[Impact and Outlook of China's Reopening] Growth Rate, Is the Real Figure 6%?

As the speed and direction of China's transition to 'With-COVID' are gradually revealed, voices expecting a strong economic rebound and trickle-down effects are subsiding. The Chinese government's focus seems to be not on a surprisingly rapid economic recovery but on a return to a normal trajectory. President Xi Jinping, who recently succeeded in launching his third term in power, repeatedly emphasizes qualitative growth of key industries and domestic demand recovery rather than reckless quantitative growth.

According to the Chinese Embassy in Korea and others, China lifted the ban on foreign tourists that had been in place during the COVID-19 period starting from the 15th and resumed issuing new tourist visas. Visa-free entry through cruise ships docking in Hainan and Shanghai is also expected to become possible. As a result, most of the quarantine measures China had imposed externally have been lifted, except for some group tours to certain countries, establishing a comprehensive 'With-COVID' system.

The Forced Decision on With-COVID Turned Out to Be a Stroke of Luck

The timing for ending China's zero-COVID policy, which had been consistent with quarantine and lockdowns, was initially expected to be after the National People's Congress and the Chinese People's Political Consultative Conference (the Two Sessions) held in March this year. Not only Hong Kong media, which are relatively familiar with mainland affairs, but also Korean and Western media agreed that the door would open only after the third-term leadership centered on President Xi was finalized with concrete solutions.

However, the actual transition to With-COVID occurred overnight on December 7 last year under the name of '10 Optimization Measures for Epidemic Prevention.' Mandatory isolation of confirmed cases and periodic PCR testing, which had tied down the entire population, were abolished instantly. The important point is that the Chinese government’s decision was pushed by the uncontrollable spread of COVID-19 and simultaneous zero-COVID protests erupting nationwide.

Experts evaluated that this hurried decision, made without other options, was the optimal choice from the perspective of President Xi and the leadership. Lee Sang-hoon, director of the Beijing office at the Korea Institute for International Economic Policy, said, "I believe the transition to With-COVID was not an intended policy step, but a decision forced by near neglect. Looking back, it was very clever timing, a stroke of luck that passed without burdening the Chinese government or Communist Party." Another diplomatic source explained, "Since October, unofficial counts of COVID-19 cases were revealed by private survey groups to be dozens of times higher than official figures. However, the situation with severe cases and deaths ended earlier than feared, and conditions improved immediately after the Spring Festival, which actually became a credit to the leadership."

Initially Humble, but Growth Expectations May Reach 6%

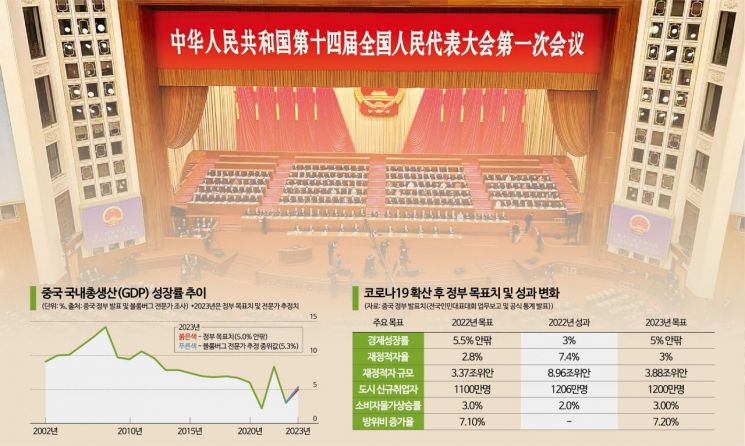

The newly launched third-term leadership of Xi Jinping is lowering expectations regarding the speed and strength of China's economic recovery. Their attitude is closer to caution than humility. The government's economic growth target of 'around 5%' for this year, announced at the recently concluded National People's Congress on the 13th, reflects the leadership's perception and concerns. The 5% range is at the lower end of growth forecasts from major global investment banks. Considering the full transition to With-COVID and the base effect from last year's weak 3% growth, this is a conservative figure below market expectations.

However, many analyses suggest that the announced growth target implies a pursuit of industrial upgrading and qualitative growth rather than reckless quantitative expansion, and also represents a strategic judgment to reduce political pressure for achieving results in the first year of the third-term leadership. The reappointment of Yi Gang, governor of the People's Bank of China, against expectations also indicates that China prioritizes macroeconomic 'stability' as a prerequisite. Lee Sang-hoon said, "In a situation with many internal and external risks and uncertainties, it is better to focus on political structure and public reforms steadily rather than setting excessive targets that could cause failure for two consecutive years."

Some analysts argue that the growth rate China secretly hopes for is closer to 6%. The urban employment target announced at the National People's Congress this year is 12 million, the highest since 1996. Given that an average of 2.1 million jobs were created per 1 percentage point of growth in 2021-2022, this employment target requires at least a 5.5% growth rate. Alicia Garcia Herrero, chief economist at Natixis, told the Hong Kong South China Morning Post (SCMP), "Job creation generally depends on stronger economic growth. This year's bold employment target contrasts with the GDP growth target."

Considering base effects from quarterly results and policy implementation lags, growth is expected to show a full rebound in the second quarter of this year. Last year's quarterly growth rates were 4.8%, 0.4%, 3.9%, and 2.9%, respectively.

Qualitative Growth and Potential Industrial Restructuring

Along with reopening, China's external goal is to expand domestic demand and pursue qualitative growth. This approach aims to dispel concerns about low quality surrounding China and is also interpreted as a preparation for technological independence in anticipation of prolonged US-China confrontation.

Li Qiang, the newly appointed Premier of the State Council, emphasized at a press conference after the National People's Congress closing on the 13th, "We will focus our efforts on achieving high-quality development," stressing stable growth, prices, and employment. He added, "China's economy remains the world's second largest in total volume, but development is unbalanced and insufficient," urging enhancement of scientific and technological innovation capabilities and acceleration of modern market system construction to promote high-quality development.

There are also forecasts that some industrial restructuring may occur in this process. With the abolition of electric vehicle subsidies starting this year, the automobile industry has already begun sorting out winners and losers. Henan Lifan New Energy Automobile, a wholly owned subsidiary of Lifan Science and Technology, filed for bankruptcy liquidation on the 7th after failing to manage debts of approximately 189.14 million yuan (about 35.9 billion KRW). The price-cutting competition in electric vehicles ignited by Tesla accelerated, with February sales increasing 38% year-on-year, successfully defending demand but expected to impact the ongoing bleeding competition market.

The real estate sector is also considered a target for restructuring. Through the Two Sessions, the Chinese government did not announce any active stimulus or support measures related to real estate. Instead, it emphasized that "Efforts to prevent disorderly expansion are necessary to promote stable development," and "Risks of real estate companies will be effectively prevented and mitigated, and asset and liability situations improved." Evergrande Group, which raised concerns about domino defaults, failed to reach a debt restructuring agreement with offshore creditors earlier this month, and real estate developer Country Garden recorded a net loss of 5.5 billion yuan last year, deepening its insolvency. Additionally, the e-commerce platform industry, which has entered full-scale price competition, may also face ups and downs. On the 10th, JD.com's CEO announced 'price competition' as the company's core strategy for the next three years.

© The Asia Business Daily(www.asiae.co.kr). All rights reserved.

![Clutching a Stolen Dior Bag, Saying "I Hate Being Poor but Real"... The Grotesque Con of a "Human Knockoff" [Slate]](https://cwcontent.asiae.co.kr/asiaresize/183/2026021902243444107_1771435474.jpg)