[Advanced Industry Promotion] Global No.1 and Domestic 60GWh Production Presented

Battery Top 3 Plan 873GWh Global Factories in 3 Years

Conditions and Environment for Domestic Factory Establishment Still Insufficient

Motivation Needed for Industrial Ecosystem and Domestic Jobs

Although the government has presented a blueprint for fostering next-generation advanced industries such as batteries, domestic battery companies are expected to produce more than 90% of their total output overseas by 2025. The scale of domestic production is projected to be only about 6.7% of the total. While the United States and Europe are competing to offer massive subsidies and tax benefits, South Korea still has not provided sufficient incentives and conditions to build large-scale production plants.

On the 15th, the government discussed a national strategy to strengthen competitiveness in advanced industries at the 14th Emergency Economic and Livelihood Meeting. In the battery sector, the goal was set to become the global number one by 2030, with plans to build a 60GWh-scale factory domestically. To achieve this, 5.3 trillion won in policy financing will be invested this year through long-term, low-interest loans and guarantees, and a private fund will be operated to invest in strong battery companies. Additionally, to secure 'super-gap' technologies such as solid-state batteries, the government aims to invest a total of 20 trillion won from both public and private sectors by 2030.

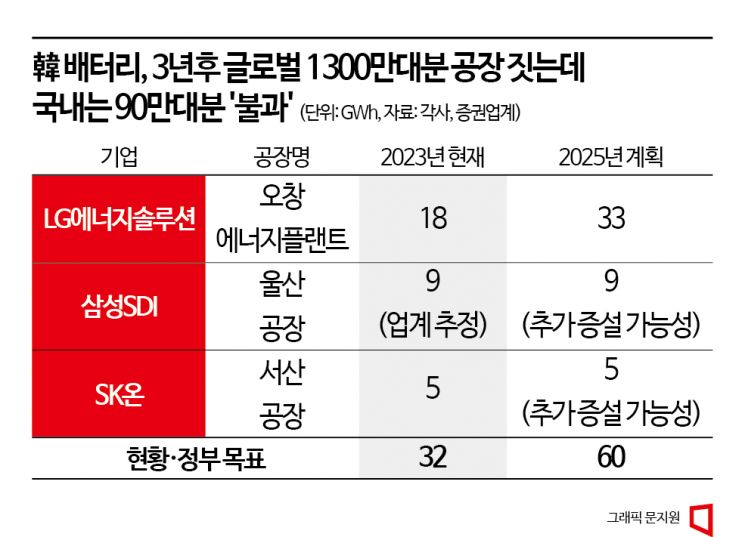

Currently, the domestic battery production capacity is 32GWh. LG Energy Solution is operating the 18GWh-scale 'Ochang Energy Plant' in Cheongju, Chungbuk, which it calls the 'Mother Factory' (a factory that serves as the center for product development and manufacturing). This plant is expected to expand to 33GWh after 2025. Samsung SDI operates a factory estimated at 9GWh in Ulsan, and SK On runs a 5GWh-scale factory in Seosan, Chungnam. All three battery companies consider Korea as their R&D hub and are pursuing the 'Mother Factory' strategy, making additional factory expansions highly likely.

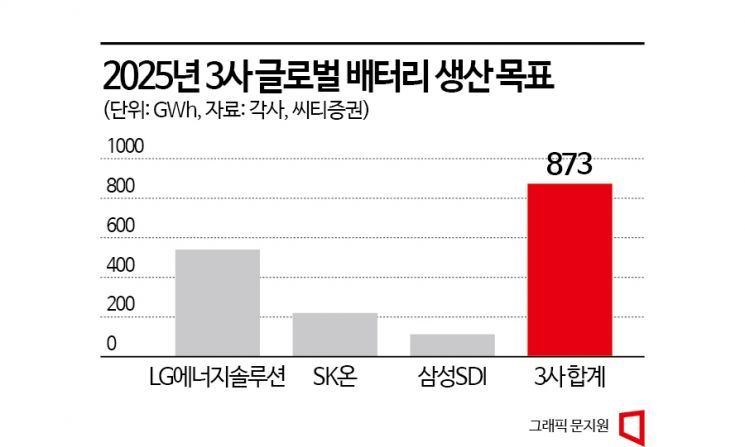

The government’s proposed domestic battery production scale of 60GWh seems achievable. However, it is a modest figure compared to the combined global production target of 873GWh set by the three domestic battery companies for 2025. LG Energy Solution is expected to produce 540GWh, SK On 220GWh, and Samsung SDI 113GWh (according to estimates by Citi Securities). Considering that 1GWh of battery capacity can produce 15,000 electric vehicles, this corresponds to production capacity for 13 million electric vehicles. The 60GWh domestic target equates to 900,000 vehicles. Even if the battery industry progresses according to the government’s plan, 93.3% of batteries produced by domestic companies will be manufactured overseas.

Batteries inherently require multiple overseas factories due to their heavy weight, necessitating factory construction in regions with high electric vehicle demand. To save transportation costs and improve production efficiency, domestic battery companies are building dozens of global hub factories in joint ventures with global automakers.

The reason overseas investments have outpaced domestic ones is also due to investment conditions. The U.S. and Europe are making every effort to attract battery companies by offering not only electric vehicle purchase subsidies but also battery production subsidies and investment tax credits of around 30%. Domestic battery companies are investing trillions of won in overseas factory construction, and the subsidies and tax credit benefits they receive from foreign governments are expected to reach trillions of won. In contrast, domestically, only electric vehicle subsidies and limited tax credits on some facility investments (8% for large companies, 15% for SMEs) are currently supported. Industry insiders point out that electric vehicle and battery companies have little incentive to build factories domestically. Although late, the government recently submitted a bill to the National Assembly to expand tax credits for national advanced industry facility investments (up to 25-35% tax credit) and is awaiting its passage in the plenary session. If domestic companies build battery factories only overseas, domestic jobs will not increase significantly, and there is concern that the industrial ecosystem will be lost abroad.

Professor Park Cheol-wan of the Department of Automotive Engineering at Seojeong University said, "The government’s recent plan to expand tax credit benefits for advanced industries is welcome," but added, "It is time to review measures such as the 'pre-cursor tariff exemption,' which further increased dependence on China for precursors (intermediate materials for cathode active materials), and to focus on policy details that can revive the industrial ecosystem."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)