KCCI Surveys 110 Advanced Strategic Industry Companies

Companies in advanced industries such as semiconductors, secondary batteries, and displays recognize the need to expand investments but are facing difficulties due to tight financial conditions. There are calls for measures to improve the financial situation of advanced industries, where timely investment is crucial.

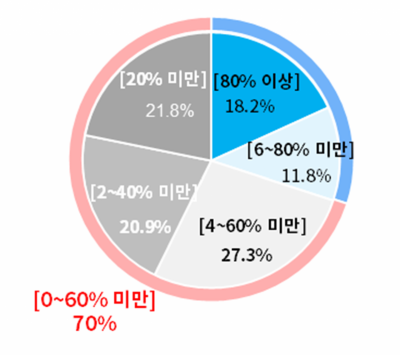

According to a survey conducted by the Korea Chamber of Commerce and Industry (KCCI) from February 27 to March 17, targeting 110 companies in advanced strategic industries (28 large enterprises, 29 mid-sized companies, and 53 small and medium enterprises), 7 out of 10 companies (70%) have secured less than 60% of the necessary investment funds.

Regarding the “ratio of currently secured funds to the required investment amount,” companies responded in the following order: “40-60%” (27.3%), “less than 20%” (21.8%), “20-40%” (20.9%), “80% or more” (18.2%), and “60-80%” (11.8%). The proportion of advanced industry companies securing less than 40% of investment funds reached 4 out of 10 (42.7%).

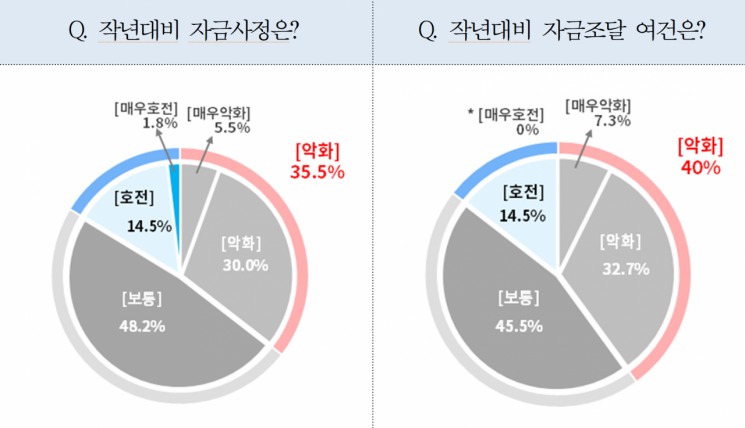

Regarding “overall financial conditions compared to last year (including internal reserves),” companies reporting “worsened” (35.5%) were more than twice those reporting “improved” (16.3%).

Current Fund Securing Ratio Compared to the Required Fund Scale for Investment Execution by Companies in the Advanced Industry Sector

Current Fund Securing Ratio Compared to the Required Fund Scale for Investment Execution by Companies in the Advanced Industry Sector [Image Source=KCCI]

The problem is that these companies recognize that now is the time to expand investments, considering the growth potential of their industries and domestic and international market conditions. Regarding the “desirable investment direction considering industry outlook, major competitors’ investment status, and technology catch-up levels,” responses overwhelmingly favored “expanding investments” in all areas: “facility investment” (60%), “R&D investment” (72.7%), and “human resources investment” (64.5%).

The KCCI stated, “Advanced industries require continuous trillion-won scale facility investments to secure market leadership and global competitiveness, but in reality, many companies find it difficult to invest due to deteriorating profitability amid the global economic downturn and worsening financing conditions.” In fact, companies reporting “worsened overall financing conditions compared to last year” (40%) outnumbered those reporting “improved” (14.5%) by 2.7 times.

The financing difficulties cited by companies in direct financing included “difficulty issuing corporate bonds due to high interest rates and credit rating downgrades” (66.3%), “difficulty issuing stocks due to investment sentiment decline and stock market stagnation” (41.8%), and “difficulty discounting bills and issuing commercial papers” (10.9%). In indirect financing, the issues were “high loan interest rates” (70.9%), “reduced loan limits” (37.3%), “strict loan screening” (22.7%), and “lack of collateral or guarantors” (18.2%).

Regarding the “government policies considered most beneficial for industry growth and domestic investment promotion,” companies ranked “investment tax credits” (57.3%), “national subsidies” (51.8%), “infrastructure support” (45.5%), and “expedited permit and approval processing support” (35.5%) in order.

Kim Mun-tae, head of the Industrial Policy Team at KCCI, said, “It is fortunate that the K-Chips Act was passed in the National Assembly last week, but it would be good to also consider a diverse policy portfolio such as expanding policy financing and subsidy support to improve companies’ financial conditions before investment.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)