LG Electronics is increasingly likely to post higher profits than Samsung Electronics in the first quarter of this year for the first time since 2009.

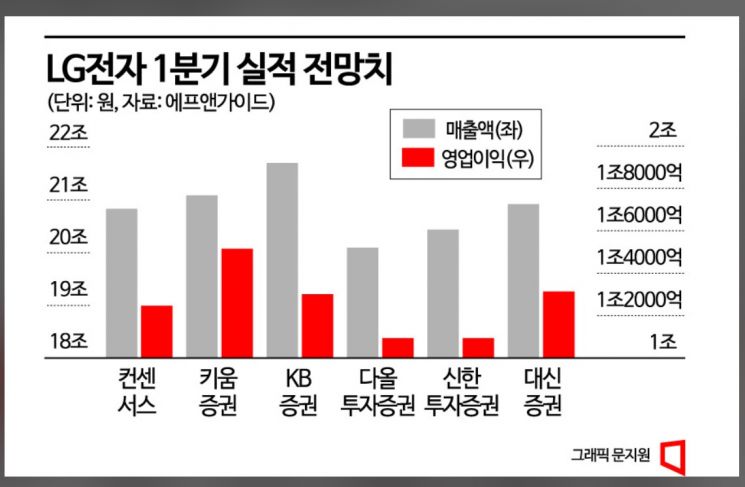

On the 31st, the consensus for LG Electronics' first-quarter earnings this year (the average forecast from securities firms over the past month), provided by financial information provider FnGuide, was sales of 20.8312 trillion KRW and operating profit of 1.2485 trillion KRW. The securities industry expects LG Electronics' sales and operating profit to decrease by 1.33% and 33.61%, respectively, compared to the same period last year.

Although these results are lower than a year ago, LG Electronics is estimated to have performed better than its competitor Samsung Electronics. Samsung Electronics' first-quarter earnings consensus is sales of 64.3536 trillion KRW and operating profit of 973.7 billion KRW. The market expects Samsung Electronics' sales and operating profit to have decreased by 17.26% and 93.10%, respectively, compared to the same period last year.

This would be the first time since 2009 that LG Electronics' operating profit surpasses Samsung Electronics'. In the first quarter of 2009, LG Electronics posted an operating profit of 501.9 billion KRW, while Samsung Electronics recorded 477.4 billion KRW. Since its predecessor Geumseongsa was established in 1958, LG Electronics has been neck and neck with Samsung in the home appliance sector, but in the 1990s, Samsung Electronics completely took the top spot by earning massive profits from its semiconductor business. Although LG Electronics briefly overtook Samsung Electronics in the first quarter of 2009 due to a semiconductor price crash following the global financial crisis, Samsung regained the lead as the semiconductor market recovered, pushing LG back to second place.

LG Electronics surpassing 1 trillion KRW in operating profit in the first quarter this year is largely due to efforts to reduce factory operating rates significantly last year to manage inventory, as well as successful expansion of B2B (business-to-business) performance, which is less sensitive to economic fluctuations. Dongwon Kim, a researcher at KB Securities, explained, "In the home appliance sector, B2B sales such as system air conditioners and built-in appliances were raised to 25% of total home appliance sales, restoring the overall home appliance division's operating rate to over 100%." He added, "The BS (Business Solutions) division also expanded B2B sales to 40% due to increased orders for digital signage and hotel TVs, and the VS (Vehicle Solutions) business, which is 100% B2B sales, appears to be operating factories at full capacity due to increased orders for electric vehicle parts."

If this pace continues, operating profit in the second quarter of this year is expected to increase by 15% year-on-year to 908.5 billion KRW, raising hopes for the best second-quarter performance in 14 years since the second quarter of 2009 (operating profit of 1.4 trillion KRW).

On the other hand, Samsung Electronics is facing inevitable worst-ever results as its semiconductor business, which had been boosting its performance, is faltering. Some even suggest that Samsung Electronics might post a loss in the first quarter of this year.

Kim Yang-jae, a researcher at Daol Investment & Securities, projected Samsung Electronics' first-quarter results at sales of 61.3 trillion KRW and an operating loss of 68 billion KRW. Due to inventory valuation losses in memory semiconductors, the semiconductor division (DS) is expected to post an operating loss of up to 4.1 trillion KRW, leading to an overall loss. Although Samsung Electronics has claimed there would be "no artificial production cuts," there are reports that it has already begun substantial production cuts. Hyunwoo Do, a researcher at NH Investment & Securities, explained, "Samsung Electronics is already conducting production cuts on a considerable scale," adding, "According to some testing and parts suppliers, orders from Samsung Electronics in the first quarter have decreased by more than 30%."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)