Increased Dividends and Capital Increase... But Risk-Weighted Assets Decrease Due to Currency Depreciation

At the end of last year, despite domestic banks increasing dividends, the capital ratio based on the Bank for International Settlements (BIS) improved thanks to the decline in the KRW-USD exchange rate.

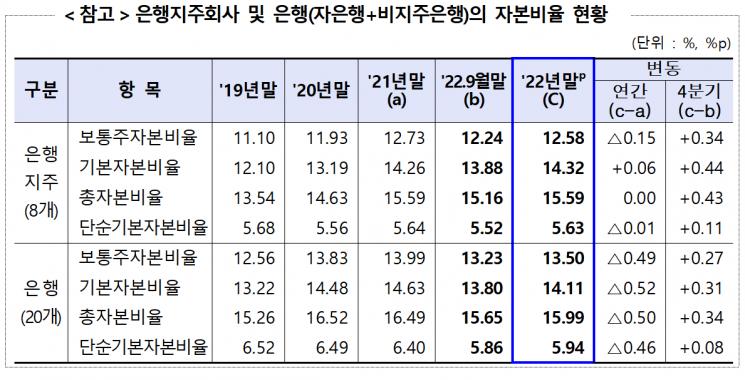

According to the Financial Supervisory Service's (FSS) "Status of Bank Holding Companies and Banks' BIS Capital Ratios as of December 2022 (Provisional)" released on the 30th, the total capital ratio of domestic banks was recorded at 15.25% as of the end of last year. This represents an improvement of 0.41 percentage points compared to the previous quarter.

The common equity tier 1 capital ratio was 12.57%, and the tier 1 capital ratio was 13.88%, rising by 0.31 percentage points and 0.38 percentage points respectively during the same period. The FSS explained, "Although capital decreased by 1.4% due to increased deductions such as year-end dividends despite net income realization and capital increases, risk-weighted assets decreased more sharply (-4.0%) due to reduced foreign currency exposure caused by the exchange rate decline."

The BIS capital ratio is the ratio of a bank's own capital to total assets (risk-weighted assets). It is considered a key indicator to gauge the financial soundness of banks. Although the numerator, capital, decreased as banks increased year-end dividends, the denominator decreased even more due to the drop in the KRW-USD exchange rate, resulting in an overall increase in the ratio.

According to the FSS, despite generating net profits and increasing capital in the fourth quarter of last year, domestic banks increased year-end dividends, causing common equity capital to decrease by a total of KRW 4.5 trillion. Supplementary capital also decreased by KRW 400 billion. Therefore, even though other capital increased by KRW 1 trillion through the issuance of hybrid capital securities, total capital decreased by KRW 4.6 trillion.

However, risk-weighted assets, which correspond to the denominator, decreased more significantly. The KRW-USD exchange rate, which surged to 1,446.30 KRW per dollar on January 24, dropped to 1,258.78 KRW on December 30. As a result, foreign currency asset exposure decreased, and credit risk-weighted assets in the banking sector fell by KRW 91.3 trillion. Operational risk-weighted assets increased by KRW 3.6 trillion due to expanded profit scale, but total risk-weighted assets decreased by more than KRW 89 trillion.

Meanwhile, as of the end of last year, all individual banks exceeded regulatory capital ratio levels. Among the five major financial holding companies, the total capital ratios were in the order of KB Financial Group (16.16%), Shinhan Financial Group (15.99%), NH Nonghyup Financial Group (15.73%), Hana Financial Group (15.67%), and Woori Financial Group (15.30%).

Among non-holding company banks, foreign banks such as Citibank (20.72%) and SC First Bank (17.83%) ranked high. Among internet-only banks, KakaoBank (36.95%), K Bank (13.94%), and Toss Bank (11.49%) had the highest total capital ratios in that order.

With growing concerns in the banking sector following recent incidents such as the US Silicon Valley Bank (SVB) crisis, the FSS plans to strengthen soundness supervision. An FSS official stated, "We will enhance monitoring of domestic banks' capital ratios and encourage banks with weak capital ratios to improve capital adequacy," adding, "We plan to implement measures such as imposing the countercyclical capital buffer (CCyB) and introducing a stress buffer capital system to ensure banks maintain sufficient capital to respond to unexpected losses."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.