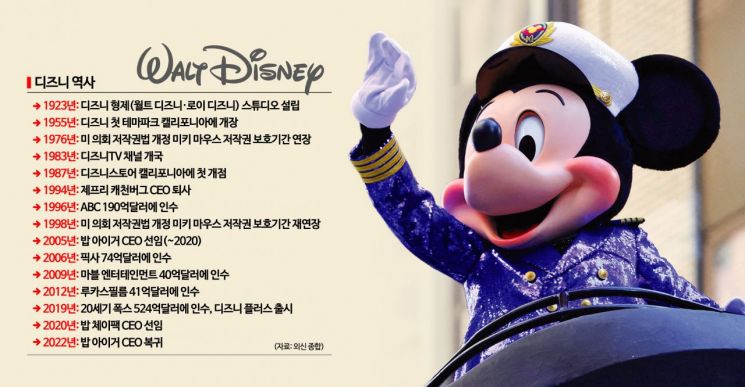

[Global Focus] Walt Disney's 100th Anniversary

Grew Content Empire through M&A

But Struggled to Overcome the Wall of Technological Revolution

Walt Disney Company, which started in October 1923 with a single character that stirred childhood innocence, ‘Mickey Mouse,’ and grew into a media giant encompassing animation, film, music, broadcasting, and online video services (OTT), is celebrating its 100th anniversary this year. Over the past century, Disney expanded its size through mergers and acquisitions (M&A) of major competitors, becoming a global top 56 company with a market capitalization of $183 billion (approximately 241 trillion KRW). However, it has struggled with deficits, unable to overcome the technological revolution barriers such as OTT. Feeling the limits amid a series of setbacks, Disney recently initiated a management overhaul and is dreaming of a turnaround for the next 100 years.

From ‘Childhood Innocence’ Disney to Copyright ‘Monster’

Starting with ‘Steamboat Willie’ (1927), featuring Mickey Mouse, Disney has created countless popular animations such as ‘Snow White’ (1937), ‘Toy Story’ (1995), and ‘Frozen’ (2013), earning a reputation as a content kingdom and a copyright monster. There is even a joke that says, “If you were left alone on a deserted island, draw a big Mickey Mouse on the sand. No matter where you are, Disney’s legal team will find you like a ghost,” illustrating how seriously Disney takes copyright.

The reason Disney became so meticulous about copyright management dates back to its early days in 1923. Contrary to popular belief, the first character Disney created after founding the company was not a mouse (Mickey Mouse) but a rabbit (Oswald the Lucky Rabbit). Walt Disney, the founder, established the company at age 19 and entrusted the distribution of Oswald to Charles Mintz. However, Mintz secretly signed a contract with Universal without Disney’s knowledge, resulting in Disney losing the rights. This incident enraged Disney and made him determined to take copyright management seriously.

Mickey Mouse, Disney’s flagship character and a symbol of the global character industry, also changed the history of copyright law in the United States. When Mickey Mouse debuted in 1928, the maximum copyright protection period under U.S. law was 56 years. However, Disney used its vast financial resources and lobbying power to successfully extend the copyright protection period twice?in 1976 and 1998?raising it to a maximum of 75 years and then 95 years, respectively.

Eiger’s Bold Move: Massive Entertainment Acquisitions

Starting in 1957, Disney expanded from animation production (studio) into a content empire producing and distributing theme parks, retail stores (merchandise), music, publishing, and TV programs. From 1984, Disney enjoyed a golden era for a decade, but after Jeffrey Katzenberg, the studio head who led this golden age, left, the company experienced a period of stagnation.

The aggressive investments that brought Disney to its current position were led by CEO Bob Iger. Iger first joined Disney in 2005, during the company’s greatest crisis since its founding. Each production underperformed, leading to ridicule that “Disney’s innovation is standing on thin ice,” and the family-run management system, filling key subsidiaries’ executives with relatives of the owners, faced harsh criticism.

