Prices in Gangnam's 3 Districts Also Fall by 2.7%

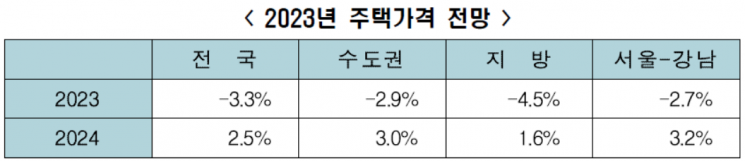

This year, amid the economic downturn and continued interest rate hikes, housing prices are projected to fall by 3.3% nationwide. The decline is expected to vary by region, with the metropolitan area dropping by 2.9% and provincial areas by 4.5%.

The Korea Economic Research Institute released a report titled "Housing Market Outlook and Impact Analysis of Changes in Housing Environment" on the 24th, detailing these findings.

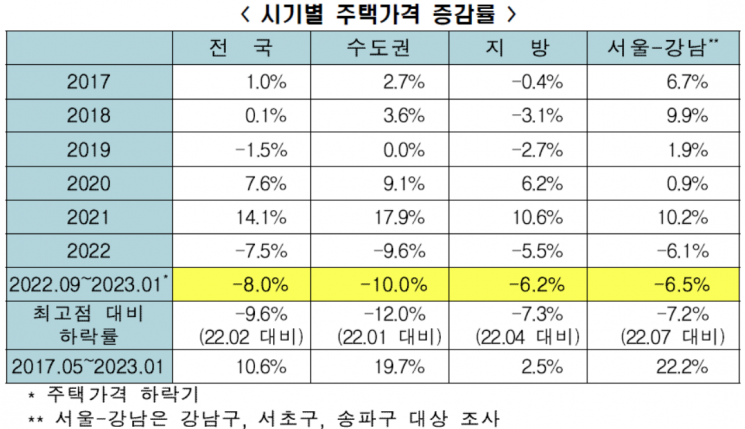

According to the report, housing prices, which had recorded a historic rise over the past five years, began to decline in the second half of last year. This was due to the economic contraction and the full-scale impact of interest rate hikes. Notably, the decrease in transaction volume had already started in the second half of 2021, two years ago.

From September last year to January this year, the housing price decline rate was 8.0% nationwide and 10.0% in the metropolitan area. The Seoul-Gangnam area (Gangnam-gu, Seocho-gu, Songpa-gu) also saw a decline reaching about 6.5%, raising concerns about a hard landing in the housing market, according to the report's analysis. However, the recent easing of housing market regulations appears to be mitigating the contraction trend in the housing market.

This year, housing prices are expected to fall by 3.3% nationwide, 2.9% in the metropolitan area, and 4.5% in provincial regions. The Gangnam 3 districts in Seoul are also forecasted to see a 2.7% price decline. Next year, a recovery is anticipated with a 2.5% price increase nationwide. The metropolitan area is expected to rise by 3.0%, provincial areas by 1.6%, and the Gangnam 3 districts by 3.2%.

Lee Seung-seok, a senior researcher at the Korea Economic Research Institute, stated, "Although the decline in housing prices is not insignificant, the market perception that interest rate hikes have nearly peaked is spreading, and the effects of government regulatory easing are becoming visible." He evaluated that "the extent of the housing price decline is less than initially expected."

However, he warned, "If the housing market experiences a hard landing during the economic downturn, the possibility of economic recovery could disappear." He argued, "To reduce this risk, it is necessary to swiftly and decisively proceed with normalizing the housing market through regulatory easing."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.