Opaque National Treasury Support, Difficulties in Preparing Medical Fee Negotiations

Government "5-Year Temporary Extension" vs Opposition "Permanentization"

"Without National Treasury Support, Insurance Premiums Rise from 7% to 17%"

The government and the National Assembly have failed to resolve the issue of national treasury support for health insurance in a timely manner, increasing confusion among officials preparing for medical fee negotiations. Negotiations must be prepared according to the annual budget, but the decision on whether to provide national treasury support has not yet been made. Since medical fees also affect health insurance premiums, voices are calling for the political sphere to promptly resolve the situation.

According to a comprehensive report by Asia Economy on the 21st, the National Health Insurance Service (NHIS) recently began preparations for medical fee negotiations. Medical fees refer to the insurance payments borne by the NHIS and patients according to medical services. Typically, discussions between the NHIS and medical provider organizations start in April, with main negotiations taking place in May, but strategies are formulated and stakeholders contacted starting from March. Depending on the negotiations, the insurance premiums paid by the public and the prices of medical services vary.

The NHIS side admits that preparations for this year’s medical fee negotiations are facing difficulties. This is because the future of the national treasury support for health insurance, which ended at the end of last year, remains uncertain. An NHIS official said, “Accurate prediction of the annual budget is necessary for smooth medical fee negotiations, but the national treasury support has not yet been decided,” adding, “We are also considering the worst-case scenario where a decision is not made until next month.” Lee Sang-il, NHIS Executive Director of Benefits, also said on the 8th, “It seems this year’s fee negotiations will be much more difficult than last year’s.”

The unresolved issue of national treasury support stems from differences in views between the government and opposition parties. The Ministry of Economy and Finance, responsible for fiscal affairs, and the Ministry of Health and Welfare, the NHIS’s supervising ministry, have agreed to extend the national treasury support for five years on a temporary basis. Since the national treasury support itself has been provided temporarily since 2007, the intention is to continue it under a sunset clause first and continue discussions later. They also believe the rule of supporting 20% of the expected health insurance revenue from the treasury should be maintained.

"Without national treasury support, maintaining coverage would require insurance premiums to rise from 7% to 17%"

On the other hand, the Democratic Party of Korea advocates abolishing the sunset clause and making national treasury support permanent. Although the government has maintained the principle of 20% national treasury support, it has actually reduced the amount of support provided. This was justified by the claim that the NHIS’s expected revenue was underestimated. In response, Democratic Party lawmakers on the Health and Welfare Committee held a press conference at the end of last year urging, “The government and ruling party should actively participate in discussions to abolish the sunset clause.”

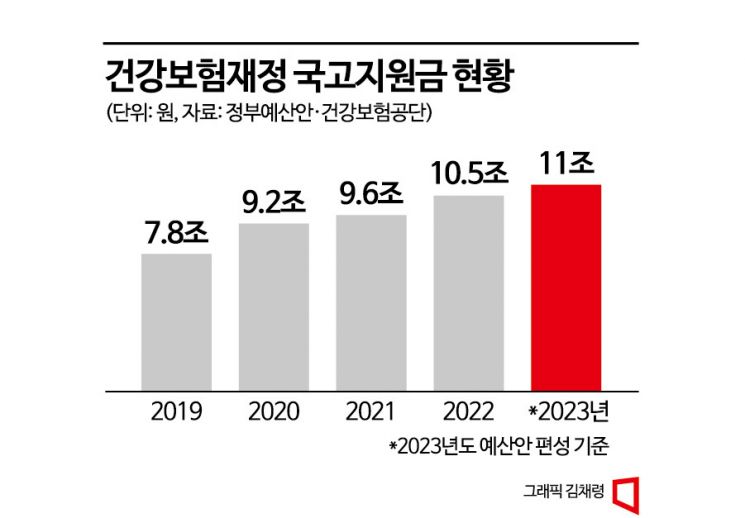

The government holds the position that it is difficult to mandate or increase the amount of national treasury support due to the potential increase in fiscal burden. The national treasury support funds allocated to health insurance finances by the government amount to 11 trillion won this year. This has been increasing annually from 9.2 trillion won in 2020 to 9.6 trillion won in 2021 and 10.5 trillion won in 2022. A related government official explained, “If the government starts covering more costs, other areas will suffer deficits,” adding, “It is difficult to accept mandating national treasury support for health insurance by law.”

Recently, the Organization for Economic Cooperation and Development (OECD) raised questions about Korea’s national treasury support for health insurance, further complicating the issue. On the 8th, the OECD held a bilateral meeting with the Ministry of Economy and Finance in Paris, France, to discuss the matter. The OECD analyzed, “It is very unusual that the government cannot monitor insurance expenditures at all and has no means to determine the rate of expenditure increase, yet automatically injects budget into health insurance finances.” They also advised that Korea should manage the national treasury support as a fund, as other OECD countries do, rather than just accounting for it.

The NHIS labor union points out that if national treasury support is not provided, health insurance premiums will inevitably rise. They warn that insurance benefits may be reduced or the insurance premium rate paid by patients may increase during the negotiation process. The union claims that to maintain the current coverage without national treasury support, the health insurance premium rate, currently at 7.09%, would need to be raised by about 10 percentage points to 17.6%.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)