Japan Export Share 4.9% → 4.5%

Steel, Petroleum Products, Home Appliances Expected to Benefit Industry

Analysis shows that if South Korea's export volume is restored to the level before the deterioration of Korea-Japan relations, it could increase by $2.69 billion annually (approximately 3.5225 trillion KRW).

The Korea Chamber of Commerce and Industry's SGI (Sustainable Growth Initiative) stated that Japan's share of South Korea's total exports decreased by 0.4 percentage points from an average of 4.9% in 2017-2018, before the deterioration of relations, to 4.5% in 2022. SGI further analyzed that if South Korea's export structure is restored to the 2017-18 level through improvements in Korea-Japan relations, domestic export volume could increase by about $2.69 billion.

SGI said, "The expected export increase effect of $2.69 billion from improved Korea-Japan relations corresponds to a 0.43 percentage point upward factor in the domestic export growth rate," and "using input-output analysis to calculate the impact of increased exports to Japan on South Korea's gross domestic product (GDP), the economic growth rate is predicted to rise by 0.1 percentage points."

While major economic forecasting institutions predict this year's domestic economic growth rate to be in the mid-to-high 1% range and the number of new jobs to decrease to one-tenth of last year's figure, improvements in relations with Japan are expected to be a hopeful factor for the domestic economy alongside China's reopening and Middle East demand driven by expanded exports of nuclear power and defense products.

Industries such as Steel, Petroleum Products, Home Appliances, and Auto Parts, Which Saw Significant Declines in Export Share to Japan After Korea-Japan Relations Deteriorated, Expected to Benefit

SGI analyzed the impact on South Korea's exports to Japan for 13 major export items by comparing the period before the deterioration of relations (2017-2018) with the current situation through a regional and product matrix analysis.

The results showed that industries with the highest export share to Japan?steel, petroleum products, home appliances, and auto parts?were significantly affected by the deterioration of Korea-Japan relations.

Specifically, South Korea's steel industry's export share to Japan decreased from an average of 11.7% in 2017-2018 to 10.4% in 2022 (a decline of 1.3 percentage points). Petroleum products dropped from 10.0% to 8.2% (down 1.8 percentage points), home appliances from 7.7% to 6.4% (down 1.3 percentage points), and auto parts from 4.0% to 2.2% (down 1.8 percentage points).

SGI stated, "If exports in industries that were heavily impacted by the deterioration of Korea-Japan relations recover their previous export shares to Japan, it is expected to help reverse the export growth rate, which sharply fell by 12.1% year-on-year in January-February this year."

Meanwhile, SGI evaluated that improvements in Korea-Japan relations would also aid Japan's economic recovery. Japan pursued Abenomics, which focused on quantitative easing, fiscal expansion, and economic stimulus to escape the 'lost 30 years,' but Japan's economic growth rate averaged -0.5% annually from 2019 to 2022.

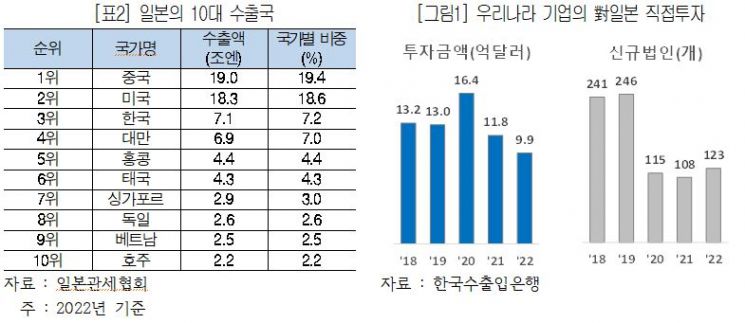

Japan continues its export expansion policy through a weak yen to overcome low growth. Looking at Japan's regional export volume in 2022, South Korea ranked as the third-largest export market with 7.1 trillion yen (approximately 70.4298 trillion KRW), following China (19.0 trillion yen, about 188 trillion KRW) and the United States (18.3 trillion yen, about 181.5305 trillion KRW).

Not only exports but also increased investment by South Korean companies in Japan is expected to help the Japanese economy. Investment by domestic companies in Japan decreased from $1.32 billion in 2018, before the deterioration of Korea-Japan relations, to $990 million in 2022, and the number of new corporations dropped from 241 to 123 during the same period.

Maximizing Effects: ① Strengthening Korea-Japan Trade Cooperation ② Enhancing Predictability of Relations ③ Utilizing Financial Tools such as Korea-Japan Currency Swap

SGI stated, "Improving Korea-Japan relations benefits both economies," and emphasized the need to consider ways to maximize effects in trade and investment after normalization of relations.

First, the necessity of strengthening trade cooperation with Japan was highlighted. Kim Cheon-gu, a research fellow at the Korea Chamber of Commerce and Industry SGI, advised, "Domestic companies caught in the US-China hegemonic competition should pursue stable supply chain establishment, sustainable export market securing, and cooperation with countries of similar positions," adding, "With the improvement of Korea-Japan relations, it is necessary to strengthen semiconductor collaboration activities between South Korea, which has strengths in memory semiconductors, and Japan, which has world-class competitiveness in materials and equipment."

Second, SGI called for enhancing the predictability of Korea-Japan relations. SGI said, "Recent conflicts between Korea and Japan are cases where political and diplomatic issues have spilled over into economic problems," and emphasized that "future economic cooperation between the two countries should be carried out independently of political issues, sharing the perception that political uncertainties should be resolved so that corporate investment and technological cooperation can be actively pursued."

Lastly, SGI mentioned promoting domestic financial stability through improved bilateral relations. Min Kyung-hee, an SGI research fellow, said, "Recent banking crises in the US and Europe, such as Silicon Valley Bank and Credit Suisse, could lead to instability in the domestic foreign exchange market," and stressed, "In the current atmosphere of Korea-Japan economic cooperation, it is necessary to reactivate the Korea-Japan currency swap, which was suspended after 2015, to promote financial stability."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.