Financial Holding Companies and Banks Accumulate 31.5 Trillion KRW in Issuances Over 10 Years

Significant Portion of BIS Tier 1 Capital Ratio

Low Write-off Risk but Refinancing and New Issuance Challenges Expected

Swiss financial authorities have decided to fully write off the 22 trillion won worth of contingent convertible bonds (CoCo bonds) issued by Credit Suisse (CS), prompting domestic financial companies to closely monitor the situation. CoCo bonds are a type of bond but serve as Tier 1 capital alongside common stock. Due to the deteriorating market sentiment, there are growing concerns that refinancing or new issuances may become difficult. Domestic financial holding companies and banks have issued tens of trillions of won worth of CoCo bonds to meet the Basel III international settlement bank capital adequacy ratio (BIS ratio) standards.

Chairman of the CS Medical Association and Chairman of UBS attending a press conference after UBS decided to acquire CS

Chairman of the CS Medical Association and Chairman of UBS attending a press conference after UBS decided to acquire CS [Image source=AP Yonhap News]

According to foreign media on the 22nd, the yield on AT1 bonds issued by European banks surged sharply from the previous 4-6% range to around 15-20%. The rise in yields indicates a plunge in bond prices, which implies an increased risk of principal loss. A bond market insider said, "AT1 bond yields issued mainly by European banks such as Deutsche Bank, HSBC, and Barclays have skyrocketed," adding, "As selling offers (yields) rise, there are signs of a kind of panic selling, and investor sentiment toward AT1 bonds is deteriorating drastically."

AT1 stands for 'Additional Tier 1,' referring to bonds recognized as core capital in addition to common stock or retained earnings. With the application of Basel III, a bank soundness supervision standard, financial holding companies and banks are allowed to issue these as part of their core capital. They are similar to CoCo bonds (Contingent Convertible Bonds) issued by domestic financial holding companies and banks. CoCo bonds are bonds that can be written off or converted into common stock if a financial company faces distress. Domestic financial authorities have set write-off and conversion conditions so that if a specific financial company is designated as a distressed financial institution, CoCo bonds can be written off or converted into common stock.

As investor sentiment toward AT1 bonds turns extremely cold, there are concerns that this could negatively impact the capital adequacy ratios of domestic financial holding companies and banks. According to the domestic Banking Act, banks subject to Basel III must meet standards such as a total capital ratio of 10.5%, a Tier 1 capital ratio of 8.5%, and a common equity tier 1 ratio of 7% or higher. This means that at least 7% of total risk-weighted assets (RWA) must be covered by common stock to provide a loss-absorbing buffer, while the remainder can be met with hybrid capital securities or subordinated bonds. If the sum of common stock (including retained earnings) and AT1 bonds reaches a Tier 1 capital ratio of 8.5% or higher, the bank is considered sound.

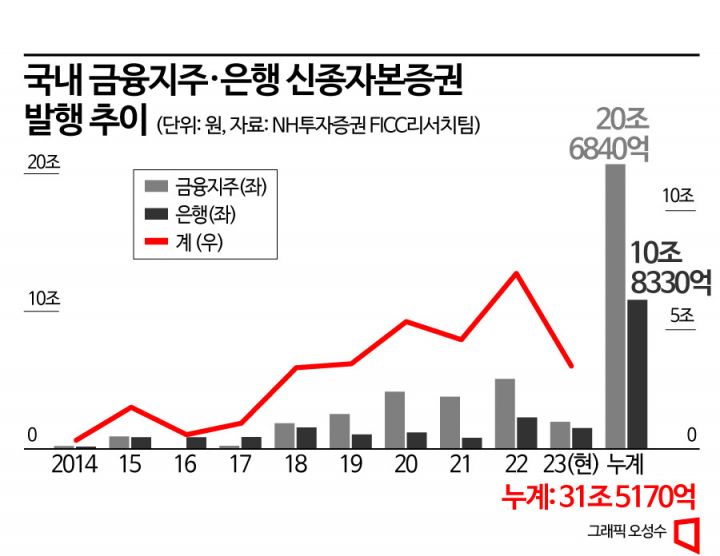

According to NH Investment & Securities, domestic financial holding companies and banks issue several trillion won worth of hybrid capital securities, including CoCo bonds, annually. Until 2017, they issued around 1 trillion won per year on average, then increased to the mid-3 trillion won range for two years starting in 2018, the mid-5 trillion won range for two years starting in 2019, and reached the 7 trillion won range last year, steadily increasing each year. Since 2014, financial holding companies have cumulatively issued hybrid capital securities worth 20.684 trillion won, and banks have issued 10.833 trillion won worth.

Experts believe that the likelihood of hybrid capital securities issued by domestic financial companies being written off or converted into stock is low compared to Europe. An executive from an investment banking (IB) firm said, "Domestic financial authorities strictly control and manage banks' BIS ratios, and unlike European banks with IB characteristics, domestic banks mostly hold household assets, so the possibility of widespread distress at once is low," adding, "The risk of principal loss through write-offs of hybrid capital securities is almost nonexistent."

However, there are concerns that worsening investor sentiment toward hybrid capital securities could make refinancing or new issuances difficult, or cause interest rates to rise significantly even if issued. An IB industry official said, "Although hybrid capital securities issued by domestic financial companies are generally considered relatively safe, it will be difficult to go against the overall market sentiment," and "It will become harder to secure new investment demand, or even if demand is secured, interest rates will rise sharply." Researcher Choi Seong-jong of NH Investment & Securities noted, "Most hybrid capital securities issued by financial holding companies and banks are denominated in Korean won, and investors tend to hold them to maturity, so they are relatively less affected by international financial markets," but also expressed concern that "some foreign currency securities could face supply-demand deterioration and rising interest rates."

Domestic financial holding companies and banks are also closely watching market conditions. They need to refinance (repay and reissue) or newly issue several trillion won worth of hybrid capital securities annually, but market conditions are volatile. A fund manager at a financial holding company said, "Since the CS incident, the trading situation of hybrid capital securities issued by domestic financial companies has not been observed," adding, "After shareholders' meetings, the capital raising costs for financial companies planning to issue hybrid securities could rise significantly, so we are closely monitoring both the Korean won and foreign currency bond markets."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)