee Soo-man, gaining support from minority shareholders.

At SM's shareholders' meeting in March last year, through a vote battle, Align Partners and small shareholders succeeded in appointing an auditor recommended by them as a director. The contract with Lee Soo-man's personal company, Like Planning, was also terminated early. During this process, Lee Soo-man stepped down from the front lines of management.

As Align Partners' shareholder activities gained market influence, they became the catalyst for the management dispute between HYBE and Kakao earlier this year. After a fierce battle, Kakao gained the upper hand, and at this regular shareholders' meeting, Lee Chang-hwan was newly appointed as a non-executive director at SM. Regarding SM, Lee perfectly won on the stage he set.

Subsequently, Lee has continued investing in undervalued SBS shares. Align decided to invest based on the judgment that SBS's operating profit has more than tripled compared to during COVID-19, but its stock price remains undervalued. Lee said, "It can also be considered an achievement that SBS newly appointed Lee Nam-woo, a visiting professor at Yonsei University's Graduate School of International Studies, recommended by Align, as an outside director." However, Align did not make an official shareholder proposal at this shareholder meeting. They are actively engaging in confidential dialogues through shareholder activities. They conveyed the need to reflect the value of Studio S, a subsidiary, in SBS's stock price to enhance SBS's corporate value behind the scenes.

Earlier, Lee also caused a stir in the banking sector. Despite record-breaking earnings, major financial holding companies were stingy with shareholder returns, but Lee demanded shareholder return policies, leading to noticeable changes. In January, Lee sent an open letter to seven financial holding companies urging the introduction of capital allocation policies and medium-term shareholder return policies. The securities market saw a 'bank stock rally' fueled by expectations of shareholder returns. Bank stocks surged about 15% in January. Subsequently, financial holding companies raised their dividend payout ratios one after another, leading to substantial changes. Although bank stocks have lost momentum due to the global 'Bankdemic' (bank + pandemic), Lee clearly demonstrated that stock prices move when he moves.

However, Lee lost the vote battle at the JB Financial Group shareholders' meeting. He evaluated, "It is regrettable that Align Partners' proposals regarding capital allocation, shareholder return policies, and board structure were not reflected, but it is positive that discussions on these matters were induced." Regarding the background of the vote defeat, he analyzed that it was due to the failure to overcome the special oligopolistic shareholder structure and said, "As promised at the shareholders' meeting, we will continue to demand the company persistently and carry out campaigns until changes are made." Lee emphasized, "We will continue to make long-term investments in major high-quality but undervalued domestic listed companies and actively utilize Align's various capabilities to contribute to enhancing corporate value."

Lee departed for the United States on the 7th for fundraising. He plans to visit the UK, Canada, and other countries consecutively to meet major institutional investors such as overseas pension funds. Currently managing about 270 billion KRW across three funds, Align aims to increase its assets under management (AUM) to 1 trillion KRW by the end of this year. He said, "I am trying to raise institutional funds overseas," adding, "I will actively persuade them to invest in Korean listed companies by showing cases of corporate value improvement created through Align's active shareholder activities in SM and financial holding companies in Korea."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)