Amid continued stagnation in the local housing market and delays in selling existing homes, the apartment occupancy rate fell last month.

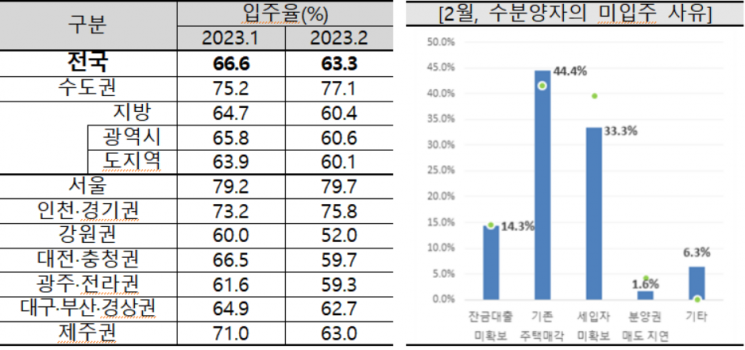

According to a survey conducted on housing developers by the Korea Housing Industry Research Institute on the 21st, the nationwide apartment occupancy rate in February was 63.3%, down 3.3 percentage points from January. By region, the metropolitan area rose from 75.2% to 77.1%, but the five major metropolitan cities fell from 65.8% to 60.6%, and other regions dropped from 63.9% to 60.1%.

Within the metropolitan area, Seoul (79.2→79.7) and Incheon-Gyeonggi area (73.2→75.8) saw occupancy rates increase, but non-metropolitan areas experienced declines: Gangwon region (60.0→52.0), Daejeon-Chungcheong region (66.5→59.7), Gwangju-Jeolla region (61.6→59.3), and Daegu-Busan-Gyeongsang region (64.9→62.7). The Korea Housing Industry Research Institute analyzed, "While housing prices are falling and transactions remain sluggish in most regions nationwide, interest rate cuts and large-scale deregulation have slowed the decline in housing prices and led to a recovery in transaction volumes in popular metropolitan areas. However, the local housing market still appears to be maintaining a stagnant state."

They added, "Due to the recent bankruptcy of the U.S. Silicon Valley Bank (SVB), additional base rate hikes in March, and South Korea’s export slump and expanding economic recession, it will be difficult to escape the stagnation phase for the time being."

Among the causes of non-occupancy, ‘delays in selling existing homes’ rose from 41.7% in the previous month to 44.4%, accounting for the largest cause. In contrast, ‘failure to secure tenants’ (33.3%), ‘failure to secure balance loans’ (14.3%), and ‘delays in selling pre-sale rights’ (1.6%) decreased compared to last month.

Meanwhile, the apartment occupancy outlook index is expected to rise by 8.1 points from 72.1 in February to 80.2 in March. The Korea Housing Industry Research Institute forecasted, "This appears to be due to optimistic expectations about housing market soft-landing measures such as the full lifting of regulated areas, easing of resale restrictions, relaxation of regulations on multiple homeowners, easing of loan regulations for the homeless, and announcements of real estate-related tax relief plans."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)