Demand Forecast for Up to 300 Billion Won Public Bond on the 30th

Preparing Additional CP Issuance

Responding to Funding Needs Including Maturing Loans and 600 Billion Won Dividends

SK Enmove, a subsidiary of SK Group's base oil division (formerly SK Lubricants), is preparing to raise a large amount of funds by issuing corporate bonds and commercial paper (CP). This is to repay borrowings maturing within the year and to meet funding demands arising from large-scale dividends. The company is drawing attention by issuing ultra-long-term bonds with a maturity of 7 years based on a stable financial condition.

According to the investment banking (IB) industry on the 29th, SK Enmove plans to issue corporate bonds worth up to 300 billion KRW. The bonds will be divided into 70 billion KRW with a 3-year maturity, 100 billion KRW with a 5-year maturity, and 30 billion KRW with a 7-year maturity, and a demand forecast will be conducted. The desired interest rate was presented as the private bond rating agency's evaluation rate (market interest rate) for the same maturity ±30 basis points (1bp = 0.01 percentage points).

On the 30th, a demand forecast will be conducted targeting institutional investors to determine the final issuance amount and bond interest rates by maturity. If sufficient investment demand is gathered during the demand forecast, the corporate bond issuance amount will be increased to a maximum of 300 billion KRW. Samsung Securities was previously selected as the lead manager, and SK Securities, NH Investment & Securities, KB Securities, and Hanwha Investment & Securities were included in the underwriting group along with the lead manager.

The funds raised will mainly be used to repay maturing borrowings. SK Enmove must respond to corporate bond maturities of 180 billion KRW and 120 billion KRW in May and September, respectively. The plan is to operate the funds raised from the bond issuance in early April through short-term financial products such as money market funds (MMF) and use them as repayment funds as the corporate bond maturities come sequentially.

SK Enmove is also reportedly preparing to issue additional CP. SK Enmove, which had not issued CP for several years, started with 100 billion KRW in August last year and increased the CP balance to 300 billion KRW in October last year when market interest rates fluctuated due to the Legoland incident. An IB industry official explained, "Despite stable performance improvements, SK Enmove's funding needs have increased due to dividend payments at the beginning of the year," adding, "They are proactively securing liquidity due to unstable market conditions at some banks in the US and Europe."

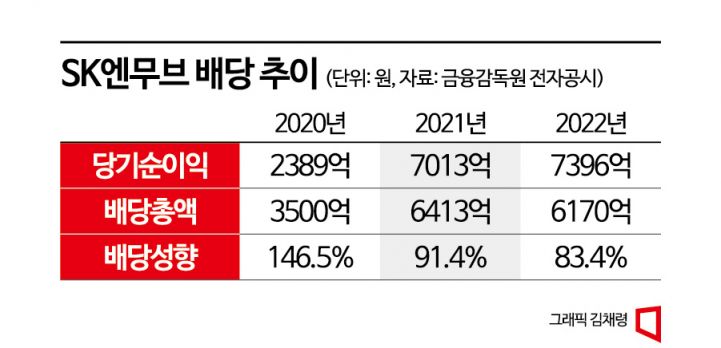

After SK Innovation, the major shareholder of SK Enmove, sold its 40% stake for 1.1 trillion KRW to Ecosolution Holdings under IMM Private Equity (IMM PE), a private equity fund management company, dividend payments have significantly increased. Over the past five years, dividends averaging 400 billion KRW annually have been paid. Dividends of 350 billion KRW and 641.3 billion KRW were paid for the 2020 and 2021 fiscal years, respectively, and based on the 2022 fiscal year, a total dividend of 617 billion KRW is expected to be paid this year.

An industry insider said, "SK Enmove is generating over 1 trillion KRW in annual EBITDA through the spread increase of its main product, base oil, despite rising costs," and added, "Even with continued large-scale dividends, it is expected to maintain a stable financial condition."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.