The number of large transactions exceeding 100 billion KRW in Seoul's commercial real estate market has sharply declined. With the scale of sales also significantly reduced, the market size has shrunk to about 20% of last year's level. Due to the uncertain outlook for the U.S. economy and the Federal Reserve's future interest rate policies, the transaction lull is expected to continue for the time being.

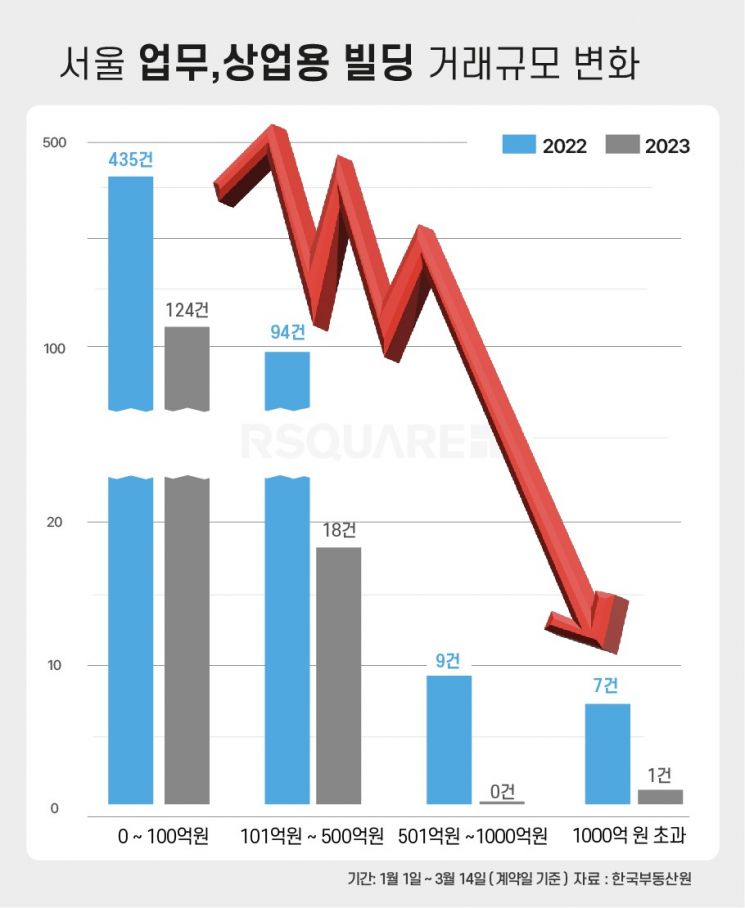

On the 22nd, commercial real estate data company RSquare analyzed the sales status of office and commercial buildings in Seoul through the Korea Real Estate Board from the beginning of this year until the 14th of this month (based on contract date), finding that there was only one transaction exceeding 100 billion KRW. This is a significant decrease compared to seven transactions over 100 billion KRW in Seoul during the same period last year.

The single transaction this year was an office facility in Jung-gu, contracted earlier this year for 308 billion KRW. The next largest transaction was a neighborhood living facility in Sinsa-dong sold for 50 billion KRW.

The total sales volume of office and commercial real estate also dropped to 1.099 trillion KRW, down 80.8% from 5.7168 trillion KRW in the same period last year. Sales of 'small buildings' priced below 10 billion KRW also fell to 124 cases this year, about one-third of the 435 cases in the same period last year.

Although rents for large buildings continue to rise steadily, the steep increase in interest rates makes it difficult for institutional investors to generate profits. RSquare explained that small buildings are also facing a challenging environment for buyers to approach due to the economic slowdown.

Ryu Gang-min, head of RSquare's Research Center, said, "The bankruptcy of the U.S. Silicon Valley Bank (SVB), signs of economic slowdown, and rising inflation have made it difficult to predict interest rates. However, since the direction of interest rates must focus more on the economy than inflation, there is a possibility that the frozen commercial real estate market could warm up by the end of the year."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.