"Group Affiliate CEOs' Top Concern: Stock Prices"

SK Inc. Hits 52-Week Low... Affiliate Stocks Also Weak

CEOs Communicate Directly with Shareholders About Business

"Semiconductor and Secondary Battery Business Normalization is Key"

"The chairman is very concerned about the stock price."

A recent SK Group executive I met frequently checked the SK stock price on his mobile phone. Another SK Group official I saw at a different meal said, "These days, the biggest concern for the heads of group affiliates is the stock price." Yu Young-sang, president of SK Telecom, also revealed in an internal interview last September that his current concern is raising the undervalued corporate value. At that time, he said, "I am also an SK Telecom shareholder," and "I also check the stock price every day."

Choi Tae-won, chairman of SK Group, has emphasized the need to pay special attention to stock price management whenever he meets with affiliate CEOs. It is known that he reprimanded poor stock performance at the expanded management meeting in June last year and instructed at the CEO seminar in September of the same year to prepare measures to boost the stock price for each affiliate. He believes that SK㈜ and the group affiliates' corporate values are not properly evaluated by the market. However, CEOs are frustrated by the stock prices that hardly rise.

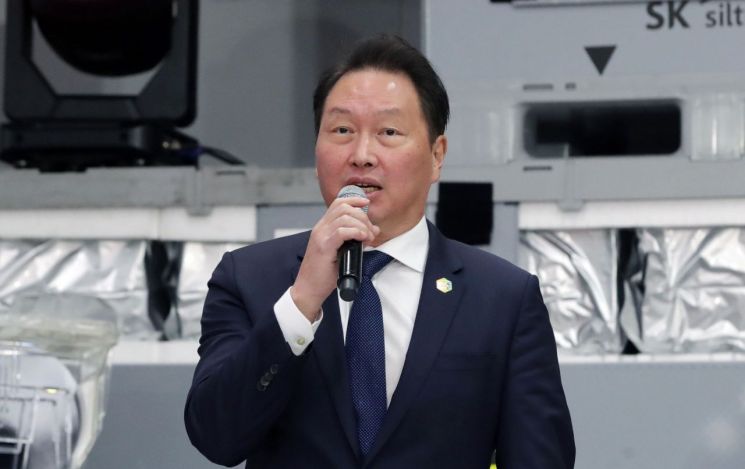

SK Group Chairman Chey Tae-won attended the semiconductor wafer expansion investment agreement ceremony held on the 1st of last month at SK Siltron in Gumi, Gyeongsangbuk-do, and gave a response speech after President Yoon Suk-yeol's encouragement speech.

SK Group Chairman Chey Tae-won attended the semiconductor wafer expansion investment agreement ceremony held on the 1st of last month at SK Siltron in Gumi, Gyeongsangbuk-do, and gave a response speech after President Yoon Suk-yeol's encouragement speech. Photo by Presidential Office Press Photographers Group

[Image source=Yonhap News]

The stock price of SK㈜, SK Group's investment holding company, hit a 52-week low of 162,300 won again during trading on the 16th. This is a 40% (about 100,000 won) drop compared to the highest price in the past year. It is four times the KOSPI decline rate (11%). This year, while the KOSPI has risen 6.8% up to that day, SK㈜ stock price fell 12.3%.

The stock prices of major affiliates are mostly weak, though to varying degrees. SK Innovation, the energy intermediate holding company, which rose to 246,000 won (June 9 last year) in the past year, fell to the 160,000 won range as of the 17th, and SKC, the chemical and materials intermediate holding company, dropped from the 160,000 won range to the 90,000 won range during the same period. SK Hynix, ranked third in KOSPI market capitalization, fell from the 120,000 won range to the 70,000 won range, and SK Telecom dropped from the 60,000 won range to the 40,000 won range. SK Square, an investment company spun off from SK Telecom, approached 60,000 won but is currently in the 30,000 won range.

CEOs of SK Group's key affiliates devoted themselves to studying stock price management throughout last year. They even invited market experts to their companies for lectures. A business insider said, "Chairman Choi decided to increase the weight of stock price evaluation in CEO management evaluation (KPI) from the existing 30% to at least 50%, so SK Group CEOs studied intensively to have their corporate values properly evaluated by the market." The impact of Chairman Choi's demand at the 'CEO seminars' in 2020 and 2022 for CEOs to voluntarily prove corporate value to the market was significant.

As a stock price boosting measure, SK Group first started buying back and canceling treasury shares. SK㈜ announced in August last year the purchase and complete cancellation of treasury shares worth 200 billion won. SK㈜ terminated the 'trust contract for acquiring treasury shares' entrusted to SK Securities on the 2nd of this month and plans to cancel the shares within this month. Earlier, at the regular general meeting of shareholders in March last year, SK Group announced that it would buy back treasury shares equivalent to 1% of market capitalization by 2025 to enhance corporate value. The year 2025 is when SK㈜ Vice Chairman Jang Dong-hyun set the goal of "opening the era of 2 million won stock price."

SKC also announced in October last year that it would acquire treasury shares by January this year and completed the purchase of 1.89 million shares (about 197 billion won), equivalent to 5% of issued shares, a month ahead of the schedule set on December 20 last year. SK Telecom also stated on the earnings conference call on the 8th of last month that it would consider buying back treasury shares.

Dividend policies have also been strengthened. SK Innovation decided on a stock dividend of 0.033 treasury shares per common and preferred share, which is three times the level of 2021, as a year-end dividend last year, and plans to get approval at the general meeting of shareholders. SK Innovation is so determined to boost the stock price that it even includes stock price trends when calculating performance bonuses.

Also, CEOs of SK Innovation affiliates are directly promoting corporate value to the market by sharing business vision and management goals through internal media channel interviews.

Choi Nam-gon, a researcher at Yuanta Securities, said, "In the case of SK㈜, market concerns about the holding company managing the affiliate portfolio are reflected in the stock price," adding, "The semiconductor market is not favorable, and there are no results in secondary batteries." SK Hynix posted an operating loss of about 1.9 trillion won in the fourth quarter of last year due to weak semiconductor demand. The securities industry expects a loss of 3 to 4 trillion won in the first quarter of this year. SK On recorded an operating loss of 1.0726 trillion won last year.

He continued, "In the context of rising interest rates, SK Group's borrowing scale is relatively larger than other groups, which is also a concern for the market," and said, "Since the causes of the stock price decline are concerns about the business, how quickly the core businesses return to normal is important." SK Hynix played a leading role in SK Group's performance during the semiconductor boom. At the same time, group affiliates used SK Hynix as a treasury when making large-scale investments. SK Group's dependence on SK Hynix has become too high. When SK Hynix caught the flu, the entire group started to suffer."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)