Since the 1·3 real estate measures, the price decline of so-called ‘flagship apartments’ located in the Gangnam area has noticeably slowed down. Recently, with the depletion of urgent sale listings and growing expectations due to the easing of reconstruction regulations, the price stabilization trend is gaining momentum.

View of apartment complexes in downtown Seoul from Lotte World Tower Seoul Sky in Songpa-gu, Seoul

View of apartment complexes in downtown Seoul from Lotte World Tower Seoul Sky in Songpa-gu, Seoul Photo by Yonhap News

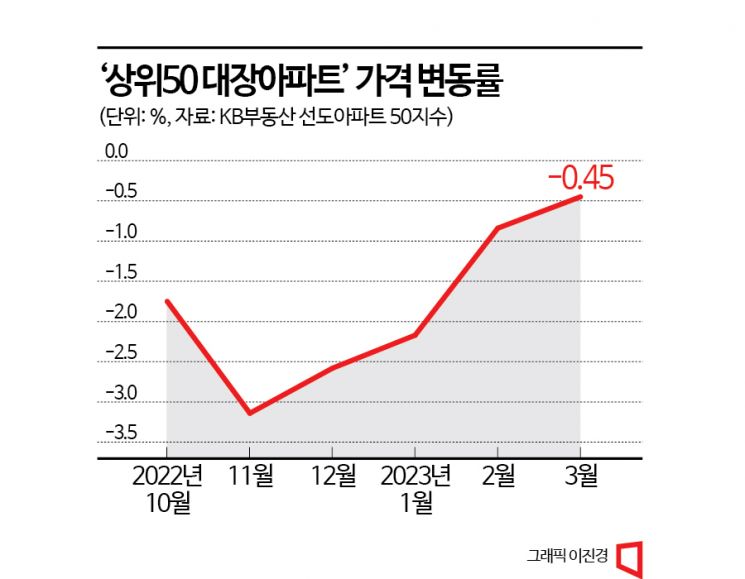

According to the monthly housing trend report released by KB Kookmin Bank on the 28th, the ‘KB Leading Apartments 50’ index fell by 0.45% this month compared to the previous month. This is a decrease of 0.39 percentage points from the previous month’s decline (-0.84%), meaning the rate of decline has dropped by about half. This index recorded the largest drop ever last November with a 3.14% decline but has seen a sharp reduction in the rate of decline for four consecutive months since then.

The KB Leading Apartments index selects the top 50 apartment complexes nationwide by market capitalization and shows the rate of change in market capitalization. It is highly sensitive to price fluctuations and is mainly used as a leading indicator to anticipate the housing market. Major Gangnam area complexes such as Jamsil Jugong 5th Complex, Acro River Park, and Eunma Apartments are included in large numbers.

The reduced rate of decline in this index is interpreted as an effect of the government’s 1·3 real estate measures. Most of Seoul’s regulated areas have been lifted, and loans for multi-homeowners have been eased, leading to a decrease in urgent sale transactions. A representative from real estate agency A near Helio City in Garak-dong, Songpa-gu, Seoul, which has the largest market capitalization, said, "Following the easing of real estate regulations and loan restrictions, recent purchase inquiries have increased considerably," adding, "As urgent sale listings increase, many buyers are attempting to ‘trade up’ to better areas." In fact, an 84.96㎡ (exclusive area) unit in this complex was sold as an urgent sale for 1.58 billion KRW in January but changed hands again for 1.8 billion KRW on the 19th of last month.

In particular, the Gangnam 3 districts (Gangnam, Seocho, Songpa), where more than half of the Leading 50 apartments are concentrated, have recently seen a sharp decrease in the rate of price decline. According to the Korea Real Estate Board, as of the third week of this month, the apartment price change rates in Seocho-gu and Gangdong-gu recorded 0.00%, returning to a stable trend after 31 weeks and 40 weeks, respectively. Songpa-gu also showed signs of price increase, recording 0.03% in the first week of this month. Even for the entire southeastern region, the price change rate was high at -2.05% in December last year but has sharply decreased in January (-1.38%), February (-0.75%), and March (-0.13%) this year.

The easing of layered reconstruction regulations is also analyzed to have had an impact. According to Real Estate R114, the price change rate for reconstruction apartments in Seoul was -0.16% this month. This is 0.07 percentage points lower than the general apartment price change rate (-0.23%), which contrasts with the situation until January when reconstruction complexes experienced a larger decline than general apartments.

In fact, actual transaction prices of major reconstruction complexes are also recovering. According to the Ministry of Land, Infrastructure and Transport’s real transaction price information system, the ‘Olympic Trio’ called Olympic Family in Munjeong-dong, Songpa-gu, with an 84.7㎡ unit, was traded for 1.34 billion KRW in December last year but was transacted for 1.54 billion KRW on the 20th, showing price recovery.

The Eunma Apartments in Daechi-dong, Gangnam-gu, known as a ‘reconstruction big fish,’ saw prices drop to 1.77 billion KRW in November last year but traded for 2.04 billion KRW on the 16th, increasing by 270 million KRW. A representative from real estate agency B in Daechi-dong nearby said, "With the easing of reconstruction regulations accelerating the project, purchase inquiries are increasing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)