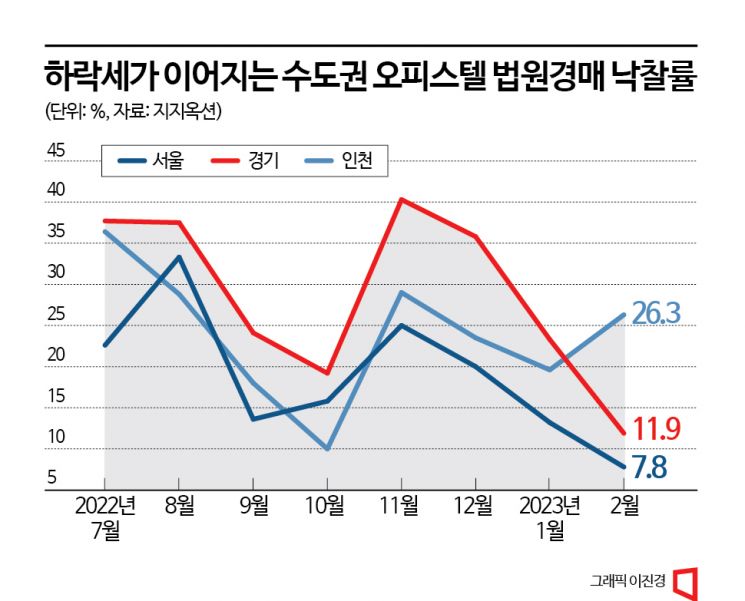

Officetels and knowledge industry centers, which were popular as income-generating real estate, are being shunned in the auction market. Due to consecutive interest rate hikes lowering yields and a contraction in the domestic economy reducing corporate demand, properties are repeatedly failing to sell. In particular, the auction success rate for Seoul officetels has dropped to single digits, indicating a halt in investment demand.

According to Gigi Auction, a court auction specialist company, the average auction success rate for officetels in Seoul last month was 7.8%. The success rate refers to the ratio of properties with confirmed buyers among those put up for bidding, meaning that fewer than one out of ten officetels on auction found new owners. This is the lowest figure in 19 years and 4 months since October 2003, representing a 75.5 percentage point drop from the record high of 83.3% in September 2020, falling to less than one-tenth of that peak.

In the same month, the auction price ratio for Seoul officetels was 81.9%, down 19.3 percentage points from 101.2% in October last year. The auction price ratio is the ratio of the winning bid to the appraised value; for example, an officetel appraised at 100 million KRW was sold at 81.9 million KRW. After rising to the 90% range since June 2021 (84.1%), the Seoul officetel auction price ratio has been declining again since December last year, falling back to the 80% range after 1 year and 6 months.

The same downward trend is observed in the metropolitan areas outside Seoul. Last month, the auction success rate for officetels in Gyeonggi Province dropped by 11.4 percentage points to 11.9% compared to the previous month. In Incheon, the success rate has fluctuated between 10% and 20% over the past six months, dropping to 10% in October last year.

Rising Loan Interest, Falling Yields... ‘Apartment Substitute’ Effect Ends

This decline is attributed to the consecutive interest rate hikes since last year. As loan interest rates rise, the burden of financing increases and yields decrease, reducing the popularity of officetels aimed at rental income.

Most of the properties that do get sold are small officetels priced under 500 million KRW. Among the 39 officetels sold in the metropolitan area last month, the most expensive was Officetel A located in Munbae-dong, Yongsan-gu, Seoul, which found a new owner at 371.11 million KRW. This price was 69.88 million KRW lower than the appraised value of 441 million KRW. Industry analysts say investors have concentrated on products that minimize loan amounts to reduce interest burdens.

Additionally, demand for medium-to-large officetels (exclusive area of 85㎡ or more) has sharply declined due to eased apartment regulations. Medium-to-large officetels, known as ‘Apateol’ (Apartment + Officetel) because of their apartment-like structure, were favored as alternative housing during the real estate boom when apartment prices soared. However, with recent significant easing of apartment loan and tax regulations, officetels, which do not enjoy special benefits, have become relatively less attractive.

Corporate Demand Drops Amid Economic Slowdown... Knowledge Industry Centers Also Falter

Meanwhile, knowledge industry centers, which were also popular as income-generating real estate alongside officetels, are taking a direct hit in the auction market. According to Gigi Auction, the court auction success rate for knowledge industry centers in the metropolitan area last month was 22.7%, down 7.8 percentage points from 30.5% the previous month. During the same period, the auction price ratio plummeted from 82.3% to 45.8%.

There are cases where properties are sold at about half the appraised value. Last month, Knowledge Industry Center B in Gwangjak-myeon, Yangju-si, Gyeonggi Province, was sold at 171 million KRW, which is 51% of the appraised value of 338 million KRW. Also, Knowledge Industry Center C in Oryu-dong, Seo-gu, Incheon, found a new owner at 195.19 million KRW, 50% of the appraised value of 389 million KRW.

The continued decline appears to be the combined effect of high interest rates and concerns over economic recession. Joo Hyun Lee, Senior Researcher at Gigi Auction, analyzed, “Knowledge industry centers, which were popular due to strong investment demand in the past, have faced issues of oversupply as the supply volume increased significantly. As the domestic economy contracts and corporate demand decreases, demand for knowledge industry centers has further diminished.”

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

!["The Woman Who Threw Herself into the Water Clutching a Stolen Dior Bag"...A Grotesque Success Story That Shakes the Korean Psyche [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)