Q1 Expected Deficit of 4 Trillion Won...Inevitable Increase in Borrowings

Corporate Bond Issuance Rates Also Expected to Rise Due to Credit Rating Deterioration

SK Hynix is facing increasing debt burdens due to deteriorating earnings, with a large-scale deficit expected in the first half of this year. Operating cash flow (OCF) has significantly decreased, forcing the company to increase external borrowing. Moreover, credit rating deterioration has led to rising corporate bond market interest rates, further increasing interest expenses.

According to the bond market on the 17th, the yield on corporate bonds issued by SK Hynix is on an upward trend. Recently issued SK Hynix corporate bonds are trading at yields 20bp (1bp=0.01 percentage points) to 80bp higher than the private bond rating agencies' average yields (minpyeong yields). This contrasts with earlier in the year when bonds traded below the average yields. Actual trading yields by maturity are formed at levels ranging from the high 3% range to the high 4% range.

A bond market official stated, "Following the Legoland incident last year, government bond yields and credit spreads surged but stabilized continuously until the first quarter of this year," adding, "In SK Hynix's case, the trading yields of corporate bonds in the secondary market have started to rise again recently." This is because SK Hynix is expected to record a large-scale deficit in the first quarter of this year. Daishin Securities recently forecast in a report that SK Hynix will record an operating loss of 4.2 trillion KRW in the first quarter. They also expect the operating loss to narrow to 2.9 trillion KRW in the second quarter. The estimated operating deficit for the first half of the year is about 7 trillion KRW.

In this regard, the investment banking (IB) industry expects SK Hynix's operating cash flow this year to decrease significantly compared to previous years, leading to a sharp increase in borrowings. Due to debt maturities and operational funding burdens, external funding demand is expected to grow. Even though capital expenditures (Capex) may decrease due to production cuts, the basic investment amount that must be executed is still considerable.

Even if SK Hynix reduces investment due to production cuts, an increase in external borrowing is inevitable. Daishin Securities projects that SK Hynix's capital expenditures this year will decrease by 58% compared to last year, totaling 8 trillion KRW. Analyst Wi Minbok of Daishin Securities analyzed, "Although SK Hynix successfully raised funds through corporate bonds at the beginning of the year, cash assets will be constrained because it plans to execute investments exceeding 9 trillion KRW next year."

SK Hynix's borrowings increased significantly amid deteriorating performance last year. As of the end of last year, net borrowings stood at 16.6 trillion KRW, about a 60% increase from 10.5 trillion KRW a year earlier. With the worsening performance this year, the trend of increasing borrowings is expected to be unavoidable.

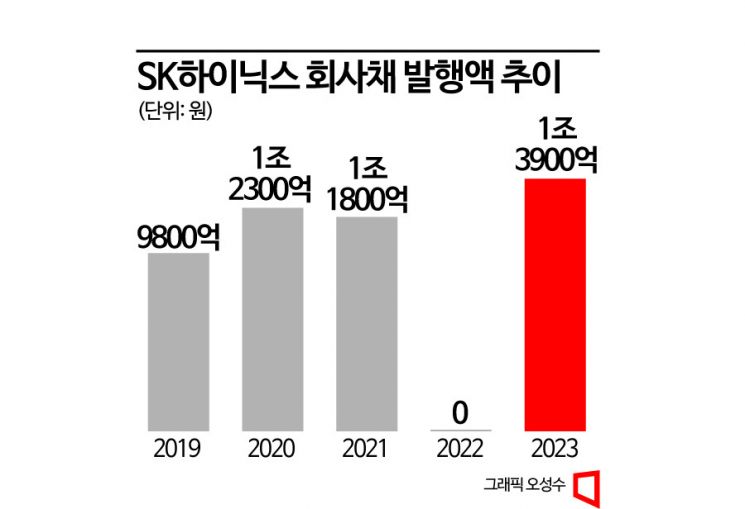

In fact, SK Hynix has significantly increased corporate bond issuance since the beginning of this year. As of March this year, SK Hynix has issued corporate bonds totaling 1.39 trillion KRW. This is the largest amount of corporate bonds ever issued by SK Hynix and the highest among domestic large conglomerate affiliates as a single company. It accounts for 27% of the total corporate bonds issued by SK Group affiliates this year.

SK Hynix did not issue corporate bonds last year. In 2021, it issued 1.18 trillion KRW worth of bonds. It had issued about 1 trillion KRW in corporate bonds annually on average, but this year’s issuance has already far exceeded the average annual issuance before the first quarter ended. An IB industry official said, "Deficits have continued since the fourth quarter of last year, and there are limits to reducing investments," adding, "With a loss exceeding 4 trillion KRW in the first quarter, borrowing to repay debts and secure operating funds will continue."

Interest expenses on borrowings are also expected to increase. A bond market official said, "As SK Hynix records large-scale deficits, corporate bond yields are rising," and "As cumulative deficits expand, SK Hynix’s credit rating will deteriorate, making it highly likely that corporate bond issuance yields will also rise."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.