Reform of the Public Announcement System for Showmanship... Actual Reduction Levels to Be Disclosed

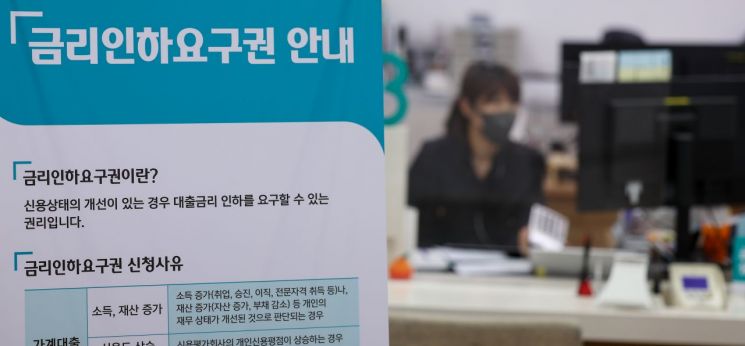

Financial authorities are revamping the disclosure of insurance companies' rights to request interest rate reductions to strengthen customer rights. Disclosure will likely be mandatory not only for simple acceptance rates but also for how much the rates were actually lowered.

According to the financial sector on the 26th, the Financial Supervisory Service (FSS) has decided to implement the insurance business supervision enforcement rules from the 27th, which include disclosures by insurance companies on how much they have reduced interest rates after receiving customer requests for loan interest rate reductions.

The right to request an interest rate reduction allows borrowers to ask financial institutions to lower their loan interest rates if their credit status has improved after taking out a loan. Until now, disclosures regarding this right have been limited to simple figures such as the number of requests, number of acceptances, interest reduction amounts, and acceptance rates, which has been criticized for lacking effectiveness.

Accordingly, financial authorities have mandated through the new enforcement rules that insurance companies additionally disclose the reduced interest rates accepted under the right to request rate reductions and the rate of non-face-to-face applications. Last year, insurance companies were criticized for raising the average interest rate on unsecured loans up to 13% due to high funding costs amid high interest rates. They also reduced the limits on policy loans, which do not require loan screening and have no early repayment fees or overdue interest, making it easier for insurance customers in urgent need of funds to use them without burden.

In the second half of last year, the acceptance rate of interest rate reduction requests by insurance companies was 48.3% for non-life insurers and 55.37% for life insurers. Among non-life insurers, Hanwha General Insurance (41.4%) and Heungkuk Fire & Marine Insurance (41.7%) had the lowest rates. Among life insurers, Dongyang Life Insurance had the lowest at 27.56%.

Kim Ju-hyun, Chairman of the Financial Services Commission, and Lee Bok-hyun, Governor of the Financial Supervisory Service, have urged not only banks but also insurance companies to operate the right to request interest rate reductions transparently and reasonably, fearing that vulnerable groups will face difficulties due to the economic downturn.

Going forward, the FSS plans to focus inspections this year on preventing consumer damage during periods of rising interest rates by examining unreasonable loan interest rates and the appropriateness of the operation of the right to request interest rate reductions.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)