Issuing 110 Billion KRW CP at 4% Interest in March

Deficit Due to Acquisition Financing Burden... Decline in Debt Repayment Ability

Hoping New Releases Like 'Modoo Marble 2' Become a Breakthrough

Netmarble has started increasing short-term borrowings due to the burden of debt accumulated from large-scale mergers and acquisitions (M&A) and worsening earnings. Recently, the company has been issuing commercial papers (CP) consecutively, indicating a growing reliance on short-term debt. The lack of visible improvement in performance despite successive M&As aimed at diversifying its revenue structure is also contributing to the financial burden.

According to the bond market on the 21st, Netmarble has recently increased CP issuance. On the 10th, the company issued CP worth 70 billion KRW for the first time since its establishment, followed by an additional 40 billion KRW raised from the CP market on the 17th. As a result, Netmarble's CP balance rose to 110 billion KRW. The maturity of the issued CP is one year, with interest rates in the low to mid-4% range. The credit rating was assigned as A2+. KB Securities reportedly underwrote all Netmarble CPs as discount bonds with interest paid upfront and then sold them to institutional investors.

The reason Netmarble has recently increased CP issuance is interpreted as the company not having escaped the aftermath of large-scale M&A and experiencing deteriorating profitability. In 2021, Netmarble acquired 100% of the shares of Leonardo Interactive Holdings, the holding company of SpinX, for 2.513 trillion KRW. At that time, to reduce the burden of the acquisition payment, Netmarble consecutively sold its stakes in Kakao affiliates. It sold all shares in Kakao Games and Kakao Bank in four rounds for a total of 1.282 trillion KRW.

However, since the price of SpinX was high at the mid-2 trillion KRW range, an increase in borrowings was inevitable. To pay the acquisition price, Netmarble raised 1.834 trillion KRW through short-term borrowings from KEB Hana Bank, providing SpinX and NCSoft shares as collateral. Previously, in 2019, Netmarble also borrowed 550 billion KRW from financial institutions when acquiring Coway.

In this process, financial indicators deteriorated significantly. Borrowings surged from 266.6 billion KRW at the end of 2019 to 2.5179 trillion KRW as of the end of the third quarter last year, increasing about tenfold. Although the company pursued diversification of sales channels through successive M&As, it did not lead to improved profitability. Last year, EBITDA continued to decline for the second consecutive year, and operating cash flow (OCF) turned into a large deficit (-).

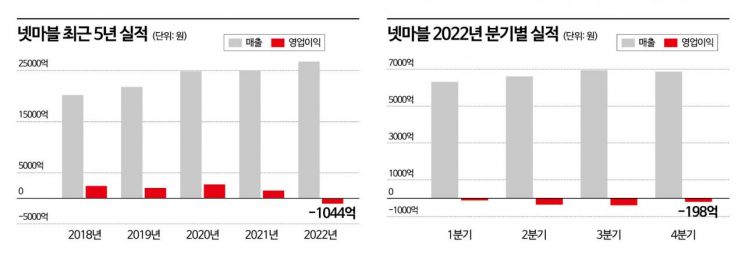

Netmarble’s operating profit was stable at the 200 billion KRW level, recording 241.6 billion KRW in 2018, 202.6 billion KRW in 2019, and 272 billion KRW in 2020. However, in 2021, operating profit decreased to 151 billion KRW, and by the end of the third quarter last year, it turned into a loss of 84.6 billion KRW. The dominant view is that the chronic issue of lacking proprietary intellectual property (IP) has led to poor profitability.

A credit rating agency official said, "Most of Netmarble’s main games utilize external IP, so compared to other game companies with profit margins around 10%, Netmarble shows lower operating profit margins," adding, "Despite undertaking M&As to diversify the revenue structure while bearing financial burdens, it has not led to overall profitability improvement."

Because of this, the company’s ability to repay borrowings has also deteriorated. As of the end of September last year, consolidated net borrowings (borrowings minus cash equivalents) increased to 1.6394 trillion KRW. With profitability declining last year, the net borrowings to EBITDA ratio (net borrowings/EBITDA) rose to 14 times, compared to below 3 times in 2021. The stock price also continued to fall. While it once exceeded 200,000 KRW in 2020, it has recently been trading between 50,000 and 60,000 KRW.

With recent interest rate hikes, Netmarble’s burden of refinancing existing borrowings and interest payments is expected to increase further. An investment banking (IB) industry official analyzed, "Before the large-scale M&A, Netmarble was able to issue long-term corporate bonds at mid-1% levels," adding, "The deterioration of the financial structure along with recent interest rate hikes is becoming a burden for refinancing acquisition financing and raising operating funds."

The improvement of the financial situation is expected to hinge on the success of new releases. Lee Hyo-jin, a researcher at Meritz Securities, said, "Netmarble is making efforts to improve financial figures, including publicly stating that it will not increase personnel this year," and added, "Several new titles such as Everyone’s Marble 2, Arthdal Chronicles, and Solo Leveling are scheduled for release this year, so profitability improvement can be expected."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.