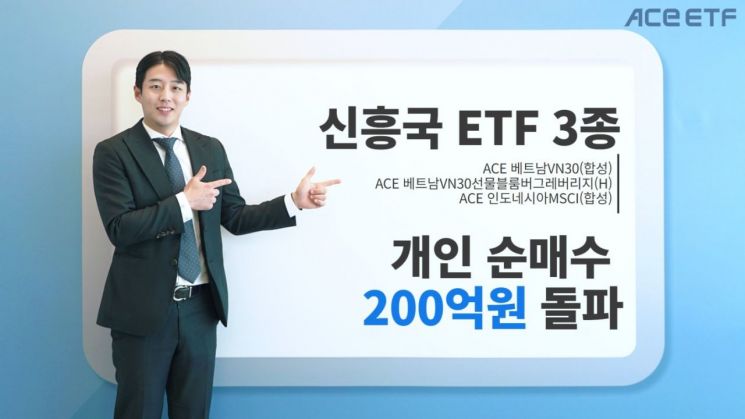

Korea Investment Trust Management announced on the 22nd that the net purchase amount by individuals for three exchange-traded funds (ETFs) investing in emerging markets has surpassed 20 billion KRW.

The three ETFs investing in emerging markets are ▲ ACE Vietnam VN30 (Synthetic) ETF ▲ ACE Vietnam VN30 Futures Bloomberg Leveraged (H) ETF ▲ ACE Indonesia MSCI (Synthetic) ETF.

According to Korea Investment Trust Management, individual investors have net purchased approximately 20.2 billion KRW of the three emerging market ETFs since the beginning of the year. By product, ACE Vietnam VN30 (Synthetic) ETF and ACE Vietnam VN30 Futures Bloomberg Leveraged (H) ETF attracted 17.3 billion KRW and 1.8 billion KRW respectively, while ACE Indonesia MSCI (Synthetic) ETF saw a net purchase of 1.1 billion KRW.

The ACE Vietnam VN30 (Synthetic) ETF is based on the VN30 index, which consists of 30 large-cap stocks with high market representativeness and liquidity listed on the Ho Chi Minh Stock Exchange in Vietnam. The ACE Vietnam VN30 Futures Bloomberg Leveraged (H) ETF is characterized by tracking twice the daily return of the Bloomberg VN30 Futures Index, which is the futures index of VN30.

Additionally, the ACE Indonesia MSCI (Synthetic) ETF is based on the MSCI Indonesia Index, which reflects the performance of stocks listed in Indonesia.

Interest in emerging market ETFs is interpreted as due to the remarkable growth of emerging countries amid the global low-growth trend. Vietnam and Indonesia recorded economic growth rates of 8% (according to the Vietnam General Statistics Office) and 5.3% (according to the Korea Trade-Investment Promotion Agency) respectively last year. According to the Asian Development Bank, Vietnam and Indonesia are expected to achieve economic growth rates of 7.5% and 5.4% this year.

The steady growth of the capital markets in Vietnam and Indonesia is also a factor that increases investment attractiveness. Thanks to the expanded participation of foreigners and domestic investors in stock investment, the capital markets have matured, resulting in the market capitalization of the Vietnam stock market growing significantly from 14 trillion KRW in 2008 to 270 trillion KRW recently. The market capitalization of the Indonesia stock market also expanded from 129 trillion KRW to 756 trillion KRW during the same period.

Nam Yong-su, Head of ETF Management at Korea Investment Trust Management, said, "Vietnam is considered a 'post-China' country, and Indonesia is a 'resource-rich country' based on abundant nickel deposits. Both markets are experiencing rapid growth in their stock markets, and economic growth supported by the activation of foreign investment makes them worthy of investors' attention at this point."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.