Expert: "Current Market Accessibility Level Vulnerable"

Long-term Bonds Expected to Benefit Upon Index Inclusion

With the announcement of the inclusion in the World Government Bond Index (WGBI) just one day away, market attention is focused on whether Korean government bonds will be included. However, the industry believes that inclusion is more likely in September this year rather than in March. The WGBI, one of the world's three major bond indices, includes government bonds from 23 major countries such as the United States and the United Kingdom, and the inclusion status is announced twice a year in March and September. The assets tracking the index are estimated to be around $2.5 trillion. If Korea is included in the WGBI, the credibility of Korean government bonds will increase, leading to an influx of foreign investment funds that track the WGBI.

According to the securities industry on the 30th, FTSE Russell will announce the official list of countries included in the WGBI on the 31st. Korea was listed as a Watch List country for the WGBI last September and is awaiting the final inclusion results. Although some expectations were formed that Korean government bonds might be included in this month's semi-annual review, the government and most bond market experts consider September this year to be a more likely timing for inclusion.

Jaegyun Lim, a researcher at KB Securities, explained that the reason Korean government bonds are unlikely to be included this time and may be included as early as September is because Korea received Market Accessibility Level 1. Yoonmin Baek, a research fellow at Kyobo Securities, also said, "Realistically, the possibility of WGBI inclusion is greater in September than in March," adding, "Currently, Korea's market accessibility is at Level 1, so to be included in the WGBI, the market accessibility level must be raised to at least Level 2." Although the government has announced market accessibility improvement measures, most have yet to be implemented.

The most important factors determining final inclusion in the WGBI are the 'quantitative factors' such as the size of the domestic government bond market, and the 'market accessibility factors,' which comprehensively assess accessibility in terms of the target country's macroeconomy, foreign exchange market and bond market structure, and connectivity with global custodians and depositories. As of last month, Korea met the quantitative criteria with a treasury bond issuance balance of 965.1 trillion won, exceeding the $50 billion (about 64 trillion won, credit rating S&P A-) threshold.

However, challenges remain in the market accessibility factors. Although revisions related to tax exemption on interest and capital gains from foreign purchases of government bonds were completed earlier this year, the following remain outstanding: ▲extension of trading hours and participation of overseas financial firms in the onshore foreign exchange market (to be implemented from July next year) ▲opening of a unified government bond account with Euroclear and the Korea Securities Depository (targeted in the first half of the year) ▲abolition of the foreign investor registration system (targeted for the third quarter). Completing these tasks is necessary to achieve Market Accessibility Level 2.

Researcher Lim pointed out, "From this year, foreign investors' investments in government bonds and Monetary Stabilization Bonds are tax-exempt, and the foreign exchange market is also advancing and extending trading hours," adding, "While the advancement of the foreign exchange market can promote WGBI inclusion, it is not a mandatory condition. The decisive factor for WGBI inclusion is the introduction of Euroclear." He continued, "Using Euroclear will eliminate complicated procedures such as investor registration, appointment of a standing agent, and opening of direct domestic accounts, making investment by foreigners more convenient." Last year, the government signed a memorandum of understanding (MOU) with Euroclear, and in January at the World Economic Forum (WEF) held in Davos, Switzerland, Deputy Prime Minister Choo Kyung-ho met with the CEO of Euroclear and stated preparations are underway for Euroclear implementation within the year.

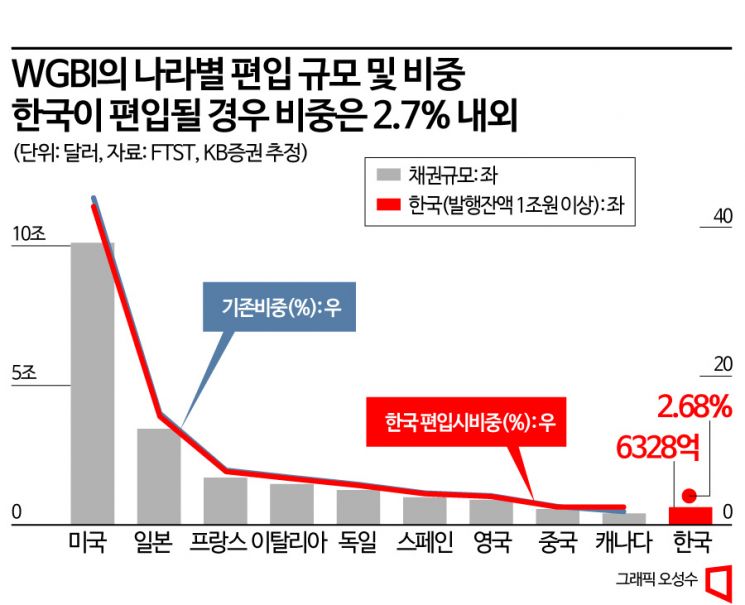

KB Securities estimated that if Korean government bonds are included in the WGBI, new funds flowing into the Korean bond market would amount to $66.93 billion, or 89.5 trillion won (based on the exchange rate at the end of August, as FTSE provides WGBI country weights using that rate). Researcher Lim said, "Since funds typically flow in over 24 to 36 months after inclusion, once WGBI inclusion is completed, an estimated 2.5 to 3.75 trillion won will flow in monthly," adding, "If we reverse-calculate the government's statement in early 2022 that a 10 trillion won supplementary budget would cause a 10 basis point (1bp = 0.01 percentage point) rise in interest rates, then an inflow of 90 trillion won due to WGBI inclusion would be expected to lower interest rates by about 90 basis points." He further noted, "If Korean government bond inclusion in the WGBI becomes likely, foreign funds will preemptively flow in to benefit from the interest rate decline associated with inclusion," and "The timing of this preemptive inflow by foreigners is expected to coincide with the introduction of Euroclear."

Research fellow Baek also said, "Korea's inclusion in the WGBI is clearly a positive factor for supply and demand as it can be expected to bring additional foreign buying funds, and if WGBI inclusion becomes visible, foreign bond investment funds are likely to flow in preemptively," adding, "Considering the size of funds tracking the WGBI and Korea's expected WGBI inclusion weight (2.0~2.5%), the amount of foreign funds that could flow into Korea upon index inclusion is expected to be between 70 trillion and 90 trillion won."

Meanwhile, if Korean government bonds are included in the WGBI, they will be included in the index according to the outstanding issuance balance of each bond. In theory, the inclusion scale is determined by the outstanding balance, so there is no difference by maturity. However, all bonds with a holding ratio exceeding 50% by funds and insurance companies have maturities of over 10 years. Insurance companies have high demand for ultra-long-term bonds due to asset and liability duration matching. Also, some bonds heavily held by insurance companies and funds are also held by foreigners; unlike short-term bonds with arbitrage demand, foreign investors holding long-term bonds are likely to be long-term investors such as central banks or central governments. Therefore, experts expect that due to the limited circulating volume in the market, long-term bonds will benefit the most from WGBI index inclusion.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.