If Considered Securities, Coins Also Regulated by Capital Markets Act

Prosecutors Judge Luna as Investment Contract Securities

In the US, Securities Confirmed Through Howey Test

Kwon Do-hyung (32), CEO of Terraform Labs and the key suspect in the Terra·Luna crash incident, was arrested in Podgorica, the capital of Montenegro, sparking intense interest in the charges and punishment he may face. Both South Korea and the United States are seeking to secure his custody, and it is expected that punishment will be inevitable regardless of which country he goes to.

Legal and academic circles predict that whether Terra·Luna are recognized as securities will influence the trial. The securities status refers to whether the virtual assets Terra·Luna qualify as securities. If securities status is recognized, CEO Kwon Do-hyung could be punished under the Capital Markets Act for fraudulent and unfair trading, price manipulation, and other charges.

Even if virtual assets take the form of tokens, if they possess the nature of securities, they are classified as token securities and subject to regulation under the Capital Markets Act. The Capital Markets Act governs securities regardless of their issuance form.

Terraform Labs issued Terra, a stablecoin pegged 1:1 to the US dollar, and also circulated Luna to maintain its value. They promoted that Terra and Luna maintain value through an algorithm linking their supply volumes, attracting investors' attention. They explained that if Terra’s price fell below $1, Luna would be sold to buy Terra, and vice versa, to prevent value decline. Investors were attracted by promises of 19-20% annual returns when staking Terra in the decentralized DeFi service Anchor Protocol. However, as virtual asset prices fell last year, Terra and Luna’s values also dropped, triggering panic selling and a vicious cycle of price declines. Ultimately, in May last year, Terra and Luna prices plummeted by over 99%, causing a crisis in the virtual asset market.

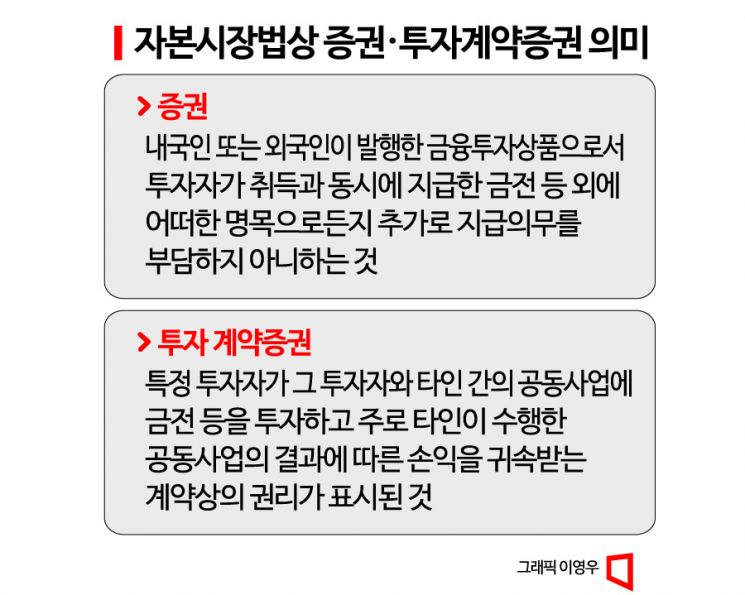

The Capital Markets Act defines securities as "financial investment products issued by domestic or foreign persons, where investors do not bear any additional payment obligations beyond the money paid at acquisition." Securities holders can exercise rights against issuers, who have obligations to fulfill them. When determining whether something is a security, explicit contracts, terms, or whitepapers are not the only considerations. Implicit contracts, contract formation and execution embedded in smart contracts, profit distribution details, advertising and solicitation content presented to attract investment, and agreements are comprehensively examined.

Securities are categorized into six types by form: debt securities, equity securities, beneficiary certificates, derivative-linked securities, depositary receipts, and investment contract securities. Representative debt securities include bonds; equity securities include stocks; beneficiary certificates include funds; derivative-linked securities include equity-linked securities (ELS) and exchange-traded notes (ETN). Depositary receipts include depositary receipts (DR). These are standardized and relatively clearly identifiable.

However, investment contract securities differ. Defined under the Capital Markets Act as "contractual rights indicating that a specific investor invests money or other assets in a joint business with others and mainly receives profits or losses from the joint business performed by others," investment contract securities have a broad scope of application. Also called unstandardized securities, they are often difficult to distinguish and must be verified case by case. The music copyright participation claims by the fractional investment company Musicow surfaced as investment contract securities. Prosecutors are known to have judged Luna as an investment contract security.