In this situation, Iger turned the crisis into an opportunity by successfully executing a series of large M&As. In 2006, Disney acquired animation studio Pixar for $7.4 billion (approximately 9.7 trillion KRW), and in 2009, it swallowed Marvel Entertainment, one of the two giants in animation, for $4 billion, leading a renaissance in film and animation production. Then, in 2012, Disney purchased Lucasfilm, the producer of the Star Wars films, for $4.1 billion, and in 2019, it acquired 20th Century Fox’s film and TV business for $52.4 billion.

This unprecedented series of acquisitions of major competitors was Iger’s strategic bet, anticipating the increasing demand for content and shifts in the market landscape. The bet paid off. During this period, Disney’s performance and stock price soared vertically, marking the company’s best era since its founding. Disney’s net profit more than doubled annually, and its stock price quintupled over ten years, surpassing competitors like Comcast, Time Warner, and Viacom.

New Frontiers in Streaming and Metaverse... The Beginning of Crisis

As of the closing price on the 2nd, Disney’s stock price stood at $100.13, returning to the level of three years ago. Compared to its historic peak ($201.91), it has halved. The main cause of the stock price slump is deteriorating performance. Despite the paradigm shift where the film and TV industry declined and the OTT industry rose, Disney failed to seize the opportunity. Disney entered the online OTT market in 2019, about ten years later than Netflix, which had already ventured into the market in 2007.

As a latecomer, Disney has been focusing on reclaiming the market with massive capital, but results have not followed. Although global subscriber numbers steadily increase due to huge marketing investments, intensified competition and a decline in advertising revenue amid economic downturn have caused the division’s losses to grow daily.

In the past two to three years, as competitors have proliferated and competition intensified, Disney has been losing over $1 billion per quarter solely in its OTT business. Ultimately, Disney’s board dismissed CEO Bob Chapek and reinstated Iger. Iger had stepped down as CEO in February 2020 and relinquished the board chairman position in December 2021 but returned to Disney within a year. Upon the news of Iger’s return, the stock price surged over 6% on November 21 last year, greeted with enthusiasm.

Rollercoaster Stock Price... Iger’s Challenge Amid Crisis

Iger has been given two years to reverse Disney’s worst performance slump. He is conducting company-wide restructuring, including the heavily loss-making OTT division. In his first conversation with employees after returning, Iger warned, “To turn the OTT division into a profitable structure, we must abandon the blind subscriber growth strategy and drastically reduce massive marketing expenditures, boldly improving the entire business.” Disney reorganized its operations into three divisions: integrating the film and TV division with the OTT division, the ESPN division operating sports media, and the Disney Parks, Disney Cruise Line, and merchandise division.

The metaverse (extended virtual world) business also became a part of the restructuring. Former CEO Chapek boldly ventured into the metaverse business in 2021, claiming “Disney is the metaverse” with vast content and copyrights that could be realized in the virtual world. However, after a few years, the company ultimately surrendered, judging the business unviable.

Cost-cutting layoffs are ongoing. In an email sent to employees on the 27th, Iger announced plans to conduct layoffs in three rounds by this summer, reducing about 7,000 employees. This accounts for approximately 3% of the global workforce of 220,000 and is expected to save about $5.5 billion.

Defending against attacks from Wall Street corporate raiders is also a challenge. Nelson Peltz, CEO of activist hedge fund Trian Fund Management, is attempting to join Disney’s board by acquiring a 0.5% stake (worth $900 million) in Walt Disney. Peltz criticizes Disney for damaging shareholder value through reckless management, citing excessive spending on the ‘21st Century Fox’ acquisition that worsened financial structure and struggles in the OTT business, rallying public opinion.

The Economist of the UK pointed out, “How Disney defends against these management challenges, manages the legacy of various character business royalties, and converts new businesses into profitable structures will determine the future of Disney’s next 100 years.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.