South Korea's early inclusion in the World Government Bond Index (WGBI) has failed. The government plans to attempt inclusion in the WGBI again this coming September.

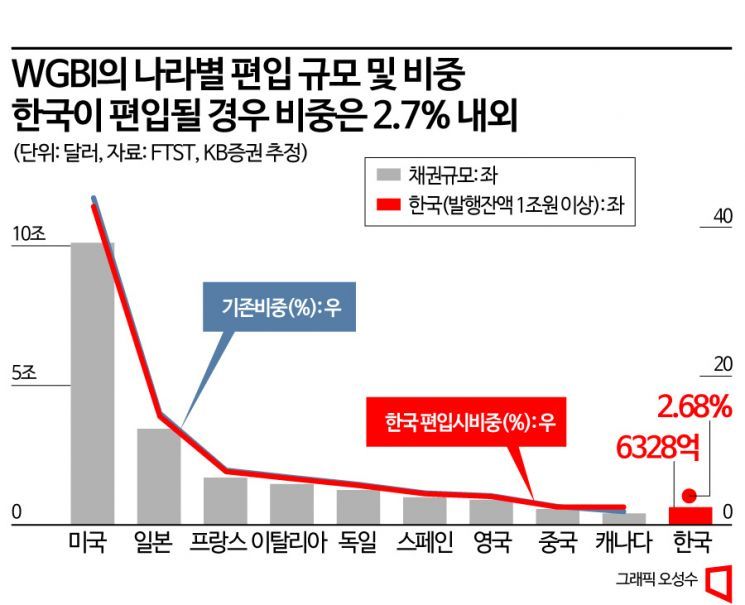

FTSE Russell, which manages the WGBI, announced on the 30th (local time) that South Korea will maintain its status as a Watch List country for the government bond index. The World Government Bond Index is an advanced bond index that includes government bonds from 23 major countries, with an estimated asset size of $2.5 trillion (approximately 3,246 trillion KRW), making it the world's largest bond index. FTSE Russell regularly announces country classifications for bond markets every March and September. South Korea was placed on the WGBI Watch List in September last year.

FTSE Russell stated, "From last year through early this year, the South Korean government has been implementing or pursuing institutional improvements to enhance market accessibility, such as exempting foreign investors from taxes on government bond interest and capital gains, opening a consolidated government bond account at the International Central Securities Depository (ICSD), abolishing the foreign investor registration system (IRC), and improving the foreign exchange market structure." They added, "While some recent measures have been implemented, there are tasks requiring legal amendments, and we will continue to monitor the effectiveness of these institutional improvements."

If South Korea is included in the World Government Bond Index, it could contribute to stabilizing the government bond market by expanding foreign investment inflows, stabilizing supply and demand foundations, and reducing interest costs. Accordingly, the government plans to do its best to achieve formal inclusion in the WGBI within this year through continuous institutional improvements.

Specifically, the government will abolish the foreign investor registration system (IRC) within the year by revising the Enforcement Decree of the Capital Markets Act and the Financial Investment Services regulations. Additionally, it plans to revise the Foreign Exchange Transactions Act to allow foreign financial institutions to participate in the domestic foreign exchange market and extend trading hours, with implementation scheduled for the second half of next year.

The government also intends to consider additional convenience measures for foreign investors by gathering opinions from global investors. In particular, during the first half of the year, it plans to provide official English forms for various applications and reports through amendments to the Enforcement Rules of the Income Tax Act and the Corporate Tax Act. Furthermore, it will strengthen cooperation with related agencies through practical consultations to ensure that the ICSD consolidated government bond account can be opened as quickly as possible.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.