First Time Since September Last Year: Forced Sales Exceed 30 Billion Won

Consignment Trading Receivables Also Hit Six-Month High

As volatility in the domestic stock market increases due to the Silicon Valley Bank (SVB) bankruptcy and concerns over Credit Suisse (CS) financial soundness, the fear of 'forced liquidation' is becoming a reality. Individual investors who engaged in so-called 'debt investing' (borrowing to invest) are taking a direct hit. It is analyzed that the significant rise in individual investors borrowing to invest is largely due to stock prices rising mainly in fundamentally unstable theme stocks, combined with securities firms slightly lowering margin loan interest rates under pressure from the Financial Supervisory Service.

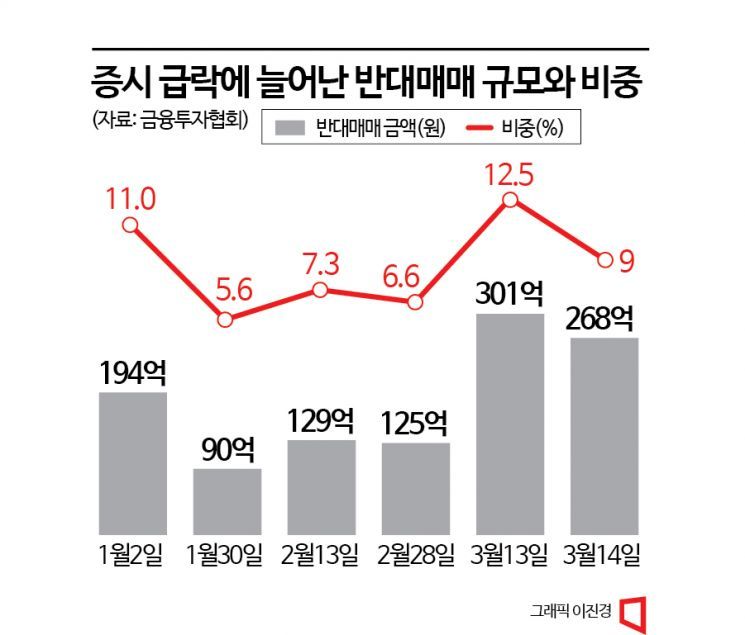

According to the Korea Financial Investment Association on the 17th, as of the 13th, the actual amount of forced liquidation compared to unsettled margin trading debt was 30.1 billion KRW. The scale of forced liquidation exceeding 30 billion KRW is the first since September 30 last year (32.4 billion KRW). Although it slightly decreased to 26.8 billion KRW on the 14th, it remains at a level similar to September last year when debt investing was at its peak. Forced liquidation refers to the compulsory disposal by securities firms of stocks pledged as collateral when investors fail to repay loans by the due date or when the stock valuation falls below a certain level (usually when the value of the pledged stocks falls below 140% of the loan amount).

The surge in forced liquidation occurred as debt investing increased while stock prices declined. Typically, debt investing bets on a rising stock market, but the unexpected SVB and CS incidents created sudden variables, increasing volatility in the domestic stock market and creating unfavorable conditions for debt-investing retail investors. In particular, the domestic stock market's rise this year was partly driven by fundamentally unstable theme stocks, raising ongoing concerns that even small shocks could trigger a flood of forced liquidations.

The risk of forced liquidation also grew as securities firms lowered margin loan interest rates under pressure from financial authorities, reducing the borrowing burden and encouraging more individual investors to engage in debt investing. Kiwoom Securities cut rates by up to 2.1 percentage points. Shinhan Investment Corp. lowered the shortest-term (7 days or less) interest rate from 5.05% to 3.9% per annum. Additionally, over the past month, a total of nine securities firms, including Samsung Securities, Mirae Asset Securities, KB Securities, and Korea Investment & Securities, have reduced their margin trading interest rates.

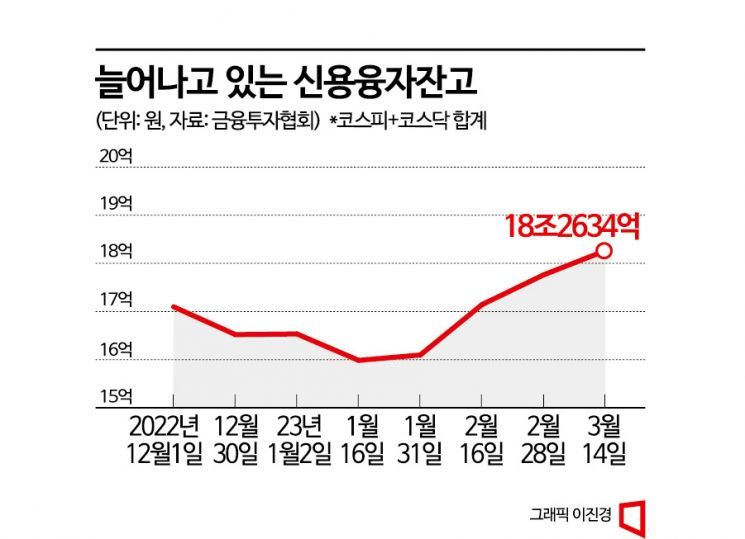

The outstanding balance of margin loans (as of the 15th) stood at 18.0947 trillion KRW (KOSPI + KOSDAQ). Although it slightly decreased compared to the 18.3477 trillion KRW on the 13th and 18.2634 trillion KRW on the 14th, the balance rising above 18 trillion KRW is the first time in six months since August last year, and it represents about a 7% increase compared to a month ago (17.1423 trillion KRW on February 16).

The outstanding balance of margin loans, which indicates the scale of individual investors' 'debt investing,' is the stock purchase funds lent by securities firms using held stocks as collateral. When investors who bought stocks on margin fail to maintain the collateral maintenance ratio, stocks are forcibly sold to cover the difference.

The expected scale of forced liquidation to come is also significant. As of the 15th, unsettled margin trading debt that could lead to forced liquidation was 208.5 billion KRW. Although this is somewhat lower than the highest level in six months recorded on the 13th (296.6 billion KRW), it remains high compared to January (144.5 billion KRW as of the 11th). Unsettled margin trading debt refers to short-term transactions where securities firms pay the settlement amount on behalf of investors for up to three trading days when there is insufficient stock settlement funds. If the money is not repaid within the period, the stocks are subject to forced liquidation.

In the securities industry, it is advised that engaging in debt investing amid growing uncertainty and downward pressure on the stock market ahead of the U.S. Federal Open Market Committee (FOMC) meeting is risky. Jae-hyuk Han, a researcher at Hana Securities, said, "Given the rapidly rising exchange rate since February and the weakened foreign demand that was explosive in January, the stock market is more likely to tilt downward than upward. The high margin loan balance is also a factor that could increase volatility in a market with short-term funds and high volatility." Dae-jun Kim, a researcher at Korea Investment & Securities, added, "If a large volume of forced liquidation occurs, there is a greater possibility of further stock price declines. Under the current circumstances, macroeconomic issues such as the direction of the U.S. Federal Reserve's benchmark interest rate have a greater impact on the overall stock market, so it is necessary to observe the situation more closely."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)