Top 10 Strategic Minerals Including Lithium and Nickel Overlap Between Korea and Japan

Participation in Japan-led 'Asia CCUS Network' Should Be Accelerated

Large-scale Overseas Hydrogen Import Needed

In the global environment where the United States is focusing on containment of China, opinions have been raised on the need to strengthen Korea-Japan cooperation in the fields of supply chains, carbon reduction technologies, and the hydrogen economy.

The Federation of Korean Industries (FKI) announced this on the 29th through a report titled "Korea-Japan Cooperation Measures to Respond to Recent Global Issues," commissioned to the Korea Institute for International Economic Policy.

The report pointed out that the U.S. decoupling policy from China is diversifying into unilateral U.S. sanctions on China such as export controls and domestic industry promotion measures in sectors like the semiconductor industry. It also noted that attempts to separate China from the global supply chain are materializing by utilizing the multilateral cooperation framework among allies called the Indo-Pacific Economic Framework (IPEF). To respond to the new supply chain environment, the report proposed cooperation in key mineral supply chains, CCUS (Carbon Capture, Utilization, and Storage) technology, and hydrogen-related technology, leveraging the normalized Korea-Japan relations following the Korea-Japan summit.

Currently, IPEF participating countries are discussing negotiation goals in four areas: trade, supply chains, clean economy, and fair economy. Regarding the supply chain sector, the report anticipated that most negotiation goals will focus on using the seven ASEAN countries (Indonesia, Thailand, the Philippines, Malaysia, Singapore, Vietnam, Brunei) and India as bases against China, along with expanding Korea and Japan's investment in the U.S., as part of the U.S. decoupling or bloc formation strategy against China. Therefore, it explained that the Korean and Japanese governments should jointly respond to the U.S. demand for de-China-ization while developing supply chain cooperation agendas that can be discussed separately from the IPEF negotiation results.

The report viewed that both countries, being resource-poor, have ample potential to cooperate in the joint development and procurement of overseas raw materials for important minerals and essential materials. It cited that the ten strategic minerals announced by the Korean government in February this year exactly match the important minerals presented by Japan in December 2022, and that Korean and Japanese companies had experience jointly developing overseas mineral resources in the early 2000s. An industry official noted that Latin American countries such as Argentina and Chile, which have various mineral deposits, are forming cooperative groups to pursue resource weaponization, and if Korea and Japan respond jointly, their negotiating power against these countries could be enhanced.

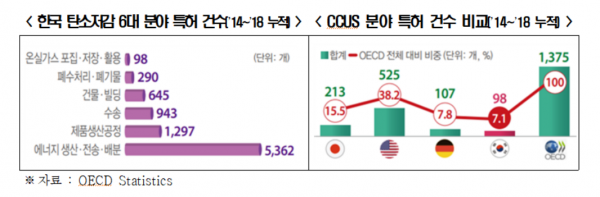

Among various carbon reduction technologies, CCUS technology is one of the fields where Korea's technological capability lags behind major countries. Except for the U.S., Japan leads the CCUS technology in Asia, particularly focusing on technology development in carbon dioxide separation and recovery. As part of achieving carbon neutrality, Japan plans to store approximately 120 million to 240 million tons of carbon dioxide annually from 2050 through CCUS technology. To this end, Japan intends to increase storage capacity by 6 million to 12 million tons annually over 20 years starting in 2030. As an international cooperation strategy to implement this plan, Japan proactively established the "Asia CCUS Network" in June 2021 and is working on knowledge sharing and improving the business environment to promote CCUS utilization in Asia.

Korea has also set ambitious goals to process 10.3 million tons annually by 2030 and up to 85.2 million tons annually by 2050 through CCUS. The FKI argued in the report that since Korea's technological capability in CCUS is relatively inferior and related regulations are not well established, it is necessary to actively participate in multilateral technology cooperation platforms like the "Asia CCUS Network" and jointly promote projects to respond to international agendas such as carbon neutrality by utilizing the recently improved Korea-Japan relations.

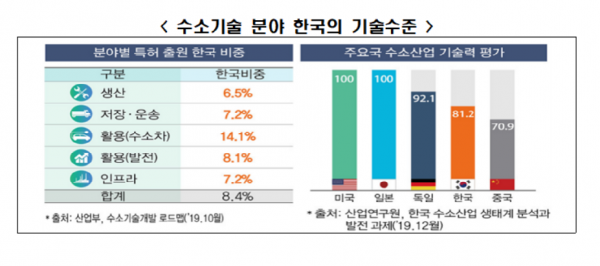

Furthermore, the report suggested that cooperation between Korea and Japan is needed in the hydrogen sector as well. Korea has relative strengths in end-use areas such as hydrogen fuel cell vehicles but lags behind major countries in production, transportation, and other infrastructure sectors. Both Korea and Japan require large amounts of hydrogen for decarbonizing industrial and transition sectors in the future, but domestic production conditions are unfavorable, leading to plans to import massive quantities of hydrogen from overseas. Senior Research Fellow Kim Gyupan emphasized the need to actively explore third-country market entry through cooperation between the two countries, as Japan is ahead in overseas hydrogen imports.

The report pointed out that since cooperation between Korean and Japanese companies in overseas hydrogen import fields has already begun, as exemplified by the June 2022 joint project between GS Energy and Mitsui & Co. for blue ammonia production in the UAE, the previously severed government cooperation channels between Korea and Japan should be promptly restored to discover additional projects.

Choo Kwang-ho, Head of the Economic and Industrial Headquarters at FKI, said, "Securing minerals such as lithium and nickel, which are key materials for batteries and electric vehicles, as well as developing CCUS and hydrogen technologies, are essential tasks for Korea's present and future growth and achieving carbon neutrality." He added, "Since Korean and Japanese companies can pursue a win-win strategy by jointly entering third countries without competing, a joint Korea-Japan discussion forum is necessary for cooperation in supply chains and carbon neutrality."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.