January transaction volume at 4,806, lowest since statistics began

Both sale and jeonse prices fall simultaneously

"Interest rate hikes combined with apartment regulation easing"

As apartment regulations are largely lifted, officetels, which serve as substitutes, are struggling due to a 'reverse balloon effect.' Transaction volumes have sharply decreased, and both sale prices and jeonse prices are rapidly falling.

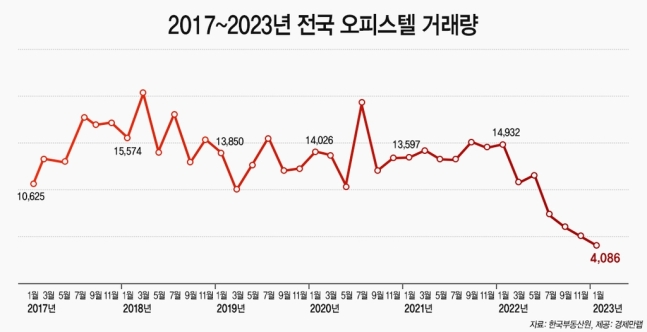

On the 15th, Economic Man Lab, a real estate information provider, analyzed the building transaction status from the Korea Real Estate Board and found that the nationwide officetel transaction volume in January this year was recorded at 4,086 cases. This is the lowest monthly transaction volume since the Korea Real Estate Board began compiling related statistics in January 2017. Compared to January last year (14,932 cases), it decreased by 72.6%.

The region with the largest drop in officetel transaction volume compared to the same period last year was Incheon. In January last year, Incheon’s officetel transaction volume was 3,459 cases, but in January this year, it dropped to 416 cases, a decrease of 88.0%. Jeonbuk decreased from 92 to 12 cases (87.0%), Chungnam 85.8%, Daegu 79.4%, Jeju 78.1%, Daejeon 76.7%, Gyeongbuk 75.7%, Sejong 73.7%, Gyeonggi 73.2%, Gwangju 73.0%, Jeonnam 71.1%, and Seoul 64.8%, in order of largest decline.

Average sale prices and jeonse prices of officetels are also on a downward trend.

According to KB Real Estate’s monthly officetel statistics, the average sale price of officetels in the metropolitan area was 277.61 million KRW in February last year, but it fell by 0.7% to 275.61 million KRW in February this year. The average jeonse price also dropped by 1.1%, from 212.89 million KRW in February last year to 210.45 million KRW this February.

According to the Ministry of Land, Infrastructure and Transport’s actual transaction price disclosure system, the officetel 'Cheongna Lin Strauss' in Cheongna-dong, Seo-gu, Incheon, with an area of 59㎡ (exclusive area, 31st floor), was transacted at 350 million KRW (31st floor) in January last year, but in January this year, a 35th-floor unit of the same size was sold for 250 million KRW, dropping by 100 million KRW (-28.6%) in one year.

The officetel 'Wirye Ziwell Prugio' in Hagam-dong, Hanam-si, Gyeonggi, with an area of 84㎡ (5th floor), was contracted for sale at 1.3 billion KRW in January last year, but in January this year, a 13th-floor unit of the same size was transacted at 787 million KRW. This represents a decrease of 513 million KRW (-39.5%) over one year.

Jeonse prices show a similar trend. The officetel 'Landmark City Central The Sharp' in Songdo-dong, Yeonsu-gu, Incheon, with an area of 84㎡ (10th floor), was newly contracted with a jeonse deposit of 400 million KRW in January last year. However, in January this year, a unit of the same size (37th floor) was newly contracted with a jeonse deposit of 180 million KRW, marking a 220 million KRW (-55.0%) drop in jeonse price over one year.

Hwang Hansol, a research fellow at Economic Man Lab, explained, "As interest rates have risen sharply, the burden of loan interest has increased, and with the easing of apartment subscription, loan, and tax regulations, officetel investment demand has decreased, leading to a decline in transaction volume and falling sale prices."

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.