CATL, leading with LFP (Lithium Iron Phosphate) batteries, showed more than double growth last year. The recent acceleration by Korean companies in developing and mass-producing LFP batteries is because they see LFP batteries as a 'profitable business.'

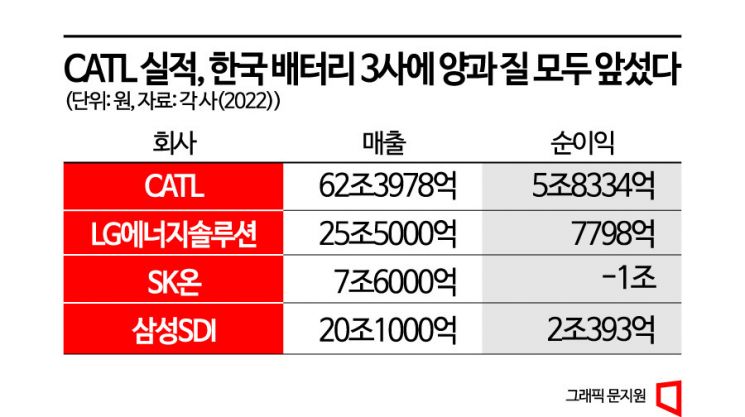

China's representative battery company CATL recorded sales of 328.6 billion yuan (approximately 62.4175 trillion KRW) last year, a 152% increase from the previous year. The combined sales of the three Korean battery companies?LG Energy Solution (25.5 trillion KRW), Samsung SDI (20.1 trillion KRW), and SK On (7.6 trillion KRW)?totaled about 53.2 trillion KRW. Even combined, there was nearly a 10 trillion KRW gap in sales compared to CATL.

CATL also showed significant growth in net profit. It reached 30.72 billion yuan (approximately 5.8352 trillion KRW), a 92.9% increase from the previous year. The net profits of the Korean companies were LG Energy Solution with 779.8 billion KRW, Samsung SDI with 2.0393 trillion KRW, and SK On recorded a net loss in the trillion KRW range. CATL outperformed Korean battery companies in both quantity and quality in terms of performance.

At the core of CATL's growth is the LFP battery. This battery is made using common minerals such as phosphate and iron, making supply chain management easier and manufacturing costs lower. Additionally, due to the chemical stability of iron, it has a lower fire risk compared to nickel-cobalt-manganese (NCM) ternary batteries. However, it has drawbacks such as lower energy density than NCM batteries, resulting in shorter driving range and slower charging speed.

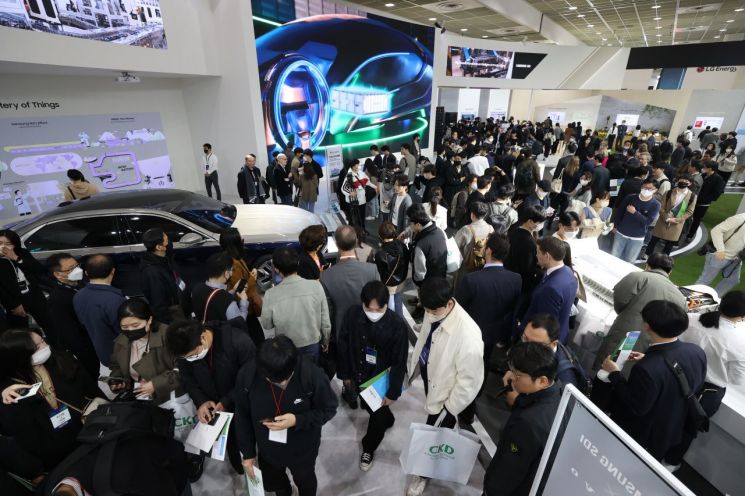

Korean battery companies, which had been passive in LFP battery development, are now accelerating development and mass production. At the InterBattery event held on the 15th of this month, SK On unveiled its first electric vehicle LFP battery, and LG Energy Solution also revealed its first LFP battery for energy storage systems (ESS). Samsung SDI announced plans to develop LFP batteries as well. Material companies such as POSCO Future M and L&F are also considering developing LFP cathode materials.

Korean companies are turning to LFP batteries because they can achieve high profit margins. CATL proves this. CATL's net profit margin last year was 9.34%, and in 2021 it reached 14%. Although Samsung SDI recorded a net profit margin exceeding 10% last year, LG Energy Solution had about a 3.05% net profit margin, and SK On has yet to achieve profitability.

LFP batteries have a structure that allows profitability because, although their selling price is low, manufacturing costs can also be reduced. Last year, the price of NCM battery cells for electric vehicles was $115 per kWh, while LFP batteries were around $92 per kWh (BloombergNEF data). LFP batteries are about 20% cheaper in price, and manufacturing costs are also more than 20% lower.

LFP batteries are widely applicable in the mid-to-low price market. As the electric vehicle market grows, LFP batteries are extensively used in low-cost models. Tesla installed LFP batteries in about half of its electric vehicles last year. In the ESS market, which is rapidly growing due to eco-friendly energy, the adoption of LFP batteries, which have low fire risk and long lifespan, is increasing.

The development of LFP batteries by Korean battery companies is also a strategy to diversify their battery lineup to meet customer demand. It is especially analyzed as a strategy to cater to the LFP demand from the U.S. and Europe, which aim to exclude the Chinese battery industry from the supply chain.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)