Order Volume and Freight Rates Both Hit Record Highs

Shipbuilding Stocks See Double-Digit Gains This Year

Korean shipbuilding stocks are once again cutting through the waves and cruising ahead. This is due to the ongoing boom in liquefied natural gas (LNG) carriers, along with a surge in new ship prices, resulting in a 'super boom' in both ship prices and orders. Additionally, with the decision by the Organization of the Petroleum Exporting Countries (OPEC) and other oil-producing countries, collectively known as OPEC+, including Russia, to cut production, international oil prices are expected to rise, which is likely to improve investment sentiment toward shipbuilding stocks.

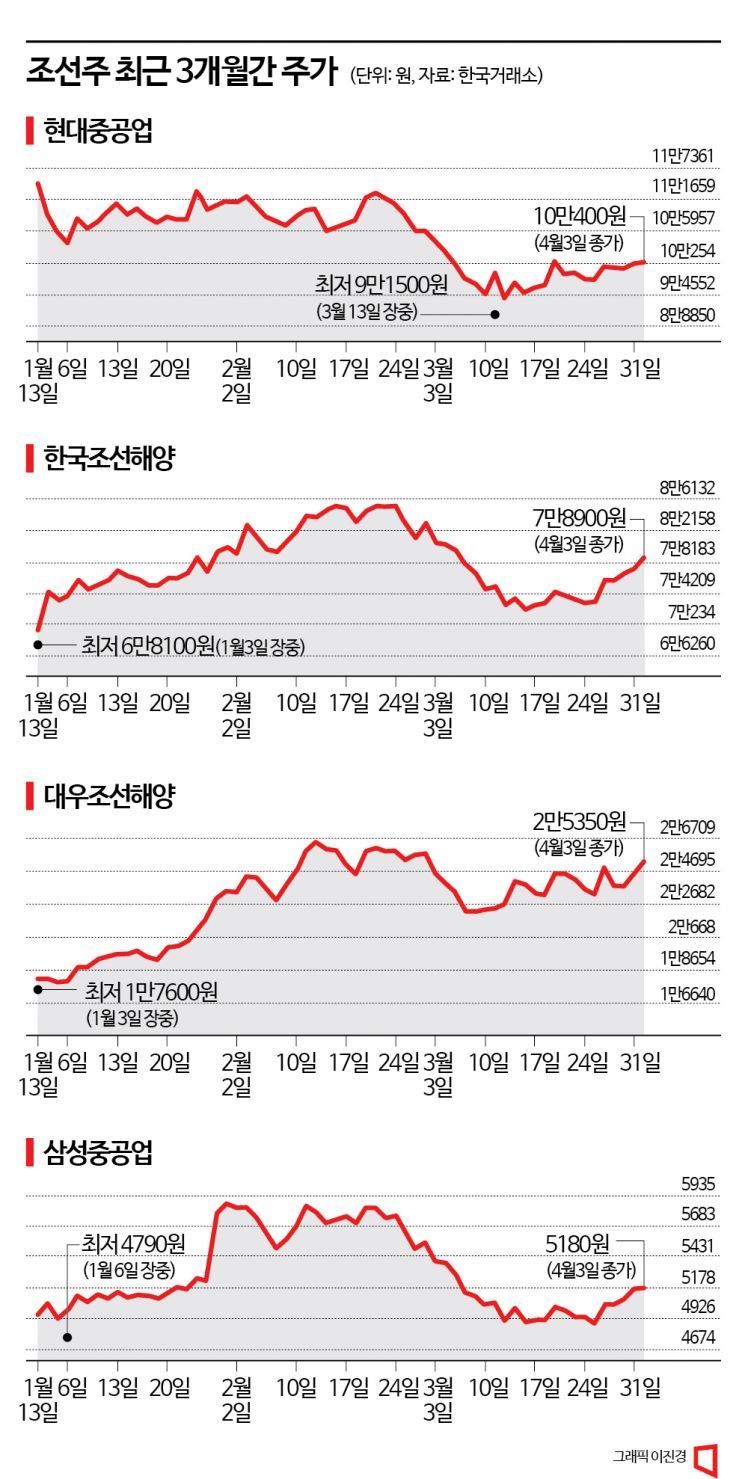

According to the Korea Exchange on the 4th, shipbuilding stocks all closed higher. The biggest gain was seen in Daewoo Shipbuilding & Marine Engineering, which closed at 25,350 won, up 3.47% from the previous trading day. Hyundai Heavy Industries (0.40%), Samsung Heavy Industries (0.19%), and Korea Shipbuilding & Offshore Engineering (1.81%) also closed higher. Since the beginning of the year, all shipbuilding stocks have recorded double-digit gains. Compared to the start of the year, Daewoo Shipbuilding & Marine Engineering rose 33.77%, Samsung Heavy Industries 1.37%, and Korea Shipbuilding & Offshore Engineering 11.60%.

The strength of shipbuilding stocks is due to increases in both order volume (Q) and ship prices (P). The newbuilding price index from Clarkson Research, a UK-based shipbuilding and shipping market analysis firm, started at 162 at the beginning of this year and has risen by 1 point each month. As of March 31, the newbuilding price index stands at 166, up 1 point from the previous week. In particular, the price of LNG carriers, an area where Korean shipbuilders have a strong advantage, has risen 36% compared to the end of 2020. This exceeds the overall ship price index increase of 32%.

Order volumes are also increasing. Including the recent order of two LNG carriers announced by Samsung Heavy Industries on this day, Korean shipbuilders have secured a total of 19 large LNG carrier orders so far this year. When including the expected orders for the rest of the year, it is realistically possible to secure around 80 LNG carrier orders. Historically, there have only been five instances where more than 60 large LNG carriers were ordered.

Han Young-su, a researcher at Samsung Securities, evaluated, “Considering that the long-term average orders (2003?2022) are around 42 vessels, the LNG carrier market this year is also at a very strong level.”

As a result, Korean shipbuilders are quickly meeting their order targets, raising expectations for a turnaround in their performance. Samsung Heavy Industries’ cumulative order amount for the first quarter reached 2.5 billion dollars, achieving 26% of its annual order target of 9.5 billion dollars. Korea Shipbuilding & Offshore Engineering has achieved about 42%, and Daewoo Shipbuilding & Marine Engineering 11% of their respective targets.

The improvement in investment sentiment toward shipbuilding stocks due to OPEC+’s production cut decision is also expected to drive the rise in shipbuilding stocks. Typically, when oil prices rise, expectations for offshore plant orders increase, leading to strength in shipbuilding stocks. Byun Yong-jin, a researcher at Hi Investment & Securities, said, “Currently, shipbuilding stocks are undervalued relative to the quality and quantity of their order backlog,” adding, “We believe that Korean shipbuilders’ market share and competitiveness remain high, and we recommend an ‘overweight’ position on shipbuilding stocks.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.