Stock Price Increase Rate of 4.31% This Year, One-Third of Market Return

Downward Revisions Continue for This Year's and Next Year's Operating Profit Forecasts

Interest Grows Whether Honorary Chairman Seo Jung-jin Will Become a Savior Pitcher

Once considered the leading stock on KOSDAQ, Celltrion Healthcare is now falling. Earlier this year, Celltrion Healthcare competed with EcoPro BM for the top spot in KOSDAQ market capitalization but ultimately dropped to second place. Now, it has fallen to third place, trailing behind EcoPro as well. As securities firms continue to lower their expectations for Celltrion Healthcare, attention is focusing on whether Honorary Chairman Seo Jung-jin can become a savior.

According to the Korea Exchange on the 16th, Celltrion Healthcare's stock price fell to 60,000 KRW during the trading session the previous day but closed flat at 60,500 KRW (0.00%). As of that day, its market capitalization stood at 9.5743 trillion KRW, dropping below 10 trillion KRW. It fell to third place in KOSDAQ market capitalization rankings, behind EcoPro BM and EcoPro. For Celltrion Healthcare, which once held the top spot in KOSDAQ market cap, this is a blow to its pride.

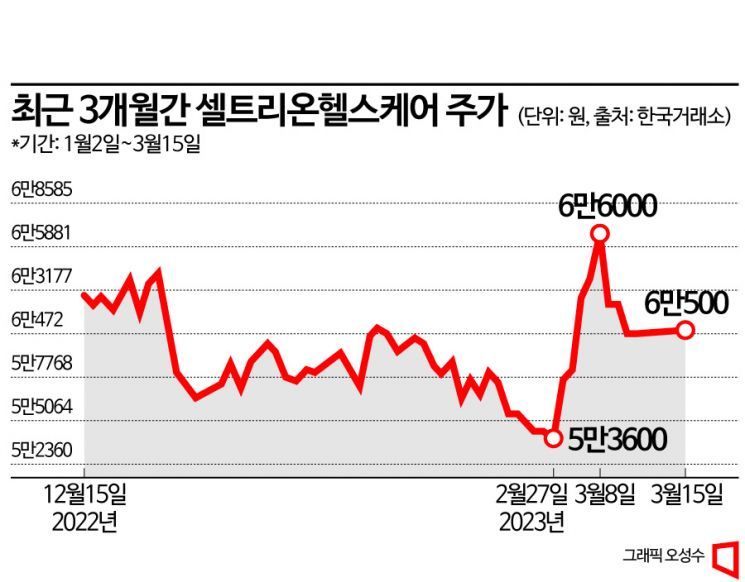

This year, Celltrion Healthcare's stock price has recorded a rise below the market average return. From January 2 to March 15, Celltrion Healthcare's stock price increased by only 4.31%, less than one-third of the KOSDAQ index's 15% rise during the same period.

Market expectations for Celltrion Healthcare are also declining. Shin Young Securities lowered its target price from 86,000 KRW to 83,000 KRW. Eugene Investment & Securities (100,000 KRW → 90,000 KRW), NH Investment & Securities (90,000 KRW → 80,000 KRW), KB Securities (92,000 KRW → 80,000 KRW), and Daol Investment & Securities (95,000 KRW → 85,000 KRW) also consecutively lowered their target prices. Among the 11 securities firms that issued reports on Celltrion Healthcare this year, seven have lowered their target prices. Earnings forecasts are also declining. According to financial information provider FnGuide, the average operating profit forecast for Celltrion Healthcare this year is 278.1 billion KRW, down about 31.5 billion KRW (10.2%) from just two weeks ago (309.6 billion KRW).

Researcher Kwon Hae-soon of Eugene Investment & Securities said, "In the first half of this year, intensified competition in the biosimilar market and price reduction pressures raise concerns about profitability deterioration. Moreover, due to increased selling and administrative expenses before new product launches this year and next, profitability improvement is expected to be difficult, leading us to revise operating profit forecasts downward by 21% and 8% for this year and next year, respectively."

Short selling is also increasing. As of March 13, the short-selling balance of Celltrion Healthcare stood at 48.5 billion KRW, about half of the 99.4 billion KRW recorded on January 2 this year. However, as of March 14, short selling accounted for 16% (142,193 shares) of total trading volume in Celltrion Healthcare, nearly double the level from two weeks earlier (February 28).

In response to this situation, Celltrion Healthcare has initiated share buybacks to boost its stock price, but the effect remains uncertain. Celltrion Healthcare completed the acquisition of 437,000 treasury shares decided in February on the 8th. On the same day, it also announced plans to acquire an additional 398,000 treasury shares (approximately 25 billion KRW) through on-market purchases over three months from March 9 to June 8. The total treasury shares to be acquired this year amount to 835,000 shares. However, despite the announcement of additional share acquisitions, the stock price has declined for four consecutive trading days since the 8th.

Attention is also focused on whether Honorary Chairman Seo Jung-jin, returning to the front lines of management after two years, can be a savior. Researcher Jung Yoo-kyung of Shin Young Securities said, "Officially, Honorary Chairman Seo's return is said to focus on discovering future growth engines such as new drug development, but in reality, he is expected to be directly involved in all major management issues, including targeting the U.S. market, launching follow-up biosimilars, and the merger of the three companies. His return with strong leadership in this crisis situation is expected to have a positive impact."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.