Shareholder Protest Introduced at 2017 AGM This Year

Two Consecutive Years of Meeting Shareholder Return Ratio Promises... Also a Shift in Securities Industry Perception

"A shareholder once gave me the nickname 'Choi Ohshipwon' (Choi Fifty Won). At that time, we paid a cash dividend of 50 won per share. There were times during the course of managing the company when I was known as Choi Ohshipwon... (omitted) I will focus more on shareholder-friendly management and build a company that grows together."

Choi Hyun-man, Chairman of Mirae Asset Securities, recalled his past embarrassing nickname 'Choi Ohshipwon.' This was at the regular shareholders' meeting held on the 23rd. The anecdote Chairman Choi mentioned dates back to March 2017, the year after Mirae Asset Securities acquired KDB Daewoo Securities, when a shareholder protested the low dividend (50 won per share) at the shareholders' meeting. At that time, the shareholder gave Chairman Choi the dishonorable nickname 'Choi Ohshipwon.'

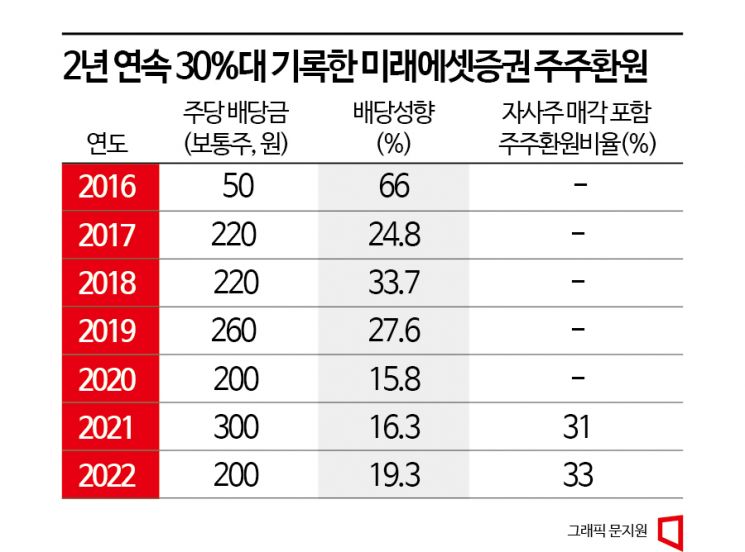

This year, Mirae Asset Securities' dividend per share is 200 won for common stock and 220 won for preferred stock. The dividend payout ratio is 19.3%. Although this is higher than last year's payout ratio (16.3%), shareholders still point out that it remains low compared to other sectors in the financial industry. Looking at the dividend payout ratios of the four major private financial holding companies in Korea, Hana Financial Group has the highest at 27.5%, followed by Woori Financial Group at 26.19%, KB Financial Group at 26.15%, and Shinhan Financial Group at 23.54%.

In response to shareholders' complaints, Chairman Choi expressed empathy but said, "Even when good investment opportunities appear, we lack the funds to pursue them, and we also lack talented personnel with a good eye for investments." He added, "We are paying close attention to mergers and acquisitions (M&A) domestically this year, but acquiring companies with compatible business models requires a lot of capital." He especially emphasized, "Money is also needed for overseas expansion," and said, "Since 2003, overcoming harsh conditions to go abroad, generate earnings, and export financial services has not happened overnight." Last year, Mirae Asset Securities recorded an operating profit of 142.7 billion won (before tax) from overseas subsidiaries, accounting for about 17% of the total.

Chairman Choi also expressed regret over the limited position of the securities industry in the domestic financial market. He said, "South Korea's economy ranks 11th in the world and is among the top 5 in manufacturing, so why is the KOSPI like this?" He added, "Rather than feeling ashamed, it is because the public still primarily associates 'finance' with 'banks.'" He continued, "For new companies eagerly waiting for venture capital, the leading player representing finance must be the investment bank (IB)." He warned, "If we only think of finance as banks, even manufacturing will decline," repeatedly emphasizing the role of the securities industry as innovative finance.

Meanwhile, Mirae Asset Securities has simultaneously pursued share buybacks along with dividends, maintaining a shareholder return ratio in the 30% range for two consecutive years. Last year, the company conducted share buybacks worth approximately 86.7 billion won, and combined with dividends, the total shareholder return amounted to 210.1 billion won, representing a 33% return ratio. Previously, in 2021, it was 31%. This marks the second consecutive year that Chairman Choi has kept his promise made at the August 2021 board meeting to maintain a shareholder return ratio of at least 30% for the next three years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.