ETF Market Sees Increased Net Buying of TF ETFs

"Investors Seek Reinvestment and Tax-saving Products Ahead of April Dividend Payments"

Foreign investors have been actively purchasing total return (TR) exchange-traded funds (ETFs) since last month. While continuing to sell off in the domestic stock market, they have been aggressively buying TR ETFs.

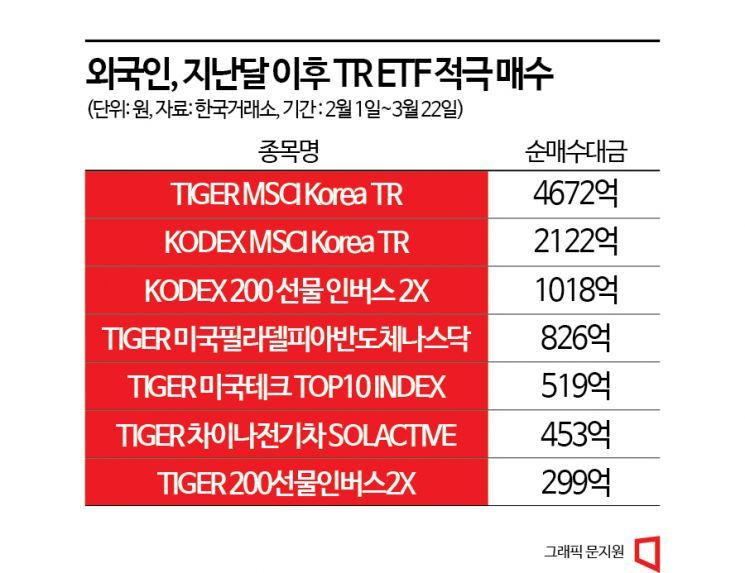

According to the Korea Exchange on the 23rd, the most purchased stock by foreigners in the domestic stock market this month is the ‘TIGER MSCI Korea TR,’ with a net buying amount of 339.1 billion KRW. Expanding the period to since last month, this ETF was bought for 467.2 billion KRW, and the ‘KODEX MSCI Korea TR’ was purchased for 212.2 billion KRW. These were the first and second most bought ETFs by foreigners among those listed domestically.

Both funds track the MSCI KOREA Gross TR index. Calculated by MSCI, the major components include top KOSPI market stocks such as Samsung Electronics (29.38%), SK Hynix (4.66%), Samsung SDI (4%), LG Chem (3.4%), and NAVER (2.7%). The TR attached to the index name stands for ‘Total Return,’ meaning dividends are reinvested. ETFs usually pay dividends on the last business days of January, April, July, and October. Instead of receiving dividends in cash, they are automatically reinvested. This is the biggest difference from general ETFs investing in the MSCI KOREA index.

The fees are also much lower. Looking at the total expense ratios of MSCI TR ETFs, the KODEX MSCI KOREA ETF has the lowest at 0.09%, followed by TIGER MSCI KOREA (0.12%) and HANARO MSCI Korea TR (0.12%). Other TR ETFs are priced between 0.04% and 0.15%. In contrast, general ETFs such as the TIGER MSCI KOREA ESG Leaders ETF have higher fees, with a total expense ratio of 0.4%, making general ETFs more expensive than TR ETFs.

The reason foreigners have been buying TR ETFs since last month can also be explained by the characteristics of TR ETFs. Typically, April is the dividend payout period for companies with December fiscal year-ends, and since dividends are largest at this time, foreigners choose TR ETFs to defer dividend income tax (15.4%). By postponing tax payments, they can invest more with the amount equivalent to the tax, thus benefiting from compound interest effects. Due to these advantages, many individual investors aiming for long-term investment in large domestic stocks also seek these ETFs. An industry insider commented, "For foreigners investing in large domestic stocks, TR ETFs are attractive because they have lower costs and allow reinvestment compared to general ETFs. The improved accessibility following the stagnation of the index after its rise since January likely also influenced this."

However, it is difficult to interpret foreigners’ purchases of MSCI KOREA TR ETFs as a sign of betting on a rise in the domestic stock market. A representative from a major asset management firm said, “Domestic institutions benchmark the KOSPI 200 index, but foreign investors mainly use MSCI indices as benchmarks. When investing in emerging markets like Korea, where information is limited, they often approach through MSCI-calculated indices.” Given the increasing foreign capital outflows and fund redemptions, it is far-fetched to say that foreigners buying MSCI TR ETFs the most means they are betting on stock price increases.

Already, ahead of the Federal Open Market Committee (FOMC) event in March, foreign investors have sold over 1 trillion KRW worth of stocks in the domestic market this month. During the same period, excluding MSCI KOREA ETFs, the ETFs most purchased by foreigners were ‘KODEX 200 Futures Inverse 2X’ (50.9 billion KRW) and ‘TIGER 200 Futures Inverse 2X’ (24.4 billion KRW).

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.