Aegis, Marston Issue Bonds at 7% Interest

Reflecting Concerns Over Domestic and Overseas Real Estate Investment Asset Defaults

Financial Authorities Strengthen Monitoring of Alternative Investment Assets

Private bond issuance yields for leading domestic real estate alternative investment managers have risen to the mid-7% range. This is interpreted as a significant increase in the interest rates demanded by investors due to the combined effects of rising market interest rates and a sluggish real estate investment market.

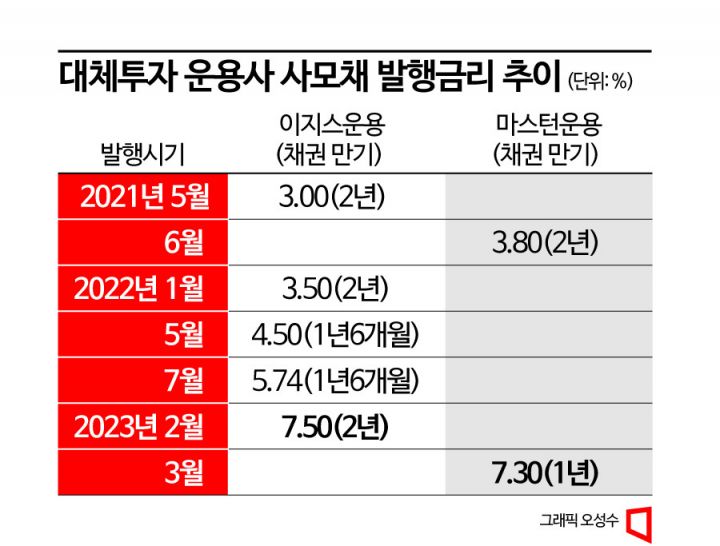

According to the investment banking (IB) industry on the 23rd, Master Investment Management issued private bonds worth 15 billion KRW yesterday, underwritten by Cape Investment & Securities. The maturity is one year, and the issuance yield is 7.3%. Compared to the issuance of two-year private bonds at 3.8% underwritten by Shinhan Investment Corp. in 2021, the interest rate has doubled in two years.

Aegis Asset Management also issued private bonds worth 80 billion KRW at the end of last month with yields in the mid-7% range. The issuance yields for 18-month and two-year maturities were set at 7.4% and 7.5%, respectively. This is about 2 percentage points higher than other corporate bonds with the same credit rating (A-). Compared to the issuance of two-year private bonds at 3.5% in early last year, the interest rate has more than doubled.

Hana Alternative Investment Asset Management, an alternative investment manager affiliated with Hana Financial Group, issued 100 billion KRW worth of hybrid capital securities (perpetual bonds) earlier this month. The maturity is 30 years, with the possibility of additional extensions after 30 years. Hana Alternative holds a call option to redeem early after five years. The perpetual bond yield was set at 6.97%.

However, if the call option is not exercised after five years, the interest rate will increase by 2% increments (step-up). Hybrid capital securities are a type of bond with perpetual maturity but are recognized as capital in accounting due to their capital-like characteristics.

The IB industry interprets the rise in funding costs for alternative investment managers as reflecting concerns in the real estate investment market. An industry insider said, "Aegis and Master are leading domestic real estate alternative investment managers with tens of trillions of KRW in assets under management," adding, "As the risk of default on domestic and overseas real estate investment assets such as overseas offices, hotels, and logistics increases, market-required yields have risen."

The financial authorities' actions toward these managers are also notable. The Financial Supervisory Service has recently been strengthening monitoring of alternative investment assets of financial companies, conducting ad hoc inspections to check for alternative investment defaults at Aegis Asset Management. Inspection procedures are also underway for asset managers with less than 1 trillion KRW in assets under management, such as Anda Asset Management, which holds many real estate investment assets.

An asset management alternative investment officer stated, "There is growing concern about defaults in domestic and overseas project financing (PF) investments, especially those in the development stage among the managers' investment assets," adding, "I understand that the burden is increasing on projects where managers have provided purchase commitments to buy at a specific price after completion." The official further predicted, "The rise in funding costs may cause difficulties for managers in securing liquidity."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)