The European Union (EU) recently announced a draft of the so-called 'European version of the IRA (Inflation Reduction Act)' to strengthen supply chain stability within Europe, prompting the domestic industry to seek countermeasures. The core of the draft released by the EU is to expand the processing ratio within the EU for items with high dependence on imports from China. However, it includes some provisions that the domestic battery and automotive industries are sensitive to, such as supply chain audits. The government plans to continue consultations with EU authorities to minimize the burden on Korean companies operating locally by collecting opinions from related industries.

According to government sources on the 21st, the Ministry of Trade, Industry and Energy will discuss countermeasures against the EU's Critical Raw Materials Act (CRMA) and Carbon Neutral Industry Act with the domestic battery and automotive industries on the 22nd at the Korea Chamber of Commerce and Industry in Seoul. The ministry previously assessed that the CRMA does not contain discriminatory provisions unlike the U.S. Inflation Reduction Act (IRA), but related industries believe there are provisions that require response. Representatives from the three major Korean battery companies operating in the EU?Samsung SDI, LG Energy Solution, and SK On?as well as key related companies such as Hyundai Motor Company, are expected to attend the meeting.

EU Commission Raises Concerns Over Supply Chain 'Audits' of Large Corporations Operating Locally

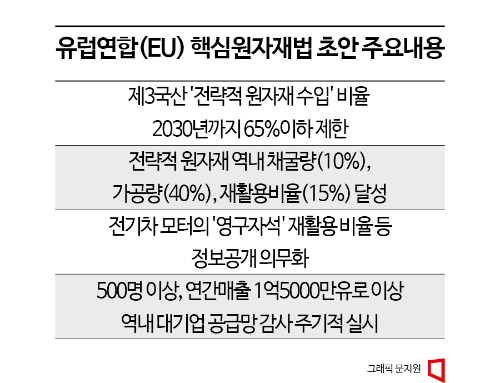

The CRMA announced by the EU Commission on the 16th (local time) aims to restrict the import of more than 65% of the EU's consumption of 'strategic raw materials' from specific third countries by 2030. The strategic raw materials defined by the EU Commission include 16 items such as battery-grade nickel, natural graphite, manganese, lithium, and rare earth elements for permanent magnets. Most of these items have a 90% dependence on China within the EU. This is why the CRMA is regarded as legislation targeting China. Additionally, the act includes provisions aiming for 10% of raw material consumption to be mined within the EU, 40% processed, and 15% recycled by 2030, but it is analyzed that these provisions are not discriminatory against specific countries such as Korea.

The aspect that the domestic battery industry is particularly concerned about is the provision for periodic audits of the supply chains of large corporations operating locally. According to the CRMA draft, supply chain audits will be conducted periodically for large corporations within the EU with more than 500 employees and annual sales exceeding 150 million euros. This sales scale, approximately 210 billion KRW, means that the three Korean battery companies operating in Poland, Hungary, and other countries are highly likely to be subject to these regulations. The issue is that the main production product of the three companies, NCM (Nickel-Cobalt-Manganese) batteries, uses lithium hydroxide as a key raw material, which has a 90% dependence on China. Diversifying the supply chain to reduce dependence on Chinese lithium hydroxide has thus emerged as a critical issue. An industry insider who requested anonymity said, "China accounts for 60% of the world's lithium hydroxide refining capacity, so dependence on China is very high," adding, "According to the EU raw materials law draft, the key will be how quickly and how much the Chinese share can be reduced by 2030."

The obligation to disclose information such as the recycling rate of 'permanent magnets' is also a burden for the domestic industry. Permanent magnets are core components used in motors for electric vehicles as well as wind turbines, and the disclosure of sensitive information about these products raises concerns about technology leakage for companies like Hyundai Motor Company. This is because companies may be required to disclose detailed information to determine not only the proportion of permanent magnets but also whether they can be separated and recycled.

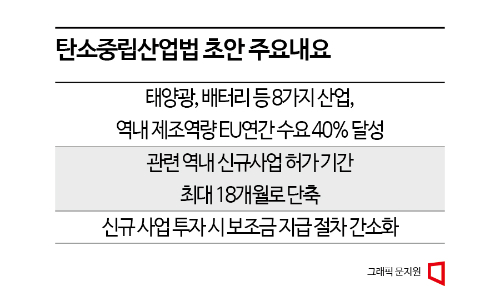

The Carbon Neutral Industry Act released by the EU is likely to benefit the domestic battery industry operating locally. According to the draft, companies with battery production facilities in Europe can receive incentives to expand manufacturing capacity of eight carbon-neutral strategic industries?including solar power, batteries, and carbon capture and storage?to 40% of the EU's annual demand by 2030.

The government believes that since the draft is expected to undergo about a year of discussions and possible revisions before becoming law, it will respond by assessing both disadvantages and benefits for companies. A government official explained, "Through the consultation meeting, we will collect opinions on information disclosure provisions and other concerns raised by the domestic related industries and conduct multifaceted discussions with the EU Commission to ensure that our companies do not suffer any damage."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![User Who Sold Erroneously Deposited Bitcoins to Repay Debt and Fund Entertainment... What Did the Supreme Court Decide in 2021? [Legal Issue Check]](https://cwcontent.asiae.co.kr/asiaresize/183/2026020910431234020_1770601391.png)