April BSI 93.0... 13 Consecutive Months of Decline

Corporate sentiment has been sluggish for 13 consecutive months, indicating a slow economic recovery. In particular, the negative economic outlook in the electronics and electrical industry, which accounts for about one-third of South Korea's exports, stands out.

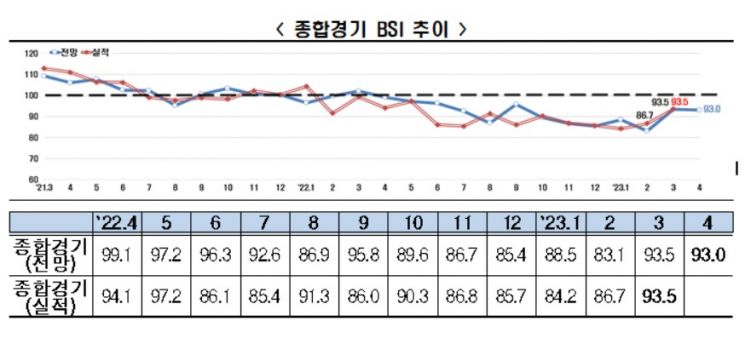

On the 29th, the Federation of Korean Industries (FKI) conducted a Business Survey Index (BSI) among the top 600 companies by sales, and the BSI outlook for April recorded 93.0. The BSI outlook has remained below the baseline of 100 for 13 consecutive months since April last year (99.1). This 13-month continuous slump is the longest since February 2021.

The actual BSI for March 2023 was 93.5. This also shows a 14-month continuous downturn since February last year (91.5), indicating a prolonged deterioration in corporate performance.

By industry, the April BSI for both manufacturing (95.0) and non-manufacturing (90.5) sectors fell below the baseline of 100 for 11 consecutive months since June 2022, showing simultaneous sluggishness.

Among manufacturing sub-industries, only general and precision machinery and equipment (110.5), which includes secondary batteries and shipbuilding equipment, and petroleum refining and chemicals (103.0) showed a positive outlook. Except for three industries hovering around the baseline (100.0)?food and beverages, pharmaceuticals, and metals and metal products?the remaining five industries (textiles and apparel (58.3), wood and furniture (80.0), electronics and telecommunications equipment (85.7), non-metallic minerals (92.9), and automobiles and other transportation equipment (94.9)) are expected to experience sluggish industry conditions.

In particular, the electronics and telecommunications equipment sector, which includes semiconductors, has been in decline for seven consecutive months, marking the longest slump in 2 years and 5 months (29 months) since November 2020 (92.0). This suggests that the sluggish export environment in South Korea may continue for the time being.

The April BSI by survey category showed negative outlooks across all sectors (investment 88.6, financial conditions 92.1, profitability 92.1, domestic demand 93.0, exports 95.9, employment 96.2, inventory 104.3). The downturn across all sectors has continued for seven consecutive months since October 2022. In particular, domestic demand (93.0), exports (95.9), and investment (87.9) have simultaneously been sluggish for 10 consecutive months since July 2022.

Choo Kwang-ho, head of the Economic and Industrial Headquarters at FKI, stated, “If the worsening economic outlook for companies continues, it could negatively impact investment, production, and employment plans, exacerbating the downturn in the real economy.” He added, “It is necessary to enhance corporate management vitality through improvements in trade environments with major countries (such as the U.S. and Japan) and continued labor reforms, including flexible working hours.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.