Change Articles of Incorporation to Form Audit Committee with Only Outside Directors

Truston Asset Management Recommends Other Non-Executive Director for Oversight

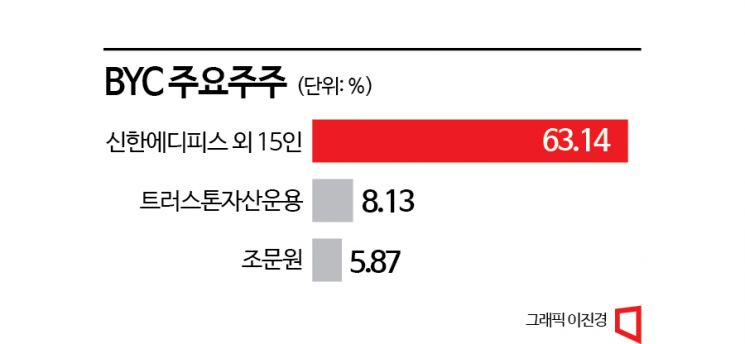

According to the financial investment industry, BYC will resolve a proposal to amend Article 36 of the Articles of Incorporation regarding the composition of the Audit Committee at the regular shareholders' meeting today (24th). Amendments to the Articles of Incorporation require a special resolution at the shareholders' meeting. Approval requires the consent of at least two-thirds of the attending shareholders and at least one-third of the total issued shares. Since BYC's special related parties, including Shinhan Edifice, hold 63.14% of the shares, they can amend the Articles of Incorporation as they wish.

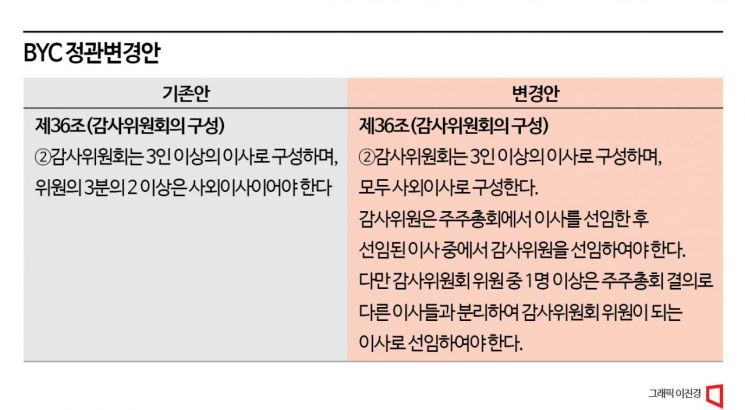

BYC's amendment to the Articles of Incorporation aims to fundamentally block the eligibility of other non-executive directors to become audit committee members. Under the existing Articles of Incorporation, not only outside directors but also inside directors and other non-executive directors can serve as audit committee members. However, the amendment changes the Articles so that all audit committee members must be composed solely of outside directors.

Previously, the activist fund Truston Asset Management proposed a shareholder proposal recommending legal expert Lawyer Kim Kwangjoong as an other non-executive director and audit committee member to eradicate unfair internal transactions at BYC. Truston claimed that after reviewing BYC’s accounting books, there were indications that BYC engaged in unfair internal transactions with affiliates where Chairman Han Seokbeom’s eldest son and daughter are the largest shareholders. Truston Asset Management currently holds an 8.13% stake in BYC, making it the second-largest shareholder.

There is no guarantee that BYC will win the vote battle at the shareholders' meeting. This is due to the '3% rule' which limits the voting rights of the largest shareholder in the election of audit committee members. This regulation restricts major shareholders to exercising voting rights on only up to 3% of the issued shares with voting rights when appointing auditors of listed companies. However, the '3% rule' does not apply when appointing outside directors as auditors. BYC cleverly avoided the '3% rule' limiting the largest shareholder’s voting rights by amending the Articles of Incorporation.

Lawyer Kim Kwangjoong of the law firm Hangyeol explained, "Although the 3% rule applies when appointing outside director audit committee members, aggregation does not apply, so if you combine the individual 3% stakes of affiliates and special related parties, the agenda can be passed." Truston argued, "BYC blocked Truston's proposal to appoint an other non-executive director (to become an audit committee member) through the amendment of the Articles of Incorporation and raised the appointment of outside directors, which the major shareholder can effectively control, thereby fundamentally blocking minority shareholders from appointing independent audit committee members through other non-executive directors." They added, "BYC’s amendment to the Articles of Incorporation, which claims to strengthen the independence of the audit committee and appears to protect minority shareholders, is actually a trick to block the appointment of independent audit committee members by minority shareholders."

Truston utilized a clause allowing shareholders holding more than 3% of the company’s issued shares to request inspection of accounting documents to verify the accounting details. As a result, last month they announced that they confirmed indications of unfair internal transactions between BYC and related companies such as Shinhan Edifice and Jewon Enterprise. Shinhan Edifice is a family company owned by Chairman Han Seokbeom’s family, with Han’s eldest son, Executive Director Han Seungwoo, holding the largest share (58.34%). Jewon Enterprise is a private company wholly owned (100%) by Han’s eldest daughter, Han Jiwon.

According to Truston’s claims, BYC transferred business rights of some stores to Jewon Enterprise without board resolution and without receiving key money or other compensation. Truston stated, "The free transfer of business rights constitutes the provision of unfair benefits, raising suspicions of breach of fiduciary duty by management," and demanded an explanation from BYC. Truston added, "To eradicate such unfair internal transactions, it is absolutely necessary to appoint directors independent from the major shareholder."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)