Foreigners and Individual Votes as Major Variables

Increased Attendance Benefits Shareholder Activist Funds

Outside Director and Audit Committee Appointment Proposals May Cause Vote Dispersion

The KT&G shareholders' meeting, which is just one day away, has emerged with the attendance rate of foreign and individual small shareholders as the biggest variable. The National Pension Service, holding the largest stake, has sided with the current KT&G management, securing an estimated friendly stake of around 30%. The shareholder activist fund Flashlight Capital (FCP) and Anda Asset Management, which proposed shareholder proposals such as dividend expansion, can only rely on small shareholders. Foreign and individual shareholders are likely to vote for the asset managers who proposed a high shareholder return rate. Therefore, the higher the voting participation rate of the overwhelming majority of foreign and individual shareholders, the more favorable the situation is expected to be for the funds.

Baek Bok-in, President of KT&G (left), and Andre Calantzopoulos, CEO of PMI (right), are taking a commemorative photo after signing a global export-related agreement recently at the Four Seasons Hotel in Gwanghwamun, Seoul.

Baek Bok-in, President of KT&G (left), and Andre Calantzopoulos, CEO of PMI (right), are taking a commemorative photo after signing a global export-related agreement recently at the Four Seasons Hotel in Gwanghwamun, Seoul.

KT&G Management Estimated to Secure 30% Friendly Stake

KT&G will hold its shareholders' meeting on the 28th at the KT&G Headquarters Talent Development Center located in Daedeok-gu, Daejeon. The three factions?current KT&G management, FCP, and Anda Asset Management?have submitted agenda items, totaling 35 in number. The agenda is broadly divided into shareholder return-related matters and the appointment of outside directors and audit committee members.

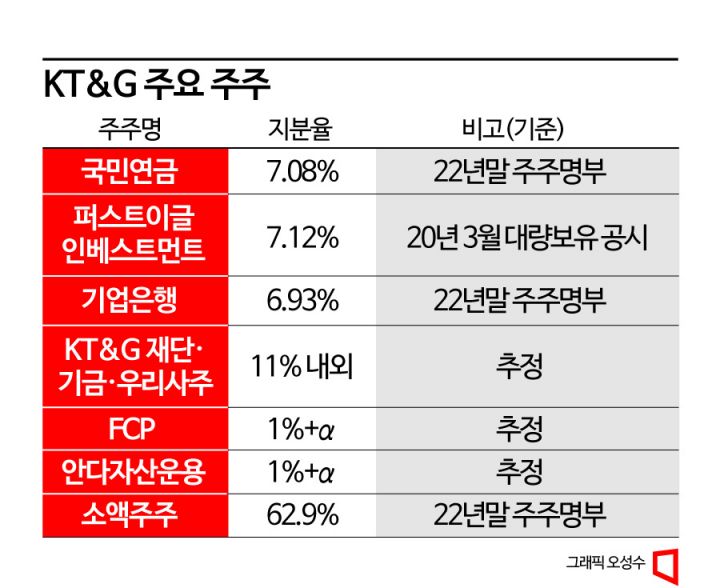

The National Pension Service opposed all shareholder proposals presented by FCP on the 24th. It expressed support for all agenda items proposed by the KT&G board. The National Pension Service is the largest domestic shareholder, holding a 7.08% stake in KT&G. Industrial Bank of Korea, holding 6.93%, is also likely to side with the current management. An asset management industry official said, "Although Industrial Bank of Korea has a history of conflict with KT&G over the appointment of outside directors, it is expected to take the same position at this shareholders' meeting."

In addition, the voting rights held by KT&G Welfare Foundation, Scholarship Foundation, Employee Welfare Fund, and Employee Stock Ownership Association are known to approach 11%. FCP pointed out, "KT&G has distributed treasury shares it acquired to various foundations, funds, and associations through in-kind contributions, which originally could not exercise voting rights, thereby increasing the likelihood that these shares will be used favorably for the current KT&G management." If the estimate is accurate, KT&G management currently holds around 30% friendly shares.

Foreign and Individual Stakes ‘Overwhelming’... Shareholders' Meeting Attendance Rate the Biggest Variable

FCP and Anda Asset Management, which made shareholder proposals to KT&G, have no choice but to expect voting participation from foreign and individual small shareholders, who account for over 60%. Among the voting rights shares, foreign ownership accounts for 43%, an overwhelming majority. Among foreign shareholders, First Eagle Investment, holding 7.12%, is KT&G's largest shareholder. FCP and Anda Asset Management are known to hold just over 1% each. So far, the friendly stake held by the shareholder activist funds is roughly 10%. The success or failure of this shareholders' meeting depends on how many of the remaining small shareholders can be secured as allies.

Accordingly, the attendance rate at the shareholders' meeting has emerged as a variable. Assuming an average attendance rate of 70%, the current management can secure victory in most agenda votes by gaining an additional friendly stake of over 5%. Conversely, the funds need to attract more than 25% additional votes. If the attendance rate reaches 90%, the additional stakes required by the management and the funds increase to over 15% and 35%, respectively.

An investment banking (IB) industry official said, "The proportion of foreign and individual small shareholders is overwhelmingly high, and these small shareholders are likely to vote for agenda items with high shareholder return rates," adding, "If the attendance rate at the shareholders' meeting increases, the funds are likely to have an advantage regarding agenda items such as dividends or treasury stock purchases."

Investor Side's 'Board Entry' Agenda Likely to Cause Vote Splitting

Since KT&G's current management, FCP, and Anda Asset Management have each nominated their own outside director and audit committee candidates, there is a high possibility that votes will be split on the board member appointment agenda.

FCP proposed former LG Household & Health Care Vice Chairman Cha Seok-yong and former Ceragem Group Vice Chairman Hwang Woo-jin as candidates for outside director and audit committee member. Anda Asset Management proposed increasing the number of outside directors to eight and nominated former Seoul Central District Court Chief Judge Lee Soo-hyung, former Louis Vuitton executive Kim Do-rin, and Professor Park Jae-hwan of Chung-Ang University's Business Administration Department as director candidates. Lee, the former judge, and Kim, the former executive, were also proposed for appointment as audit committee members. KT&G proposed reappointing current outside directors Kim Myung-chul and Ko Yoon-sung and appointing them as audit committee members.

However, there is a high possibility that votes will be split on the director appointment agenda. The cumulative voting system applies to each agenda item for director appointments. Under this system, shareholders are granted voting rights equal to the number of directors to be appointed per share. For example, if three directors are to be elected, a shareholder with one share has three votes and can allocate all three votes to one candidate.

The friendly stake of the current management is likely to concentrate on the candidates nominated by KT&G itself. In contrast, individual small shareholders are likely to split their votes between candidates nominated by FCP and those nominated by Anda Asset Management. Accordingly, FCP appealed in an urgent shareholder letter to concentrate votes on candidates Cha Seok-yong and Hwang Woo-jin.

An asset management official said, "While proxy advisory firms have opposing views on shareholder return-related agenda items, they recommend different candidates for director appointments," adding, "Votes on director appointment agenda items are likely to be split among foreign and individual small shareholders."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)