Bank of Korea Financial Stability Report

FSI 21.8... Approaching Crisis Threshold

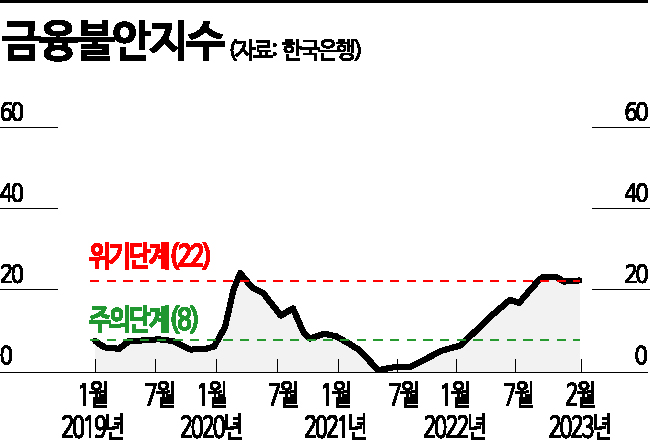

Last year, South Korea's Financial Stress Index (FSI), which surged to the 'crisis' level due to the Legoland incident, continues to remain at crisis levels as domestic and international uncertainties increase recently. Amid shocks to the global financial market caused by the recent collapse of the US Silicon Valley Bank (SVB) and Swiss investment bank Credit Suisse (CS), analysts warn that if external instability grows, the FSI, which has risen due to recent interest rate hikes, could spike sharply.

According to the Financial Stability Report released by the Bank of Korea on the 23rd, the FSI, which shows short-term volatility in financial market prices such as stocks, bonds, and exchange rates, reached 21.8 last month, approaching the crisis threshold of 22. The FSI soared to 23.5 in October last year, the highest level since April 2020 (24.6) during the COVID-19 pandemic, as the Legoland default incident and others caused liquidity tightening in the short-term financial market.

The FSI exceeded the crisis threshold of 22 with 23.1 in November and 22.1 in December last year, and rose again to 22.7 in January this year amid growing concerns over economic recession due to prolonged high interest rates, maintaining a high level. Since March last year (8.5), the FSI showed a continuous upward trend in the 'caution' stage (8 or above but below 22) for seven consecutive months until September (19.6), then entered the crisis stage in October and has hovered near the crisis level until February this year, showing an unstable trend.

The Bank of Korea stated, "The rise in the US NFCI (National Financial Conditions Index) directly leads to an increase in South Korea's FSI and causes a more sensitive reaction than when the Korean base interest rate is raised," adding, "Just as the FSI rose sharply during the global financial crisis, if external instability intensifies, the FSI could surge rapidly."

In particular, the possibility that credit risks and liquidity deterioration of some companies and financial institutions, such as the unexpected credit events like the Legoland incident last year, could affect the financial system has increased. Experts point out that if external factors such as major countries' monetary tightening policies and the SVB bankruptcy combine with domestic factors like economic slowdown and sluggish real estate market, foreign exchange and financial markets could become volatile, increasing the risk of loan defaults.

Regarding this, Kim In-gu, Director of the Financial Stability Department at the Bank of Korea, said, "The sharp rise in the FSI last year was due to a significant jump in credit spreads in the short-term financial and bond markets," adding, "Since the SVB incident, credit spreads have not risen significantly domestically, and if the trade balance improves in the second half as forecasted by the Research Department, the index is expected to stabilize downward in the future."

According to the report, the ratio of private credit (household + corporate debt) to nominal domestic gross domestic product (GDP) reached a record high of 225.1% at the end of the fourth quarter last year. A high ratio means that the debt the private sector must repay is excessively high compared to the economy's capacity.

Lee Jong-ryeol, Deputy Governor of the Bank of Korea, said, "Due to the vulnerability of the debt structure and high interconnectivity within the financial sector, the financial system is likely to overreact to changes in domestic and external conditions," adding, "Concerns about foreign securities investment outflows and foreign currency liquidity of domestic financial institutions may be highlighted."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.