If Competition Increases, There May Be a Possibility of Not Selling All Shares Through Tender Offer

Remaining Shares Might Have to Be Sold at Prices Lower Than Purchase Price

In the corporate mergers and acquisitions (M&A) market, the tender offer system, which was recognized as a mechanism to protect minority shareholders, is now being criticized as a tool that can actually harm minority shareholders. Although the system is designed to ensure that not only controlling shareholders but also minority shareholders receive fair recognition of their equity value during M&A processes, investors may suffer losses due to volatile stock prices caused by changes in the M&A landscape.

HYBE and Com2uS Participate in Tender Offer for All Their SM Shares

According to the financial investment industry on the 27th, Kakao’s tender offer to purchase 35% of SM’s issued shares at 150,000 KRW per share ended with an 'overbooking' that exceeded the target volume. The number of shares tendered was more than twice the target. Due to the oversubscription, shareholders who participated in the tender offer were able to sell only 44% of the shares they applied with at the tender offer price, while the remaining 56% had to be retained.

In this process, HYBE, the largest shareholder holding 15.78% of SM shares, and Com2uS, which acquired 4.2% at the end of last year, put all their SM shares up for Kakao’s tender offer. It was not only them; a large number of SM minority shareholders also reportedly responded to the tender offer. According to a securities industry insider, general shareholders flocked to the branches of Korea Investment & Securities, the securities firm handling the tender offer, not only on the closing day but also from two days prior.

Kakao stated that if the number of shares tendered exceeds the target volume (8,333,641 shares), the excess shares will not be purchased, and the purchase volume will be allocated proportionally. For this reason, SM shareholders could not sell all their shares.

Excluding Kakao and Kakao Entertainment (15.78%), SM’s treasury shares (1.3%), and Align Partners Asset Management’s stake (1.1%), which had already declared they would not participate in the tender offer, it is estimated that about 22.07 million shares were available for tender. The subscription competition rate could have risen to as high as 2.65 to 1. The final competition rate for SM’s tender offer conducted by Kakao was approximately 2.27 to 1. Accordingly, the allocation ratio was set at 44.1%. Kakao decided that if the tendered volume exceeds the target, the excess would not be purchased and the purchase volume would be allocated proportionally.

Participants in the tender offer can sell only about 44% of the shares they put up to Kakao. HYBE is expected to be able to sell only about 1.56 million shares out of the 3,537,237 shares it holds. Since HYBE purchased SM shares at 120,000 KRW per share, the resulting capital gain is approximately 44.7 billion KRW.

The remaining shares that could not be sold through the tender offer (about 1.98 million shares) are likely to be held for the time being. If, after the tender offer ends, SM’s stock price returns to the level before the management dispute, HYBE could face a significant valuation loss. On the 27th, SM was trading around 97,000 KRW on the KOSDAQ market. Since the price fell to the 90,000 KRW range in early February, HYBE would incur a loss of about 23,000 KRW per share on SM stock at the current price, resulting in a valuation loss of approximately 45 billion KRW.

Minority Shareholders Dissatisfied Expecting Capital Gains

Minority shareholders have expressed dissatisfaction, saying that institutions holding large amounts of SM shares, such as HYBE and Com2uS, participated in the tender offer, reducing the portion they can sell.

To assess the final gains and losses of the tender offer, the risk burden due to unsold shares must also be calculated. On the 23rd, SM’s April futures price closed at 86,300 KRW. This indicates that the market expects the stock price to decline further after the tender offer. The market anticipates that although the stock price adjusted once after the HYBE and Kakao agreement, it will undergo additional adjustments starting from the 27th, after the tender offer concludes.

In the securities industry, the tender offer price of 150,000 KRW corresponds to a price-to-earnings ratio (PER) of about 40 times, while the stock price in the 110,000 KRW range is evaluated at a PER of 28 to 29 times. This is relatively high compared to competitors such as YG Entertainment (21 times) and JYP Ent. (29 times).

Experts who have observed the actual process of the tender offer system, which has recently become widespread in the market, emphasize that the tender offer system is merely an M&A technique and not a device to protect minority shareholders. They stress that the tender offer system involves considerable uncertainty, requiring prudent investment decisions.

The tender offer is conducted by announcing the purchase period, price, and quantity in advance and buying shares from an unspecified large number of shareholders outside the stock market. It is mainly used in management disputes or hostile M&As.

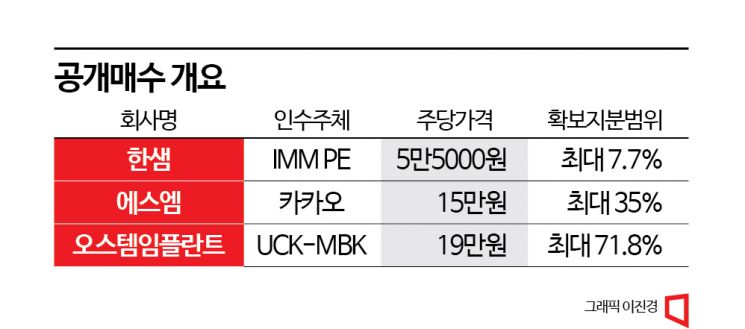

This year, tender offers have been conducted not only for SM but also for acquiring management rights of Osstem Implant and for boosting stock prices and raising funds for Hanssem. Following the announcement of tender offers, the stock prices of the respective companies surged.

Dr. Hwang Se-woon of the Korea Capital Market Institute said, "The tender offer system involves considerable uncertainty and is primarily a means to secure management rights." He added, "Companies do not prefer this method because it requires a lot of time and cost and involves high uncertainty. It is mostly used as a last resort."

He particularly emphasized that the tender offer system has not been properly operated in Korea so far. Therefore, he advises inexperienced investors to be even more cautious. Even if they respond to the tender offer after purchasing shares on the market, there is no guarantee they can sell 100%, so they must remember that they may not be able to dispose of all the shares they want and plan their trading strategy accordingly. Dr. Hwang said, "Although it is common to set the tender offer price higher than the market trading price, it is not sufficient to compare prices alone. It is necessary to consider the possibility that the unsold shares after responding to the tender offer may have to be sold at a price lower than the purchase price."

A financial investment industry official said, "If the mandatory tender offer system, which requires acquiring a certain percentage of shares through a tender offer when securing controlling rights, is introduced next year, the number of tender offer cases is expected to increase further." He added, "After participating in a tender offer, various cases may occur, such as the buyer giving up management rights or the management launching a large-scale paid-in capital increase to defend management rights, causing the stock price to plummet, so careful consideration is necessary."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.