Financial Services Commission: "Examining Problematic Coins Case by Case"

The Financial Services Commission states that if "the issuer performs business with investors' money and attributes the resulting profits to them, and actively presents the issuer’s efforts, experience, and ability to succeed in the business when recruiting investors," it is highly likely to be judged as an investment contract security. Also, if "the source of money paid to investors is the profit generated from the business performed with investors' money, and the compensation is proportionate to business performance, effectively distributing business profits," it can be recognized as an investment contract security. Especially, if profit distribution based on business performance is actively presented during investor recruitment, the likelihood increases. A Financial Services Commission official explained, "Basically, financial and investigative authorities examine problematic coins case by case," adding, "Coin issuers and traders should check for illegality according to guidelines to prevent illegal activities."

The Digital Asset Exchange Joint Council (DAXA), composed of South Korea’s five major virtual asset exchanges (Gopax, Bithumb, Upbit, Korbit, Coinone), considers securities status when deciding on trading support (listing) for virtual assets. On the 22nd, DAXA announced a common guideline for trading support review titled "Legal Risks - Securities Status of Virtual Assets," which examines whether the asset qualifies as a security under domestic law. A DAXA official said, "We determine securities status through materials and procedures that demonstrate compliance with authorities’ guidelines, overseas cases, and securities status." According to DAXA, no tokens with securities status are currently traded on member exchanges.

The Financial Supervisory Service (FSS) formed a task force (TF) to support the judgment of securities status for virtual assets circulating domestically. An FSS official explained, "We monitor whether virtual assets with securities status are traded on exchanges, and if problems are found, we examine them in detail."

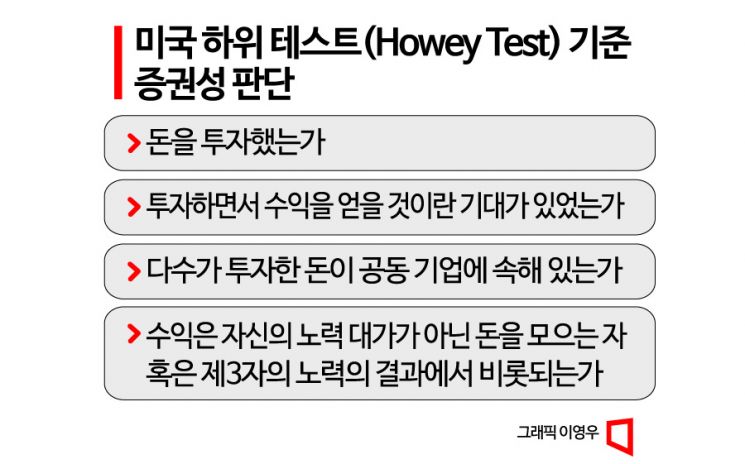

In the United States, the "Howey Test" is used to determine the existence of securities status. The Howey Test considers whether ▲money was invested ▲there was an expectation of profits from the investment ▲the invested money is part of a common enterprise ▲profits come from the efforts of others rather than the investor’s own efforts. If these conditions are met, the asset is considered a security.

The U.S. Securities and Exchange Commission (SEC) filed a lawsuit against CEO Kwon Do-hyung in the Southern District Court of New York for fraud and unregistered securities sales under the federal securities laws. The SEC found that Kwon and others misled investors by advertising that Terra maintained a 1:1 exchange rate with the dollar, emphasizing the coin’s safety. Investors invested money, which was considered part of a joint enterprise called the Terra·Luna ecosystem. The SEC judged that investors expected profits from Terraform Labs’ efforts and that price manipulation was conducted to maintain Terra’s value. The New York prosecutor also indicted Kwon on eight charges, including securities fraud and conspiracy to manipulate prices, following news of his arrest. The New York prosecutor also applied the Howey Test and recognized securities status for Terra·Luna. Domestic investigative authorities are reported to have referred to the Howey Test when applying the Capital Markets Act.

The Ripple vs. SEC Lawsuit Outcome Also a Major Variable

The outcome of the lawsuit between Ripple and the SEC is also expected to be a significant variable. In December 2020, the SEC sued Ripple, claiming the foundation issued tokens in violation of securities laws. The trial result is expected in the first half of this year, and if the SEC wins, many coins are likely to be recognized as securities. This could make it easier to prove Luna’s securities status. Professor Hong Ki-hoon of Hongik University’s Business Administration Department said, "The reason Luna is said to have securities status is because it has the characteristics of securities when applying self-funding purposes and the Howey Test," adding, "If Ripple is recognized as a security, Luna is very likely to be as well."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)